|

Report from

Europe

Slowing pace of EU tropical timber imports

Latest trade data shows that the rising trend in EU import

value of tropical wood products that began in the second

half of 2014 levelled off in the first five months of this

year. No trade data is yet available for the period after

May when the effects of the UK vote to leave the EU

might become clearer.

Early indications are that it will lead to a significant

slowdown in European tropical wood imports in the

second half of 2016 in response to currency movements

and economic uncertainty in the UK, currently the largest

European market for tropical wood products.

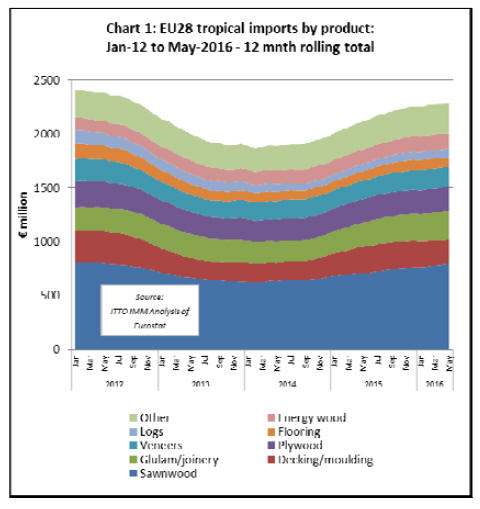

Charts 1 to 3 below show the monthly trends in imports of

tropical wood products into the EU to May 2016 using 12

month rolling totals. This is calculated for each month as

the total import of the previous 12 months. The data

removes short-term fluctuations due to seasonal changes in

supply and shipping schedules and provides a clear

indication of the underlying trade trend.

Chart 1 shows total EU euro import value of all wood

products listed in Chapter 44 of the HS codes sourced

from tropical countries. Total imports in the 12 months to

May 2016 were euro2.29 billion, only slightly above

euro2.26 billion recorded for the 12 months of 2015.

The sharp increase in imports of tropical decking and

mouldings recorded in 2015, notably from Brazil and into

the UK and France, has slowed dramatically in 2016.

Imports of tropical flooring products have also slowed this

year.

However, European imports of tropical sawnwood, veneer,

logs, energy wood and joinery products such as LVL

continued to rise between January and May 2016. After

recovering in 2014, European imports of tropical plywood

remained static between January 2015 and May 2016.

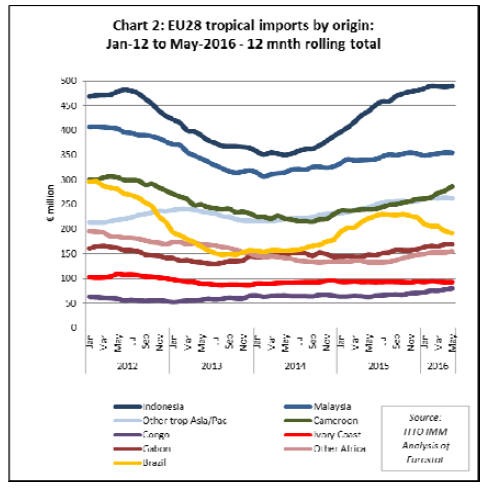

Chart 2 shows how European imports from the major

tropical supply countries developed between 2012 and

May 2016. After rapid growth in 2015 and the first quarter

of 2016, European imports from Indonesia (dominated by

decking, doors, plywood and LVL) stabilised at the higher

level in April and May this year.

Imports from Malaysia (mainly sawnwood, plywood,

doors, and LVL) remained static at a relatively low level

between mid-2015 and May 2016. Imports from

Cameroon (almost all sawnwood) were rising sharply in

the year to May. However, imports from Brazil (mainly

sawnwood and decking) fell rapidly between September

2015 and May 2016.

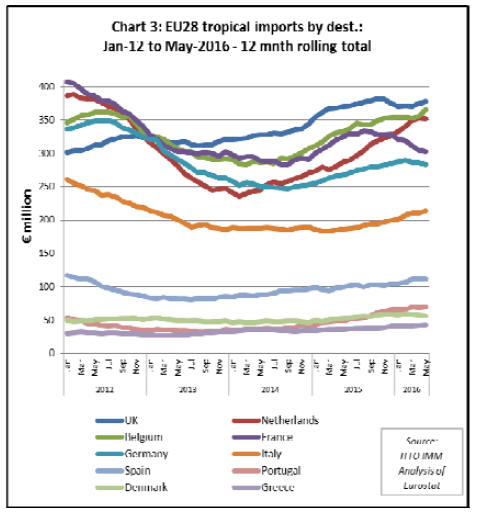

Chart 3 shows the recent trend in tropical wood imports

into the main EU consuming countries. The pace of

growth in imports into the UK (the leading EU market

which takes mainly doors, plywood and sawnwood) was

already slowing in the early months of 2016 before the

Brexit vote.

Imports into Belgium (mainly sawnwood and decking) and

the Netherlands (mainly sawnwood, LVL and decking)

continued to rise in the first five months of 2016,

narrowing the gap with the UK. Imports have also

continued to rise this year into Italy (mainly sawnwood

and veneer), Spain (mainly sawnwood and veneer) and

Portugal (mainly sawnwood, logs and chips).

In contrast, imports into France (mainly sawnwood,

decking and veneer) were declining during the first five

months of 2016, due to weakening imports from Brazil.

Imports into Germany (mainly decking and sawnwood)

also dipped a little in April and May this year.

Lower European imports expected in second half of

2016

The fall-out from the Brexit vote on 23 June, combined

with challenging economic conditions in other parts of the

Europe, particularly Italy, is likely to lead to a downturn in

European imports in the second half of 2016.

Feedback from UK timber importers in the aftermath of

the Brexit referendum vote on 23 June is that their most

immediate concern is the exchange rate.

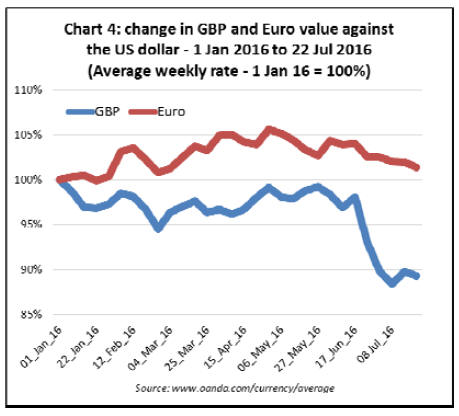

The value of the British pound, which increased from 1.41

to 1.50 against the US dollar in the days leading up to the

referendum on the expectation that ¡°Remain¡± would win,

fell sharply to a 30-year low of $1.29 on 6 July after the

result. By 22 July it had recovered only slightly to $1.31.

The euro, already low against the US dollar after a

dramatic fall in late 2014 and early 2015, also weakened

following the referendum from $1.14 on 22 June to

euro1.10 on 22 July (Chart 4).

UK import prices for hardwoods, particularly when

invoiced in dollars, have therefore increased sharply since

the referendum and a prolonged hiatus in purchasing is

now expected. Merchants and manufacturers already

appear to be hunting for landed stock before looking to

order from overseas. The extent to which prices for stock

already landed in the UK now also rise depends on

availability and the extent to which consumption slows in

response to wider economic uncertainty.

For now, UK importers report there is good availability of

landed stock of most of the key commercial hardwoods.

Overall there is probably enough stock on the ground to

tide the bulk of the UK market over the summer months.

There¡¯s therefore likely to be a sharp slowdown in orders

from UK importers at least until September and probably

longer.

UK importers report that sales to manufacturers and

merchants did not dry up after the referendum, although

buying was quiet for the last week of June when there

would usually be an uptick in activity. There are reports of

some UK customers, while not placing new orders,

sending out long lists of requirements. As one agent

commented, ¡°it looks like they are fishing for new price

structures as nobody is yet sure where the market will

settle¡±.

No one yet knows what the real economic impact will be

of the Brexit vote. But of course markets generally don¡¯t

like change or uncertainty and the Brexit process means

that the period of uncertainty will be prolonged. Some

major investors will delay decisions, while tens of

thousands of smaller investors will also wait to see what

happens. Government tax receipts and spending are likely

to be curtailed. This is likely to dampen economic growth

in the UK over the next couple of years or more.

Early indications are that the short-term economic impact

of Brexit has been severe in the UK. Following the

referendum, major house builders in the UK suffered

initial blows to their future forecasts and analysts are

predicting a slowdown in the market along with increased

costs of 10-12% for major construction projects, leading to

more being put on ice.

The UK Purchasing Managers Index (PMIs) compiled by

Markit dropped to 47.7 in July from 52.4 in June, the

sharpest one-month drop on record and a decisive shift

from expansion to contraction (50 being the threshold

value). Both services and manufacturing recorded sharp

declines, with a small silver lining being an apparent

increase in new export business, helped by the steep drop

in the British pound.

But there are some reasons for optimism. The indexes

stand in contrast to a report published on 20 July by the

Bank of England based on interviews with businesses

around the UK saying there had been no clear evidence of

a sharp slowing in activity, although uncertainty had risen.

¡¡

And the PMI may have been coloured by political

uncertainty that has decreased with the relatively rapid

appointment of a new British Prime Minister on 13 July.

No sign yet of Brexit contagion

There is also no sign yet of any significant contagion from

the Brexit vote in other European markets. The Markit

Flash Eurozone Manufacturing PMI came in at 51.9 in

July, down from 52.8 in June but only slightly below

market expectations of 52.

Although Eurozone export growth slowed in part due to

lower sales to the UK this was offset by increased export

orders to other markets due to the weaker euro.

In Germany, the widely watched IFO business climate

index dipped to 108.3 in July from 108.7 in June. That was

both better than expected and the second-highest outcome

this year. In other words, business expectations slid, but

only marginally.

The French economy has shown signs of improvement this

year with latest GDP data to end March 2016 registering

the strongest annual expansion since 2011. Even after the

British vote to leave the EU, both the finance ministry and

the International Monetary Fund (IMF) maintained their

forecasts for France to show growth of 1.5% in 2016.

However, the strength of economic recovery is still

uncertain.

The Markit composite PMI for France stood at 50 in July,

the threshold that divides expansion from contraction. The

data suggests a continued slump in French manufacturing

output which is erasing a return to growth in services.

Apart from Brexit, weakness in the Italian economy

remains the primary concern in the EU. Italy's economy is

unlikely to return to pre-crisis levels for close to a decade,

according to the IMF.

Italian banks now have an estimated euro360 billion of

non-performing loans, reflecting around 20% of Italy¡¯s

GDP and 15% of all its banking system¡¯s loans (which

compares to around 5% in the U.S. during in the 2008-09

banking crisis).

The problem is not a real estate bubble, but low growth,

deflation, and lack of competitiveness ¡ª exacerbated by a

euro exchange rate which is over-valued from the

perspective of Italian manufacturers.

Exchange rate will also be the key concern of the

European timber trade in the months ahead. Forecasting

the euro dollar exchange rate is extremely difficult given

political and economic uncertainty on both sides of the

Atlantic.

But drawing on the recent better-than-expected economic

signals in Germany and with no signs yet of any change in

ECB monetary policy, most forecasters suggest relative

stability in the euro-dollar rate for the time-being.

However, the UK Financial Times is reporting that the

majority of analysts they follow are forecasting a notably

weaker British pound in the months ahead. There is a

widespread expectation, fed by public statements by the

Governor of the Bank of England about the need for

economic stimulus, that the UK interest rate will be cut

from the current 0.5%, at least to 0.25%, perhaps even to

zero in the next few months.

In addition to a hoped for boost in spending, this would

tend to reduce inflows of foreign capital into the UK and

create further downward pressure on the exchange rate.

Therefore, it might be some time before UK importers are

encouraged back into the tropical timber market in any

volume.

|