2. GHANA

Ghana private sector gets help on VPA

The Food and Agriculture Organisation (FAO) has signed

Letters of Agreement with five corporate bodies in Ghana

aimed at supporting private sector implementation of the

Voluntary Partnership Agreement (VPA). FAO will fund

this support from its Forest Law Enforcement Governance

and Trade (FLEGT) programme.

Participating agencies include the Kumasi Wood Cluster

Association, the Ghana Timber Millers Organization and

the Nature and Development Foundation which can all

submit proposals for funding activities which support VPA

implementation.

The Forestry Commission will take the lead in capacity

building amongst small-holders and artisanal millers to

eliminate illegal practices.

At a ceremony in Accra Mr. William Hanna, Head of

the

EU Delegation in Ghana said the EU Timber Regulation

(EUTR) has placed a legal obligation on European wood

product importers to see that imported products are

manufactured from legally sourced raw material.

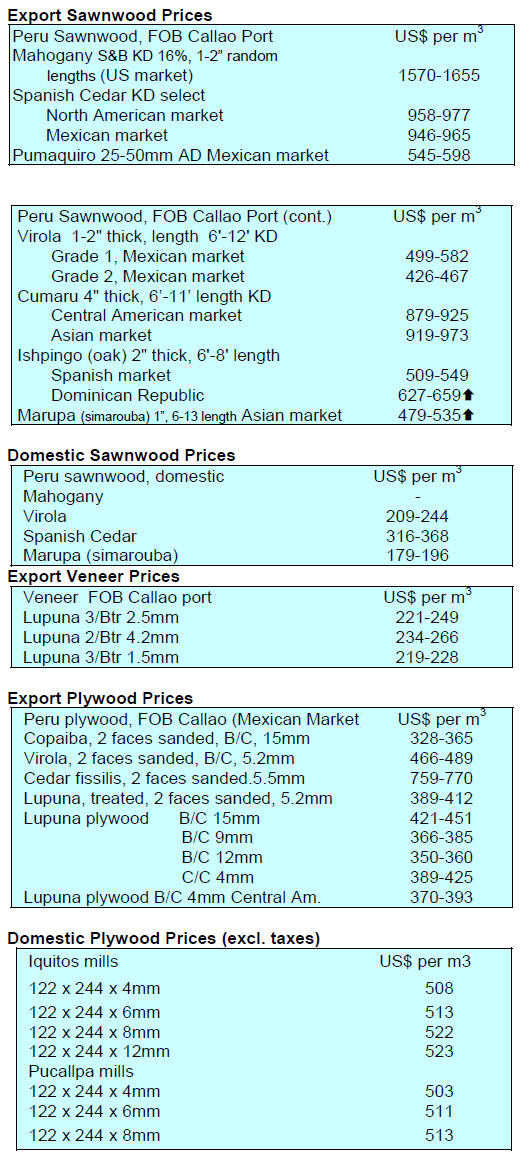

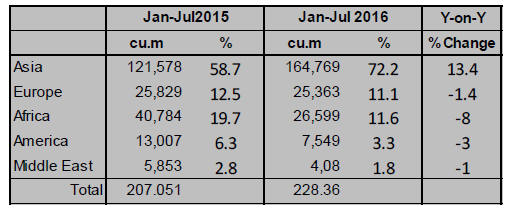

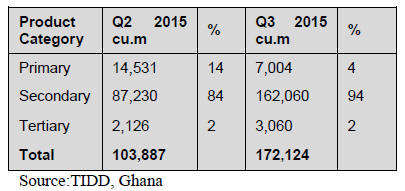

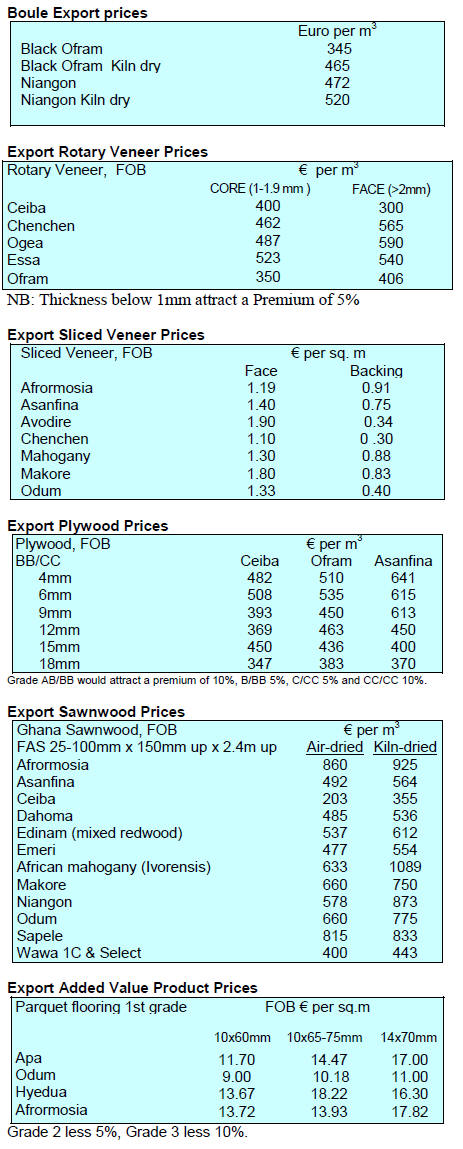

Only Asian markets have grown in first 7 months

Ghana¡¯s exports in the first seven months of this year

totalled 228,387 cubic metres and earned Euro 130,732

million. Compared to the same period last year the

performance in up to July recorded a 10% increase in

export volumes and a 24% increase in export earnings.

The leading export products up to July were air-dry

sawnwood (60%), kiln-dry sawnwood (13%), plywood to

regional markets (9%), roundwood billets (8%) and sliced

veneer (4%) with other wood products accounting for the

remaining 6%.

Export shipments of wood products from Ghana were

largely to the Asian markets which accounted for 72%

followed by African regional markets (12%) and Europe

(11%).

The Middle East and America accounted for the balance.

It was only the Asian markets where an increase in exports

was achieved.

For the period under review the average unit price

of all

wood products for 2016 was euro 572/cu.m compared to

euro 511/cu.m in 2015.

3.

SOUTH AFRICA

Malaysian exporters actively

pushing meranti

Analysts report that Malaysian shippers have become

more active in the market and are taking on the

competition from okoume through discounts. Reports

suggest there is a slight excess of stocks which has had a

downward influence on domestic sales prices. Local

traders expect this situation to ease in the coming weeks

particularly as some Malaysian (and others) export

containers are being shut-out on many vessels.

Overall, the timber market is busy and pine sales are

robust though there are some reports that sales of gangnails

for trusses construction have fallen. This seems to

point to the ¡®informal¡¯ market absorbing more timber and

this is borne out by the low stocks at most pine mills.

Reports say American hardwoods are selling well as there

is firm demand in the shop-fitting and furniture sectors.

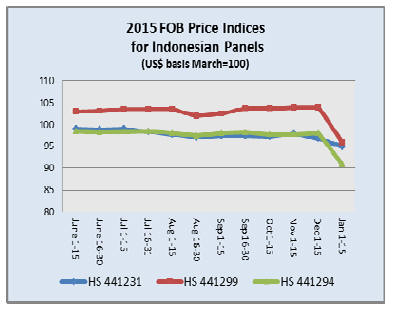

Panel market oversupplied

The panel market continues to be overtraded and there is a

lot of discounting of both MDF and particleboard at

present even in the face of the announcement by Sonae

Novobord that they will be looking to increase prices in

January.

Domestic mills continue to invest counting on an

economic rebound

Although retail sales are under pressure from slowing

infrastructure and housing spending, investment in

production capacity continues. Many government building

programmes are on hold because of the changes in

administration of some major municipalities.

Housing construction remains slow with plans passed for

residential buildings down 5%, non-residential approved

building plans are down 16% and in the alterations and

additions segment of the market there has been an 11%

drop in approvals.

Correction: In the previous issue of our report we

said a team

from the Malaysian Timber Council visited South Africa,

actually the team was from the Timber Exporters¡¯ Association of

Malaysia.

4.

MALAYSIA

Domestic demand major driver of economy

Malaysia¡¯s Ministry of Finance has just released its

¡®Economic Report on Malaysia¡¯ which indicates the

economy is expected to expand 4-5% in 2017.

The report says inflation will be benign in 2017 and

employment will hold up well especially as the services

and manufacturing sectors are expected to expand in 2017.

Non-oil related revenue will contribute more than 85% to

total revenues as the new goods and services tax collection

stabilises. Malaysia¡¯s domestic demand is a driver of

growth and this year local consumption expanded nearly

5%.

Sarawak timber legality scheme explained to Japanese

A joint mission by the Sarawak State and the timber

industry recently visited Tokyo and Osaka to explain the

operation and monitoring of the Sarawak Timber Legality

Scheme. Some 200 participants, including importers and

end-users of Sarawak wood products attended the various

events.

Japan is an important market for wood products from

Sarawak and the mission sought to inform the Japanese

timber sector of the achievements in eliminating illegal

timber from the supply chain.

Leading the mission was Minister of Resource Planning

and Environment, Awang Tengah Ali Hasan, who told the

participants the government¡¯s priority is protecting the

forest, environment and wildlife through sustainable

management, generating employment and export earnings.

PWI secures log supplies through acquisition

Towards month end Priceworth International (PWI), a

major investor in wood products manufacturing, said it

was buying Rumpun Capaian which has a long-term forest

concession in Trus Madi, Sabah.

According to PWI, this acquisition is expected to generate

a sustainable forest harvest of around 6.5 million cubic

metres over the remaining life of the concession. This

harvest will go some way to address the raw material

supply for PWI¡¯s massive logging and wood processing

capacity.

5. INDONESIA

Furniture a best seller at Expo Indonesia

The Director General of Export Development at the

Ministry of Trade, Arlinda, reported that Indonesian

furniture attracted considerable interest from international

buyers at the Trade Expo Indonesia (TEI) which recently

concluded in Jakarta.

The Minister said business was concluded with buyers

from around the world including India, Russia, Malaysia,

Japan, and Taiwan P.o.C and resulted in contracts worth

over US$950 million, a 7% rise from last year. The Expo

attracted 15,567 visitors from 125 countries.

For more see: http://www.antaranews.com/berita/590530/mebelproduk-

terlaris-di-tei-2016

And

http://www.tradexpoindonesia.com/

¡®Lightweight¡¯ plantation timbers to be promoted in

Germany

In related news, Indonesia and Germany signed a

cooperation deal on the side-lines of Expo. The Director

General of Export Development, Ministry of Commerce,

Arlinda said the two countries will cooperate to develop

markets in Germany for ¡®lightweight¡¯ timbers from

Indonesia. Media reports suggest some US$3 million will

be available to promote the trade in timbers from

Indonesia.

Trade with Romania to grow

Indonesian Foreign Minister, Retno LP Marsudi, hosted

her counterpart from Romania recently cementing the 66

years of diplomatic relations between the two countries.

This was the first official visit to Indonesia by a Romanian

Foreign Minister.

Retno LP Marsudi said growth in bilateral trade had

expanded in recent years and that Indonesia has enjoyed a

trade surplus with Romania for several years. Romania is

Indonesia¡¯s sixth-largest market and exports to Romania

include rubber, paper, paper products and synthetic fibre.

Minister outlies benefits to Indonesia from joining TPP

The Indonesian government is eager to join the Trans-

Pacific Partnership (TPP) which brings together 12

countries including Indonesia¡¯s main trading partners.

However, according to an October issue of ¡®Indonesia

Investment¡¯ opinions vary on whether joining would

benefit Indonesia.

¡®Indonesia Investment¡¯ quotes the Indonesian Minister of

trade saying he believes that Indonesia will become an

attractive production hub for Japanese manufacturers

given the competitive production environment and the

attractive size of Indonesia¡¯s domestic market. Indonesia

Investment says ¡°Existing Japanese manufacturers are

reportedly planning to increase production capacity at their

plants in Indonesia.

For more see:

http://www.indonesia-investments.com/news/todaysheadlines/

trans-pacific-partnership-makes-indonesia-attractivefor-

investment/item7281

6. MYANMAR

New Foreign Investment Law criticised

Details of Myanmar¡¯s new Investment Law are expected

to be released the end of March next year at the latest

according to U Maung Maung Win, Deputy Minister of

National Planning and Finance. The new legislation

combines the Myanmar Citizens Investment Law and the

Foreign Investment Law.

However, civil society groups have expressed concern that

the consultation period was inadequate and that the

legislation needs to be strengthened to ensure responsible

investment.

They complain that the new law does not provide for

adequate oversight of the Investment Commission and

does not provide for adequate environmental assessment.

During April to September period this year foreign direct

investment (FDI) declined significantly to US$1.4 billion

compared to US$3 billion in the same period last year.

As with many other countries the Myanmar currency has

weakened against US dollar disrupting business

transactions but despite the currency issues over the past

five months international trade reached to US$11 Billion

with the forest sector contributing just US$100 million.

Urgent need to tackle verification of legality

Following an investigation into Myanmar teak arriving in

the EU the Environmental Investigation Agency (EIA)

submitted a complaint in five countries saying some

importers were not fulfilling the terms of the EUTR.

According to Barber Cho, Secretary of Myanmar Forest

Certification Council (MFCC) representatives of one

company named in the EIA investigation sought and were

granted permission to examine harvesting controls in

Myanmar. The MFCC was told by the Forestry

Department (FD) and the Myanma Timber Enterprise

(MTE) that the proposed study tour was cancelled by the

company when the logging suspension was announced.

Mr. Cho asserts that ¡°both FD and MTE are moving in the

right direction to verify the legality of Myanmar¡¯s timber

and the EIA should do more on teak shipments (to the EU)

from China and other countries where Myanmar teak is

reprocessed for export¡±.

7.

INDIA

Slight weakening of economic indicators in

August

The Ministry of Finance monthly economic report for the

second quarter (April-June) 2016 released by the Central

Statistics Office shows GDP growth in the second quarter

was 7.1% compared to the 7.5% in the same period last

year. However, the report shows a decline in the Index of

Industrial Production (IIP) at -2.4% in July 2016 as

compared to 4.3% a year earlier.

On foreign trade the report says exports and imports both

declined in August (- 0.3% and -14% respectively

compared to a year earlier)

For more see:

http://finmin.nic.in/stats_data/monthly_economic_report/2016/in

daug16.pdf

Inflation rate trends

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI). The official Wholesale Price Index (WPI) for All

Commodities (Base: 2004-05=100) for September

declined by 0.2 percent to 182.8 from 183.1 for August.

The annual rate of inflation, based on the monthly WPI,

stood at 3.57% (provisional) for the month of September

2016 compared to -4.28% for September 2015.

See:

http://eaindustry.nic.in/cmonthly.pdf

Timber and plywood price indices climb

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood Products and Plywood are shown below.

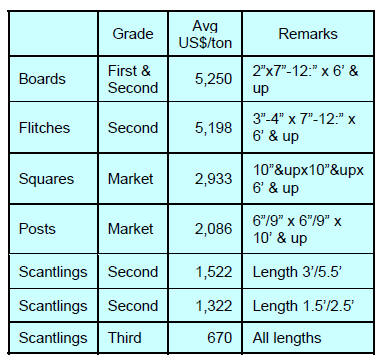

First of season¡¯s log auctions

Log auctions of the new season have been just concluded

in the Dangs Division depots. The logs offered were fresh

and of good quality. The total quantity offered was around

8,500 cubic metres, mostly teak.

Analysts report the buying tempo was upbeat and the

prices secured were much higher compared to the same

time last year. This, say analysts, was due to the scarcity

of good quality logs and bidding competition. The prices

achieved as shown below:

Good quality non-teak hardwood logs, 3 to 4 metres

long

having girths 91cms and up of haldu (Adina cordifolia),

laurel (Terminalia tomentosa), kalam (Mitragyna

parviflora) and Pterocarpus marsupium, fetched lower

prices in the range of Rs.700-900 per c.ft for the better

qualities and from Rs.600-700 per c.ft for medium quality

logs while the lowest quality attracted prices of between

Rs.300-450 per c.ft.

Auction sales at depots in Surat Division will begin 8

November and at those in Vyara Division from 10

November. The indications are that the quality of logs to

be offered at these auctions is good.

Furniture makers move online to match competition

The president of the Kerala Furniture Manufacturers and

Merchants Association has said ¡°to become more

competitive the members of the association plan to expand

online marketing of knock-down furniture¡±. Association

members reported sales of around Rs. 120 billion last year.

In an effort to upgrade both the technology and skills of

the industry in the state there are plans to consolidate the

several clusters on one site and land has been secured in

Angamaly a municipality in the Ernakulam district of

Kerala.

Media reports say 50% of the development cost will come

from the central government, 25% from the State and the

balance from industry.

For more see:

http://www.thehindu.com/news/cities/Kochi/furnituremakerstake-

the-eroute-to-beat-competition/article7505892.ece

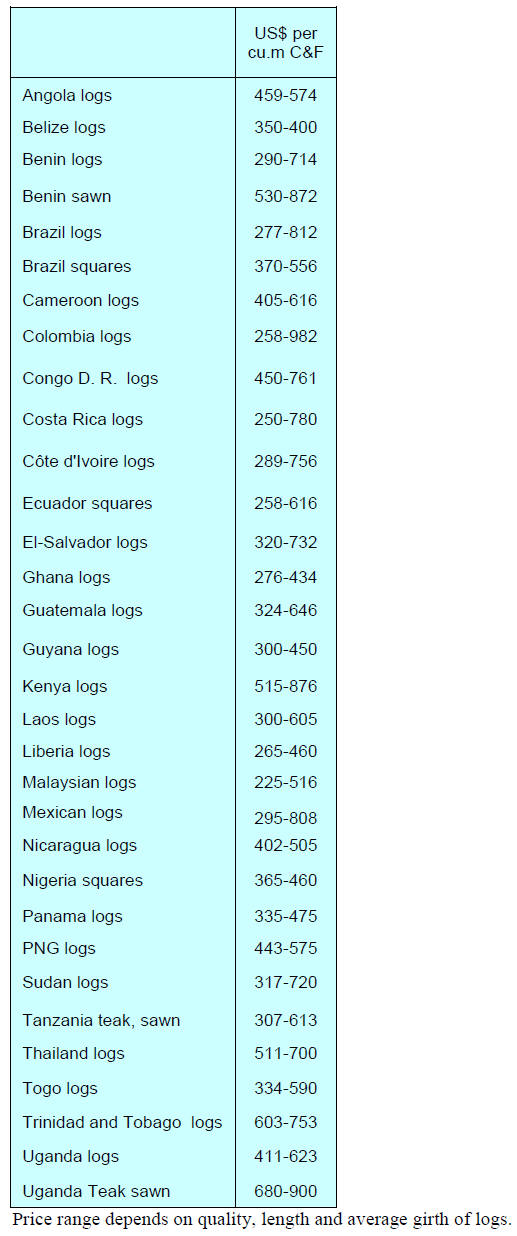

Plantation teak prices

Domestic demand for plantation teak remains firm.

Prices from the three new plantation logs suppliers

remain

unchanged at: Taiwan P.o.C (US$1036 to 2126 per cu.m

C&F) and Honduras (US$471 to US$539 per cu.m C&F).

Sawn teak: from China (US$855 to 1118 per cu.m C&F)

and from Myanmar (US$461-2895 per cu.m C&F).

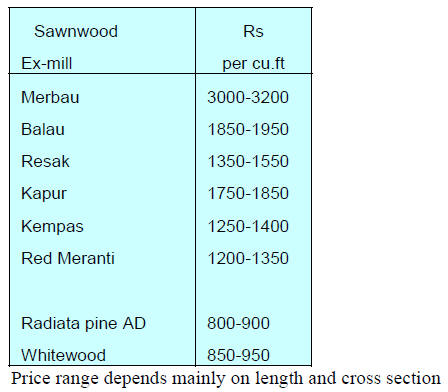

Prices for locally sawn imported hardwoods

There have been changes in prices as shown below.

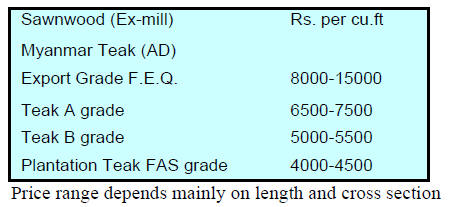

Myanmar teak flitches resawn in India

Demand remains steady and current supplies are adequate.

Imports of sawn teak from Myanmar and China have kept

prices stable.

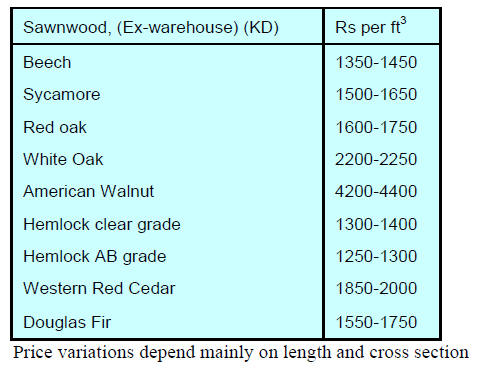

Prices for imported sawnwood

Demand for imported sawnwood has started to rise and

this has lifted prices for some species.

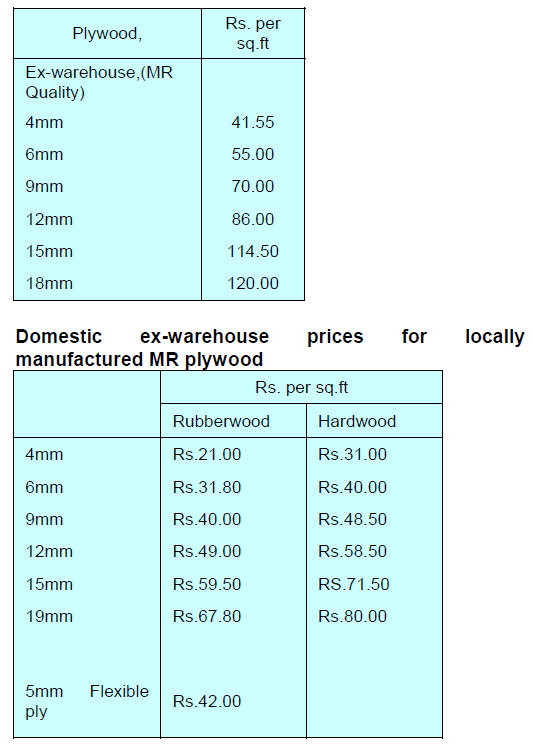

Prices for WBP Marine grade plywood from domestic

mills

Prices remain unchanged.

8.

BRAZIL

First cut in interest rates in 5 years

The official Brazilian inflation rate based on the Consumer

Price Index (IPCA) was just 0.08% in September

compared to 0.44% in October this year. This is the lowest

rate of inflation for September since 1998 when it fell to

0.22%. Over the past 12 months the cumulative inflation

rate was 5.51%.

Given the slowing inflation the Monetary Policy

Committee (COPOM) cut the interest rate (SELIC) by

0.25 percentage point, to 14% from 14.25%, the first

reduction since 2012.

Furniture manufacturers expect suppliers to be highly

professional and innovative

Product quality, fair price, prompt delivery and prompt

communications are the main attributes a furniture

manufacturers looks for from a supplier.

These factors can be achieved as commercial partnerships

evolve over time. Manufacturers also expect suppliers to

be innovative in terms of the products they offer so as to

offer opportunities to improve competitiveness and allow a

manufacturer to differentiate itself from others in the

market.

Innovation is fundamental to the growth and development

of the furniture sector as consumers expect new products

and designs such that at all stages of the supply chain there

is a need to pursue innovation.

Export update

In September 2016, the Brazilian exports of wood

products (except pulp and paper) increased 13% in value

compared to September 2015, from US$209.5 million to

US$237.0 million.

The value of pine sawnwood exports jumped 63%

between September 2015 (US$ 21.7 million) and

September this year (US$ 35.3 million) and in terms of

volume exports increased 85% over the same period, from

97,900 cu.m to 181,100 cu.m.

Tropical sawnwood exports also increased in September

by 30% from 23,200 cu.m in September 2015 to 30,200

cu.m in September this year. The value of exports also

rose but by just 24% from US$11.4 million to US$14.1

million over the same period.

In contrast to the performance of sawnwood exports pine

plywood exports fell slightly in September 2016 in

comparison with September 2015, from US$36.4 million

to US$35.8 million however, the volume traded increased

around 7% from 125,300 cu.m to 133,800 cu.m, over the

same period.

As for tropical plywood, exports increased 59% in

volume, from 3,900 cu.m in September 2015 to 13,200

cu.m in September 2016. In value, exports increased 39%

from US$3.9 million to US$5.4 million, during the same

period.

The value of wooden furniture exports increased from

US$34.8 million in September 2015 to US$35.7 million in

September 2016, a 2.6% increase.

The decline in the domestic construction sector and

strengthening of the US dollar led to an increase in

processed timber exports in the first three quarters of this

year.

Plantation pine sawnwood exports rose by 47% year on

year in the first three quarters of the year according to

ABIMCI (Brazilian Association of Mechanically-

Processed Timber Industry).

ABIMCI is forecasting that 20% of the total volume of

pine sawnwood produced this year will be exported but

that earnings will be lower than in 2015 because of the

falling prices in the international market.

Strengthening the Brazil-Canada Chambers of

Commerce link

Representatives from the forest sector and the Mato

Grosso State Development Agency met with the Brazil-

Canada Chamber of Commerce in early October to discuss

ways to strengthen ties and identify business opportunities.

The Brazil-Canada Chamber of Commerce has existed for

over 40 years and has steadily built up business links

between the two countries. One of the objectives of the

Chamber is to obtain reliable information on business

enterprises and identify opportunities for cooperation and

trade.

In the recent meeting, a representative from the Center for

Timber Producers and Exporters of the State of Mato

Grosso (CIPEM) provided details of the forestry and

industry sector of Mato Grosso including production and

output from natural and planted forests and the steps taken

to ensure natural forest logging is sustainable.

Currently, the managed forest area in the State extends to

3.2 million hectares and the State aims to increase this to 6

million by 2030 which would result in timber production

rising to 6 million cubic metres annually. Among the

exported timber species are teak (for which plantations

extend over 80,000 hectares) as well as African

mahogany.

Representative of the Chamber said that despite the US

being the main export market exports to Canada at US$17

million are significant and can grow particularly as

Canada was not seriously affected by the global economic

crisis and there is a vibrant construction sector in the

country.

Altamira forest concessions

Part of the Altamira National Forest has been earmarked

for commercial logging and has the potential to produce

around 200,000 cubic metres of logs annually. This, say

analysts, could yield an income of R$80 million per year

and generate 900 jobs.

Currently logging produces almost 500 cubic metres per

day including timbers such as angelim amargoso (Vatairea

spp.), angelim pedra (Hymenolobium petraeum), cumaru

(Dipteryx odorata) curupix¨¢ (Micropholis venulosa),

garapa (Apuleia leiocarpa), jatoba (Hymenaea courbaril),

muiracatiara (Astronium lecointei), tachi (Tachigali spp.)

and tauari (Couratari guianensis). These timbers find a

ready market in the Southern and Southeastern Regional

markets such as Rio Grande do Sul, Santa Catarina and

São Paulo.

Under the Brazilian Forest Concession Law and after

competitive bidding the government grants a long term

lease (usually 40 years) allowing the concessionaire the

right to manage the forest area.

In the Altamira National Forest the Chico Mendes Institute

for Biodiversity Conservation (ICMBio), the public

agency responsible for protected areas in Brazil, is present

to ensure concession holders adhere to the approved

management plan which addresses issues such as

biodiversity conservation.

9. PERU

37th Annual National Forestry Congress

Peru¡¯s 37th annual National Forestry Congress (Conafor)

was held in Lima from 26 to 28 October and brought

together forestry and forest industry stakeholders to

analyse trends and developments in the sector and

exchange experiences and hear about the latest research.

The main focus of this years¡¯ Conafor was management of

natural forests and forest plantations, value added forest

products and the contribution of international technical

cooperation in forestry development and management.

Mexico/Peru exchange on technological innovation

As part of a project titled "Innovation Exchange of

experiences and tools for the dissemination of design"

which aims to build stronger ties between the forestry

sectors in Peru and Mexico, a delegation from the institute

of Design and Technological Innovation in Mexico visited

Peru.

This initiative is managed by CITEmadera and one

activity is the arrangement of visits between the two

countries to develop joint activities in education, training

and industry development especially in the furniture

sector.

During the weeklong visit the delegation from Mexico

viewed the CITEmadera facilities and the work being done

on technological innovation in wood processing.

Promoting forest plantations

In order to promote forest plantation financing the

National Forest Service and Wildlife (SERFOR) in

cooperation with the Regional Government of Ucayali

announced the launch of a campaign entitled ¡®Registration

of Forest Plantations in Pucallpa¡¯.

The main aim of this campaign is to contribute to the

formalisation of the value chain for plantation timbers and

the improvement of incomes for plantation owners.

The registration of forest plantations is free and is

performed from the third year of planting established as

set out in the current forest and wildlife regulations.

Producers who register their plantations will be able to

take advantage of various benefits such as technical

assistance, marketing support, help with access to

financing and addressing issues of timber legality.

This experience of joint work between the SERFOR the

Government of Ucayali will be replicated in other regions

such as Loreto, Junin, Pasco, Mother of God, Amazonas,

Huanuco and San Martin.

New approach to National Forestry Development Plan

The Executive Director of SERFOR, John Leigh Vetter,

has announced that the immediate task of SERFOR is to

fulfill its commitment to the development of a National

Forestry Development Plan in which each region of the

country will have a work plan specifically tailored to their

potential and capabilities.

Leigh said the National Policy and Law of Forestry and

Wildlife will be the foundation upon which the National

Plan will be crafted and as such will address three

objectives: utilisation of resources based on land use

planning and forest zoning; providing access to benefits

from forest management to forest communities and

strengthening sustainable forest management.

When operational the National Plan will achieve a

reduction in the rate of deforestation, the promotion of

forest plantations and restoration of degraded areas.