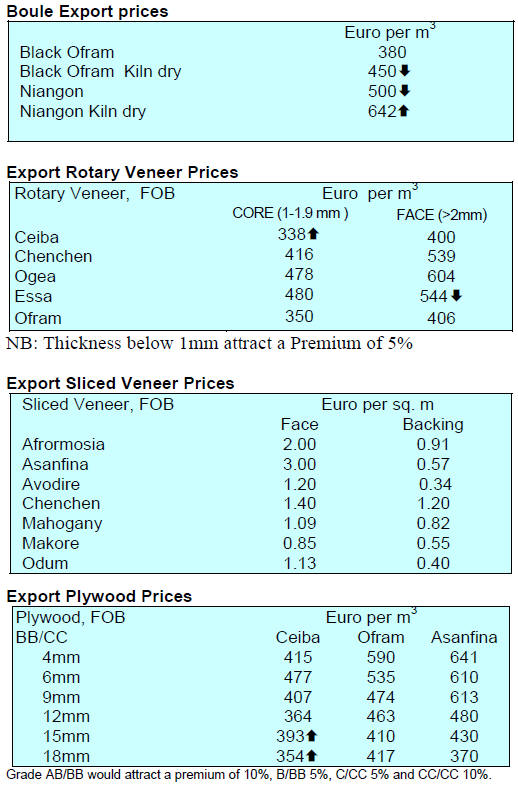

2. GHANA

Roadmap to revitalize forest resource

sector

The Minster for Lands and Natural Resources, Prof. Nii

Osah Mills, has launched a three pronged strategy

designed to address the challenges facing the country¡¯s

forest and wildlife sectors.

The strategies are set out in the ¡®Ghana Forestry

Development Master Plan¡¯, the ¡®Ghana National REDD

(Reducing Emissions from Deforestation and forest

Degradation) Strategy¡¯ and the ¡®Ghana Forest Plantation

Strategy¡¯. The aim is to transform the natural resource

sector.

The Forestry Development Master Plan is a 20-year

Action Plan, designed to fully implement the 2012 Forest

and Wildlife Policy, which has shifted the focus from

over-reliance on timber revenues to conservation of

biodiversity and increased revenues from eco-tourism and

payment for eco-system services.

The Forestry Development Master Plan provides a sound

basis for attainment of the aims of the Forest and Wildlife

Policy and its successful implementation could maximise

the rate of social and economic development in the

country.

The Ghana National REDD Strategy aims at assisting the

country to prepare itself for reducing emissions from

deforestation and forest degradation and to position the

country for the implementation of an international

mechanism for REDD.

The Ghana Forest Plantation Strategy details how the

government and private sector can reforest degraded forest

lands by developing commercial forest plantations of

recommended exotic and indigenous tree species at an

annual rate of 20,000.

VPA legislation ready for parliamentary discussion

Additionally, the strategy targets the maintenance and

rehabilitation of an estimated 235,000 ha of existing forest

plantations as well as enrichment planting of 100,000 ha

of under-stocked forest reserves with high value

indigenous timber species over the same period.

Representatives of Ghana and the European Union met 18

November 2016 in Accra to review progress on the

implementation of the Ghana-EU FLEGT Voluntary

Partnership Agreement (VPA), which aims to improve

forest governance and verify the legality of Ghana¡¯s

timber trade.

A Ghana-EU VPA Joint Monitoring and Review

Mechanism (JMRM),which includes representatives of all

stakeholder groups, oversees the implementation of the

Agreement.

A recent meeting the JMRM reviewed the status of

development of Ghana¡¯s timber legality assurance system

and discussed outstanding issues to be addressed before

FLEGT licensing can begin. When issued, the FLEGT

license will enable Ghana¡¯s timber products to enter the

EU market without importers having to do further due

diligence to meet their obligations under the EU Timber

Regulation.

Musah Abu-Juam, Technical Director of Ghana Ministry

for Lands and Natural Resources presented the draft

legislation which will be submitted to Ghana¡¯s Parliament

for enactment. When this legislation is adopted Ghana¡¯s

forest governance will be enhanced and it will pave the

way to meeting the terms of the VPA.

In addition to this development Musa said Ghana was

addressing the illegal trade in timber in the domestic

market through a new system for tracking timber in the

domestic market which involves both suppliers and

traders.

Benoist Bazin, Team Leader for Infrastructure and

Development at the Delegation of the European Union to

Ghana said ¡°These major achievements show that Ghana

continues to strengthen forest governance through the

VPA and is advancing toward FLEGT licensing.¡±

See: https://eeas.europa.eu/delegations/ghana/15525/ghana-andeuropean-

union-advance-in-joint-effort-to-improve-forestgovernance-

and-combat-trade-in-illegal-timber_en

Bank of Ghana lowers interest rates

The Monetary Policy Committee of the Bank of Ghana

(BoG) has reduced the base rate by 50 points to 25.5% and

this has sparked dismay as a 100 point reduction was

anticipated but even this small cut comes as a relief to the

private sector. Ghana¡¯s interest rates are currently one of

the highest in the world.

3.

SOUTH AFRICA

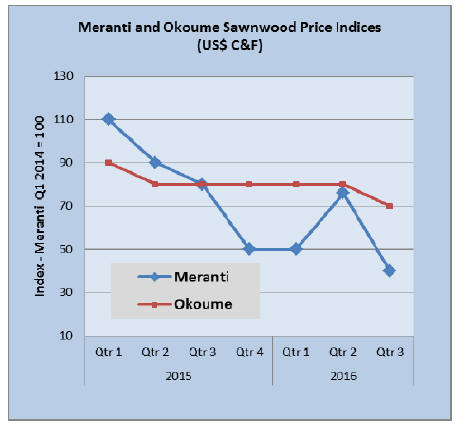

Meranti imports affected by container

shut-outs

Most of the discounted stocks of the bankrupt Zikiza have

been sold and as meranti imports begin to arrive once

more importers are raising their prices. Demand for

hardwoods is steady, say local traders. The main problem

at the moment is that shipments are being delayed because

containers are being shut out at the port of origin.

American hardwoods are selling well but because of

extended lead times in American sawmills both the level

and mix of stocks has been disrupted. There is firm

demand for white oak at present and analysts anticipate

firmer prices in the coming weeks.

Panel market slow as year-end holidays approach

Over the past weeks the plywood market has become

tighter because of a supply problem due to operational

difficulties at the new plywood mill at York Timbers. This

has driven some end-users to switch to OSB for which

importers have adequate stocks.

The panel market is expected to remain slow but steady

for now as activity in the construction and building sectors

winds down in readiness for the December holidays.

Some construction projects are set to begin early next year

but these have not yet been firmed up so suppliers are

waiting to see how the market will develop. Much

depends on industry sentiment which could be impacted

by the economic rating agencies assessment of prospects

in South Africa. If there are negative reports then some

projects are likely to be delayed.

Overall, the board market is steady with both particleboard

and MDF moving well. There has been some upward

pressure on prices as no discounted items are up for sale

and because deliveries have slowed.

Pine prices holding up despite weaker than expected

demand

Although the pine market is down about 5% year on year

in terms of volume, prices have not dropped due to low

stocks at the local mills. Analysts do not expect this to

improve until the beginning of the new year at the earliest.

Some pine products are imported from Zimbabwe and

shippers there have begun accepting Rand rather than

requiring US dollars. This has helped importers but the

problem is that production in Zimbabwe is erratic mainly

due to unstable power supplies.

Rosewood and teak fall out of fashion

In the South African market rosewood and teak are slow

movers at present as they both appear to be out of fashion.

On the other hand, demand for Kiaat (muniga) is good but

supplies are tight especially given the security issues in

Mozambique.

The decking market is steady but, given the weaker

exchange rate, some buyers are looking at local products

such as pine and eucalyptus. Shipments of sawn sapele

and okoume are landing but traders say okoume is still

priced higher than meranti.

Economic assessment - government construction

projects could be delayed

Business Monitor International (BMI) has released its

latest ¡®South Africa Infrastructure Report¡± and the BMI

website in introducing the report says ¡°We maintain our

tepid growth outlook the South African construction

market between 2016 and 2025 as political and economic

headwinds take hold.

Business confidence in the economy remains low,

hampering the outlay of much-need private investment

into infrastructure, while budgetary pressures are

hindering the government's ability to deploy the capital

earmarked for the sector.¡± The conclusion of the BMI

analysis is that growth will not expand significantly in

2017 and the government will find it increasingly difficult

to find the funds to finance all planned construction

projects.

For more see: http://store.bmiresearch.com/south-africainfrastructure-

report.html

4.

MALAYSIA

MTC leads mission searching for raw

materials

The Malaysian Timber Council (MTC) will accompany

several of the large timber manufacturers in the country on

a mission to Chile and Brazil.

The mission has two main aims, building business to

business ties and identifying potential raw material sources

for Malaysian companies. The mission is part of the

Council¡¯s Raw Material Augmenting Supply Programme.

The delegation will comprise eight timber companies

interested in sourcing tropical timber as well as plantation

resources for downstream processing in Peninsular

Malaysia.

In a press release MTC, CEO Dr. Abdul Rahim Nik said

¡°We want to introduce new timber species to the market

which can be used as an alternative supply to raw

materials and to value-add and diversify our product

range¡±. The delegation plans to visit production plants in

Chile and Brazil to discuss processing practices and seek

new business opportunities.

Malaysia reaffirms its commitment to sustainable

forest conservation and management

At the twenty-second session of the Conference of the

Parties (COP 22in Marrakech) Natural Resources and

Environment Minister Dr Wan Junaidi Tuanku Jaafar

reaffirmed Malaysia¡¯s commitment to sustainable forest

conservation and management.

The Minister said Malaysia has an ambitious REDD+

Strategy to address forest management issues and looked

forward to accessing the international finance and support

required for its implementation.

The Minister reported that extreme weather events were

already affecting Malaysia. One such event was the 2014

floods that devastated entire settlements in several States

with losses estimated at US$250 million and affected two

million people.

Wan Junaidi reminded the meeting that developed

countries needed to take the lead through reducing their

domestic greenhouse gas emissions to provide the

momentum for other countries efforts.

Heart of Borneo conference: Conservation through

Science-Policy Interface

The eighth International Conference on Heart of Borneo

was held in Kota Kinabalu, Sabah. The focus of the event

was implementation of Sabah's Heart of Borneo Strategic

Plan of Action.

The Sabah Forestry Department, organiser of the event, set

the theme as "Enabling and Empowering Conservation

through Science-Policy Interface, Conservation Finance

and Community Engagement."

During the opening of the conference, Sam Mannan, Chief

Conservator of Forests Sabah, charged participants with

the task of making conservation efforts effective and how

to scale up such efforts.

See: http://www.forest.sabah.gov.my/mediacentre/

broadcast/events/568-hob-conference-2016

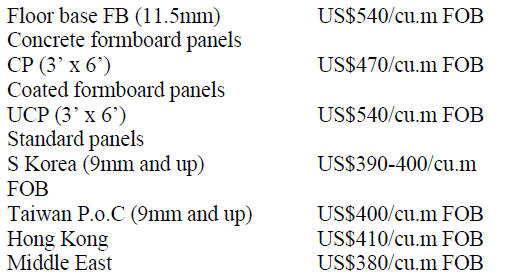

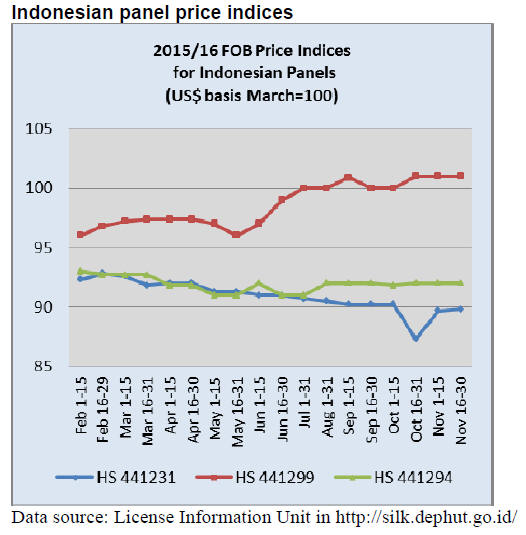

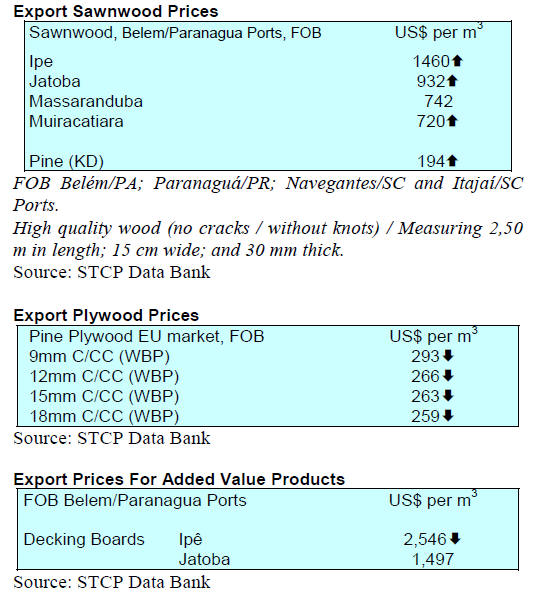

Plywood.

Plywood traders based in Sarawak reported the following

export prices:

5. INDONESIA

Singapore, Indonesia move to boost trade

ties

Singapore is looking to enhance cooperation with

Indonesia through investments beyond traditional

destinations, increasing tourist traffic and by setting up a

business council involving both countries.

A joint statement from Indonesian President Joko Widodo

and from Singapore¡¯s Prime Minister Lee Hsien Loong

provided details of plans to strengthen economic

cooperation. Last year, Singapore invested US$5.9 billion

in Indonesia making it Indonesia¡¯s biggest source of

foreign investment. Investments have grown this year with

Singapore investing over US$7 billion in Indonesia within

the first nine months.

Noting the private sector¡¯s involvement in economic

projects between the two countries, the two leaders

concluded that the best way forward is to provide a

platform for business people to get together and meet

regularly. To achieve this it was decided a

Indonesia/Singapore business council should be created.

See more at: https://www.gov.sg/news/content/today-online---

singapore-indonesia-move-to-boost-tradeties#

sthash.XsIZ9nhb.dpuf

FAO applauds Indonesia¡¯s success with FLGT

licensing scheme

In a press statement posted on its website FAO welcomed

the first shipment of FLEGT-licensed timber to the

European Union (EU). Indonesia is the first country to

have successfully concluded all the requirements of the

EUTR and through this has contributed to global efforts to

stamp out illegal logging and promote the legal timber

trade says FAO.

The FLEGT license opens up a ¡®green lane¡¯ for timber

being imported to the EU, one of the world's largest

consumers of timber products.

FAO writes, ¡°Indonesia¡¯s FLEGT-licensing scheme is

based on the country¡¯s Sistem Verifikasi Legalitas

Kayu (SVLK), or timber legality assurance system, which

ensures that timber has been harvested, transported,

processed and traded according to Indonesian law.

Under the scheme, all wood-based product types listed in a

Voluntary Partnership Agreement (VPA) between

Indonesia and the EU and directly exported to European

markets must now be accompanied by a FLEGT license

issued by an Indonesian licensing authority. In turn,

importers can place it on the market with no additional

checks.¡±

See: http://www.fao.org/in-action/eu-fao-flegt-programme/newsevents/

news-details/en/c/452397/

Consumer spending holding up well

A recent analysis from Focus-economics says Indonesia¡¯s

economy slowed in the third quarter due to sluggish

exports and a fall in investment. On the other hand

domestic consumption held up well, which bodes well for

growth in the final quarter of the year.

However, at some point consumer confidence is likely to

be dented as the currency weakens, imports become more

expensive and manufacturing output falls with a knock-on

impact on wages.

For more see:

http://www.focus-economics.com/countries/indonesia

Sustaining economic reforms

The government of Indonesia will soon release its 15th

economic policy package in an effort to maintain the

momentum of structural reforms and encourage

investment.

According to Darmin Nasution, Minister for Economic

Affairs, the 15th policy package will begin dealing with

deregulation, improving the investment climate,

infrastructure developments and manufacturing.

Peatland villages to aid restoration

The provincial government of Jambi will establish a

number of village communities in areas where fires have

destroyed the forest and severely affected the underlying

peat. The village community will be advised on peatland

management and supported in the establishment of cash

crops and eventually tree crops.

Nazir Foead of the Peatland Restoration Agency said it is

vital to speed up the peatland restoration programme to

ensure this unique eco-system survives. It has been

estimated that of the 900,000 ha. of peatland almost

200,000 ha. has been burnt.

6. MYANMAR

Merchants Federation says it can deliver

details of

timber origin

The Forestry Department has issued a statement on the

Swedish court decision that resulted in a fine for a

Swedish importer for failing to satisfy the due diligence

requirement of the EU Timber Regulation in relation to a

shipment of Myanmar teak.

The Forestry Department has admitted that when

shipments comprise timber from multiple sources and

these sources are not separately identified then the chain of

custody (CoC) can fail. The statement said that efforts are

underway to devise a system that can provide accurate

CoC details.

At the same time, the task force comprising stakeholders

preparing for the VPA with the EU has issued a statement

saying that they can respond to requests for information on

shipments from buyers. The point of contact is the

Myanmar Forest Products Merchants Federation

(MFPMF, a private sector federation which issues the

Myanmar ¡®Green Folder¡¯). The MFPMF said they will

respond with information on the timber origin in

cooperation with the Forestry Department and the

Myanma Timber Enterprise.

Container trucking restricted in Yangon

New traffic regulations in Yangon by which the movement

of container trucks will be restricted to only between 9pm

and 6am is likely to cause problems and raise transport

costs in the timber industry.

Under the current Forestry Regulations a forestry official

must be present at the mill when the container is sealed.

This means a container must arrive at a mill a day

earlier

so it can be loaded and inspected, Then the container must

be trucked overnight to arrive at the port before 6am.

In related news, to speed up export procedures, the

Ministry of Commerce has abolished one step in the

document process, the requirement that approval of the

contract price be secured in advance.

7.

INDIA

Currency swap fallout

A quick look at the responses from analysts to the

government¡¯s decision to eliminate high-value banknotes

from circulation suggests most are anticipating this will

have a negative effect on the economy for at least the next

12 months.

HSBC has written that GDP could fall from the 7% in the

first quarter of this year to around 6% over the next 12

months. This has been borne out as the Ratings Agency

Fitch said it anticipated a drop in growth in the fourth

quarter.

The immediate impact of the currency swap decision was

to undermine the rupee exchange rate. In mid-November

the rupee slid to a low of 68.86 to the US dollar despite

selling of US dollars by the Reserve Bank of India (RBI).

The RBI has estimated that by the end of the month just

7% of the 5 trillion rupees in 500 and 100 rupee notes

have been exchanged.

For more see:

http://www.nipfp.org.in/search/?q=currency+swap

Inflation rate trends

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI). The official Wholesale Price Index (WPI) for All

Commodities (Base: 2004-05=100) for October rose by

0.1% to 182.9 from 182.8 for September.

The annual rate of inflation, based on the monthly WPI,

stood at 3.39% (provisional) for the month of October

2016 compared to 3.70% for September 2015.

See:

http://eaindustry.nic.in/cmonthly.pdf

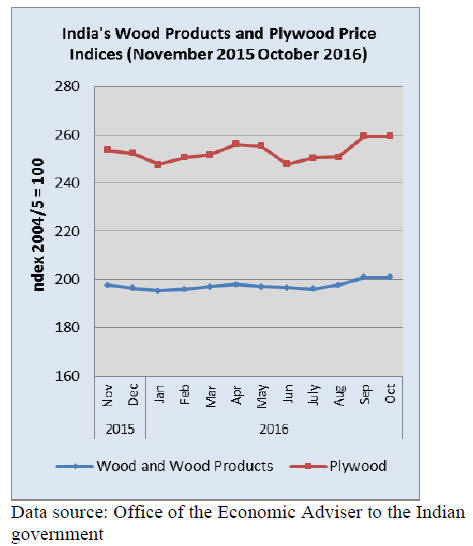

Timber and plywood price indices climb

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

WoodProducts and Plywood are shown below.

Procedures for wood industry license applications

streamlined

New regulations have come into effect making it easier

and faster for enterprises to obtain manufacturing licenses.

The changes are contained in the Wood Based Industries

(Establishment and Regulation) Guidelines, 2016 as

proposed by the Ministry of Environment, Forest and

Climate Change. These Guidelines are applicable in all

States andTterritories.

Prior to the introduction of these new guidelines to get a

license companies had to apply to the Centrally

Empowered Committee (CEC) located in New Delhi. This

had to be done through individual state/territory Forest

Departments. This often had to be followed up with costly

visits to the capital.

Now each State and Territory is required to constitute a

State Level Committee (SLC) to implement new

regulation and the SLCs are required to meet at least

once every three months.

The SLC will include one invited representative from

industry nominated by the state sawmillers association.

The SLCs are required to assess the availability of log raw

materials for every mill once every 5 years and decide

whether or not the mill should continue at its present

location or move to an area with a better supply of logs.

To determine the log raw materials available in a given

area the SLVs will commission studies in collaboration

with institutes/universities which will take into account the

volume of wood available locally as well as that coming

across state boundaries.

In the North Eastern States of Arunachal Pradesh,

Assam,

Manipur, Meghalaya, Mizoram, Nagaland, Tripura and

Sikkim wood based industries shall only be permitted

within industrial estates.

For mills utlising only imported logs the SLC will

determine the impact of these mills on the viability of

mills using domestic logs and if necessary move to protect

these mills.

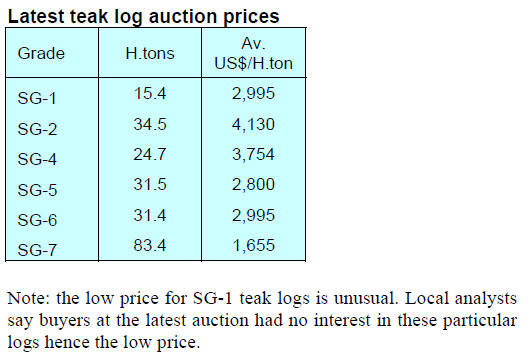

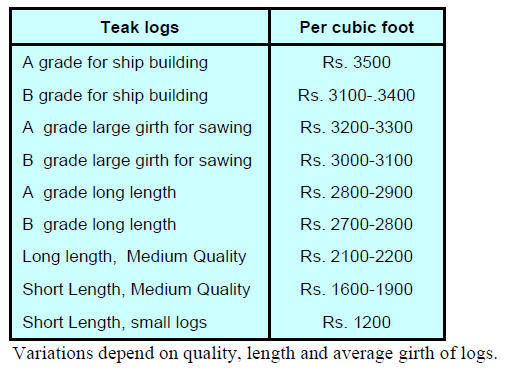

Teak prices hold up well despite currency swap

turmoil

Auctions recently concluded in Surat and Bharuch as well

as the Vyara Divisions of Surat Circle have thrown up

surprisingly good results. Observers were expecting prices

to fall due to the ¡®cash crunch¡¯ in the country and the

general uncertainty in the industry but this was not the

case.

The log lots on offer were from various Departmental

forests, private forests as also from Forest Worker Co-

Operative Society forests.

With such a mix of sources it was anticipated that bid

prices would be highly variable and lower than usual but

this was not the case.

Prices for good quality non-teak hard wood logs

eased in

the recent auctions. Logs of 3-4 metres length having

girths 91cms and up of haldu (Adina cordifolia), laurel

(Terminalia tomentosa), kalam (Mitragyna parviflora) and

Pterocarpus marsupium attracted lower prices in the range

of Rs.800-900 per cu.ft.

For medium quality logs prices were from Rs.600-800 and

logs of average quality attraced just Rs.300-500 per cu.ft.

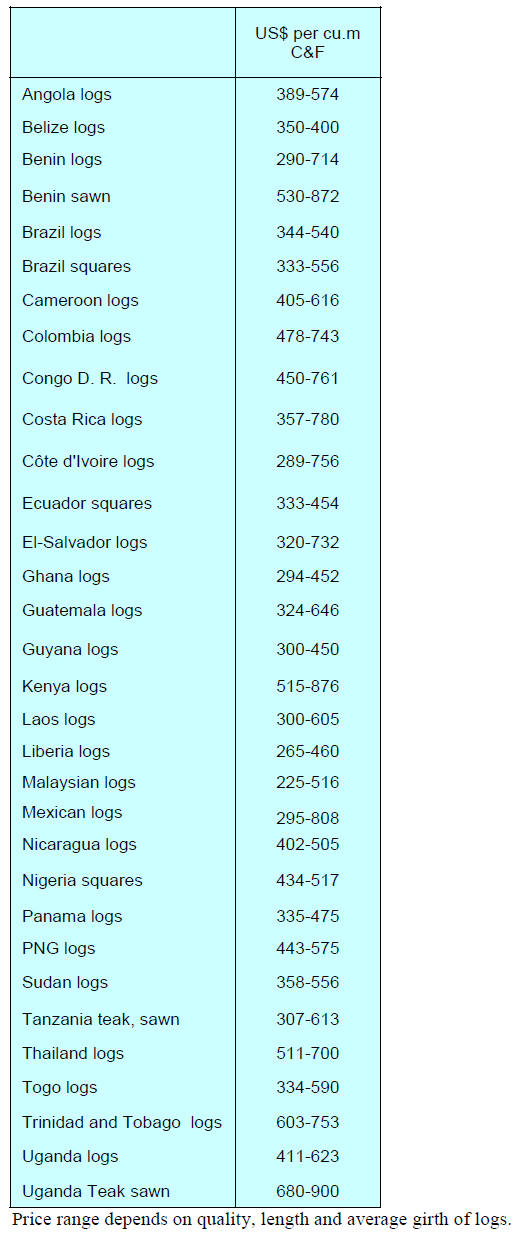

Plantation teak prices

Demand for planation teak continues to be good and in

recent shipments some suppliers have been providing

larger diameter log which has lifted prices.

As was the case in mid-November, prices from the

three

new plantation teak log suppliers remain unchanged

at:Taiwan P.o.C (US$1036 to 2126 per cu.m C&F) and

Honduras (US$471 to US$539 per cu.m C&F). Sawn teak

from China (US$855 to 1118 per cu.m C&F) and from

Myanmar (US$461-2895 per cu.m C&F).

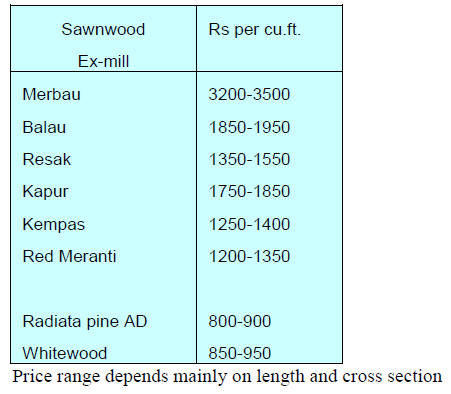

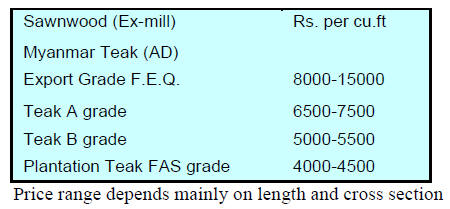

Prices for locally sawn imported hardwoods

Price levels have not changed since the increases reported

for mid-November.

Myanmar teak flitches resawn in India

Steady supplies of sawn teak from Myanmar and China

are keeping prices stable.

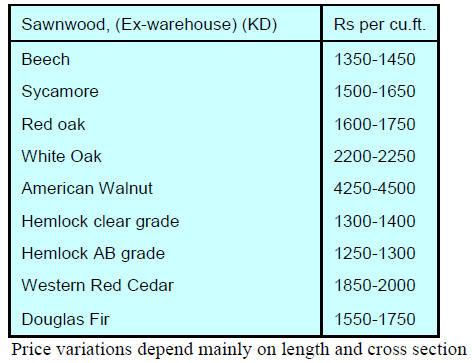

Prices for imported sawnwood

Traders report that demand for imported sawnwood has

started to improve but there have been no recent price

increases.

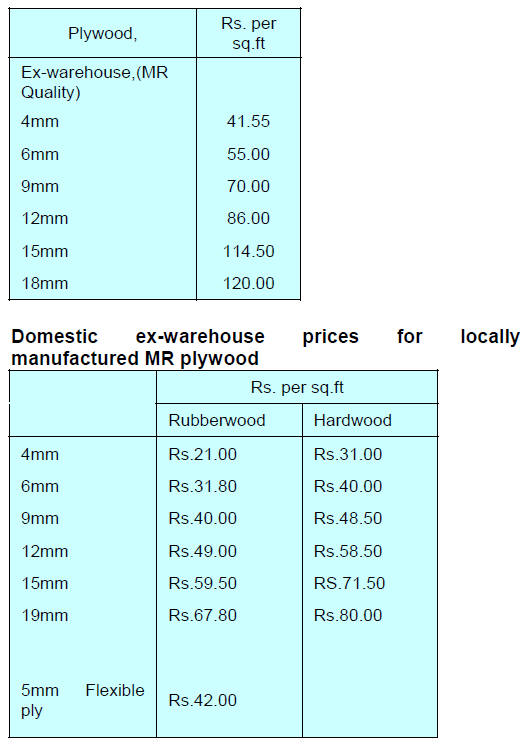

Prices for WBP Marine grade plywood from domestic

mills

Prices remain unchanged. The anticipated rise in plywood

prices as a result of the new Goods and Services Tax is yet

to materialise.

¡¡

8.

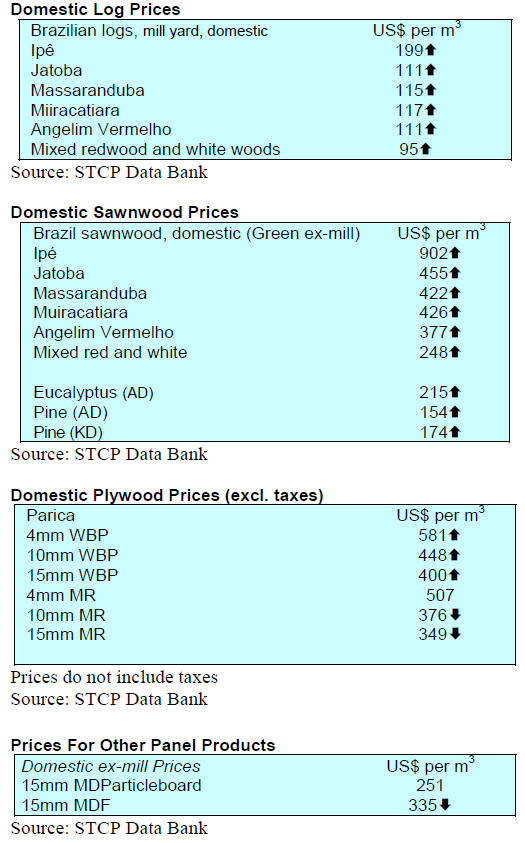

BRAZIL

Exporters fare better than companies

trading in the

domestic market

In an analysis of trade trends in Brazil¡¯s wood product

sector it has been observed that, while some sector of the

industry dedicated solely to the domestic market are facing

tough times, manufacturers focused on export markets

have managed better.

Brazil¡¯s exports of all wood products amounted to

US$201.4 million in September 2016 representing a

10.4% decline compared to a month earlier. Imports of

wood products totalled US$8.7 million in September down

just under 1% from the previous month.

The corresponding improvement in the wood product trade

balance was almost 11% in September 2016.

Between January to September 2016 wood product exports

totalled US$1,742.5 million up 0.4% year on year. Imports

over the same period totalled US$74.1 million and were

16% lower compared to the same period in 2015.

Despite the economic and political issues Brazil is

facing

exports values and the accumulated trade balance in 2016

are contributing to a recovery. According to ABIMCI it is

the decline in domestic building and construction that is

hurting companies focused on domestic sales while the

stronger US dollar has helped exporters.

Survival depends on finding new markets

In efforts to sustain their companies in the face of the

domestic economic downturn many are seeking alternative

markets overseas.

According to the Union of Timber and Furniture Industries

of Linhares and Northern Region of Espirito Santo State

(Sindimol) the sector has already lost about 10% of its

workforce as a consequence of the fall in sales. According

to the ¡°Brazil Furniture 2016" report the number of

persons employed in the furniture sector fell from 4,327 in

2014 to 3,770 in 2015.

The Linhares furniture cluster has 55 industries, 13% in

the State of Esp¨ªrito Santo, which has 434 furniture

factories. Production in 2015, according to the Brazil

Furniture 2016 report totalled 10.7 million pieces and the

value of this production was R$978.5 million, just under

2% of total Brazilian production.

Between October 26 and 28 this year many domestic

furniture companies participated in a furniture products

exhibition in Cuba. Participants discovered that Cuban

enterprises are actively seeking trading partnerships with

countries of South and Central America.

Export update

In October 2016 Brazilian exports of wood-based products

(except pulp and paper) increased 5.9% in value compared

to October 2015, from US$210.0 million to US$222.4

million.

Pine sawnwood exports increased 10.9% in value between

October 2015 (US$25.7 million) and October 2016

(US$28.5 million). Export volumes increased 20% over

the same period, from 121,900 cu.m to 146,700 cu.m.

In contrast, tropical sawnwood exports fell 18% from

31,900 cu.m in October 2015 to 26,100 cu.m in October

2016. The value of exports fell also but by a higher margin

dropping almost 20% from US$15.1 million to US$12.1

million over the same period.

In October, plywood exports increased year on year. Pine

plywood exports increased 14% in value in October 2016

in comparison to October 2015, i.e. from US$30.2 million

to US$34.5 million. Over the same period export volumes

increased almost 19% from 109,400 cu.m in October 2015

to 129,800 cu.m October this year.

There was a big jump in tropical plywood exports in

October as an 89% increase in the volume of exports was

achieved (7,500 cu.m in October 2015 to 14,200 cu.m in

October 2016).

The value of tropical plywood exports also rose (approx.

55%) from US$3.6 million in October last year to US$5.6

million.

However, the value of exports of wooden furniture fell in

October this year from US$36.7 million in October 2015

to US$ 35.6 million this October.

Brazilian wood industry sectoral study published

The Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI) published its 2016 Sectoral

Study in early November 2016. The sectors covered in the

study include plywood, sawnwood, wooden doors,

mouldings and wooden flooring.

This study reports that 57% of the jobs in the forest and

wood based industry sectors are in the processed wood

industries and that most of the industries are SMEs

producing a wide range of products mainly for the

domestic market.

The study provides information that can be used in a

practical way by industries, government and authorities to

assess business strategies and public policy plans that

contribute to the sector¡¯s development.

According to ABIMCI¡¯s evaluation the data show that,

despite difficulties caused by domestic economic crisis

and some challenges in the world timber markets, the

Brazilian industry continues to develop and is gaining

ground in international markets.

The timber sector has expectations for growth in the

domestic housing market which can grow significantly.

According to the Brazilian Institute of Geography and

Statistics (IBGE) the housing deficit in Brazil exceeds 5.8

million homes.

Among the priorities of ABIMCI are the need to expand

product certification, work on improvement and

development of technical standards, contribute to the

improvement of Brazilian wood exports, defend the

interests of the sector and promote sustainable practices

and transparency.

For more see: http://www.abimci.com.br/estudo-setorialapresenta-

perfil-da-industria-de-madeira-brasileira/

Timber exchange launched by BVRio

A private sector online trading platform the "Responsible

Timber Exchange" has been launched by an enterprise

named the BVRio Institute.

This trading platform aims to help buyers find wood

products from producers who can verify the legal origin of

their products or are offering products from certified

sources. In addition to B to B ¡®match-making¡¯ those

participating will have access to additional services that

add value to their transactions.

The timber exchange relies on integrated due

diligence

and a BVRio Risk Analysis system to facilitate tracking

along the supply chain. The objective, says BVRIO, is to

facilitate trade in responsibly sourced and manufactured

wood products while at the same time helping to promote

transparency, legality and sustainability in the timber

sector.

The exchange is designed to facilitate compliance with the

EU Timber Regulation and the Lacey Act as it offers the

means to identify timber products from legal sources in

Brazil, Indonesia (based on FLEGT license) as well as

those that have FSC and PEFC certification.

The company website says ¡°The BVRio Madeira

Exchange is a trading platform that promotes trade in

forest products of legal origin or certified wood (e.g.

FSC®) creating transparency, efficiency and liquidity to

this market. The platform is integrated to a risk analysis

system to assist in the due diligence process of each batch

of traded wood.¡±

For more see: http://bvrio.org/

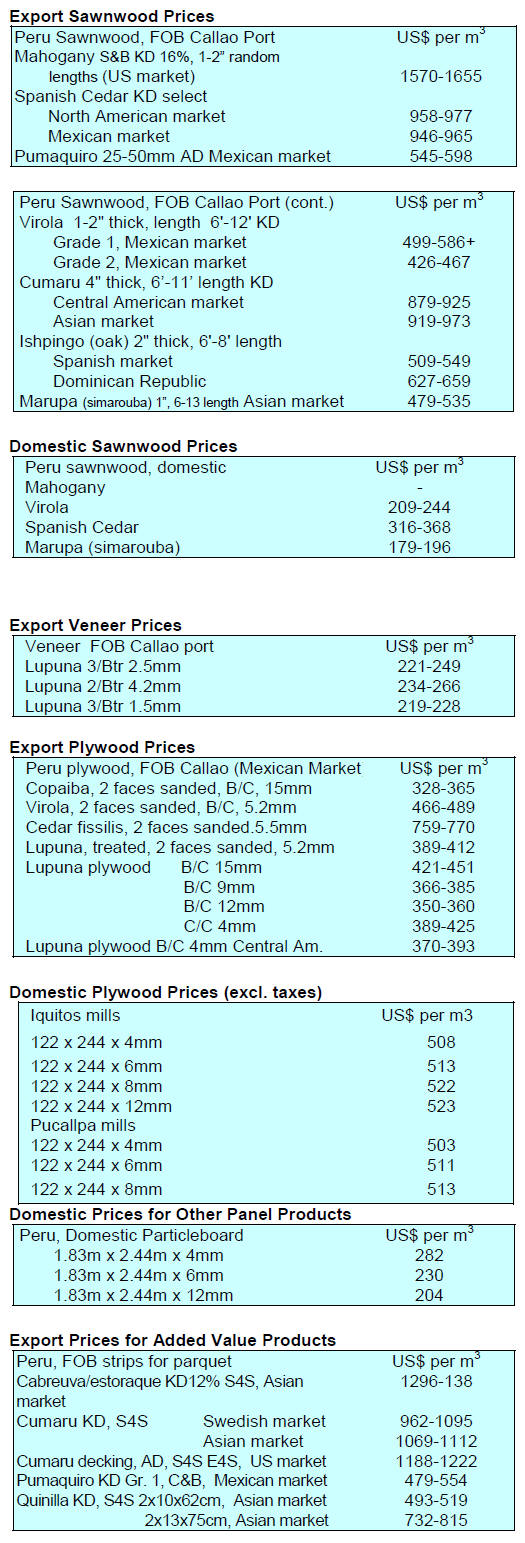

9. PERU

Peruvian government plans reforestation

in Amazonia

Peru¡¯s President Pedro Pablo Kuczynski announced during

a visit to the Amazonian town of Puerto Inca, located in

the region of Hu¨¢nuco 410 kilometres from Lima, that his

government plans reforestation of two million hectares of

Amazon. This plan has two major aims; maintenance of

ecosystem balance in the Amazon and strengthening of

development in the region.

The people of Peru, said the President, are spread across

both the Andean and Amazonian areas but geography

makes communication difficult and this must be

addressed. He said shortening distances between the

valleys of Peru, between workers and entrepreneurs,

between the people and their leaders is of vital importance

to ensure plans for social and economic integration

succeed.

Peru to host ITTC in 2017

During the 52nd International Tropical Timber Council

(ITTC) meeting in Japan Peru¡¯s invitation to host the next

Council meeting in Lima was unanimously welcomed.

The ITTC brings together representatives of all members

of the ITTO.

Action to address forestry and timber trade issues

Representatives of the Governments of Peru and the

United States met this month to exchange information on

progress with the Peru - United States Trade Promotion

Agreement (TPA) and discussed progress on issues in the

annex to this agreement on forest sector governance which

attracts support under the United States-Peru

Environmental Cooperation Agreement (ECA).

For the full joint meeting press release see:

https://ustr.gov/about-us/policy-offices/press-office/pressreleases/

2016/november/joint-statement-meetings-peru-us

The Peruvian Government highlighted actions it has taken

as part of its domestic agenda to strengthen the forestry

sector, such as: the implementation of the National System

on Forest and Wildlife Management (SINAFOR), the

National System of Control and Surveillance on Forest

and Wildlife (SNCVFFS), the Management Information

System created by OSINFOR (SIGO), the National Pact

for Legal Timber, the Legislative Decrees N¡ã 1220, which

establishes measures to fight against illegal logging, and

N¡ã 1237 which modifies the Peruvian criminal code to

increase penalties for forest crimes, among others actions.

Peru announced unilateral actions that will be

implemented promptly as part of its domestic agenda to

address on-going challenges regarding timber export

products and strengthen the forestry sector:

Amend export documentation requirements by the end

of the first quarter in 2017 to include additional

information to improve traceability throughout the

supply chain;

Implement the National Information System on Forest

and Wildlife ¨C Control Module (SNIFFS-MC) in the

Amazon corridor (Loreto, Ucayali, Huanuco and

Lima) by the end of the first quarter of 2017 and

continue to enrich information in the system and

advance its progressive implementation in 2017;

Implement measures to promote legal trade of timber

products through: 1) risk-based measures for

prevention and timely detection of illegally harvested

timber, including inspections by OSINFOR prior to

commercialization for export, and 2) promoting the

use of voluntary mechanisms for improving due

diligence in the exports of timber products, such as

the National Pact for Legal Timber and inspections by

OSINFOR upon request prior to commercialization

for export;

Improve the accuracy of annual management plans,

including by strengthening the capacity of regional

governments to conduct visual inspections prior to

POA approval, and ensuring that forest regents are

promptly removed from the national registry of

regents for wrong-doing in accordance with Peruvian

legislation;

Take measures to ensure that regional governments

promptly transfer annual operating plans to the

appropriate authorities in accordance with Peruvian

legislation;

Determine the responsibilities of those involved in the

timber shipment subject to the verification and impose

sanctions, in accordance with Peruvian legislation.