|

Report from

Europe

Pace of EU tropical import growth slows in 2016

The latest trade data shows that the sharp rising trend in

EU import value of tropical wood products that began in

the second half of 2014 levelled off in the opening months

of this year. This was mainly due to slowing imports of

tropical sawn wood and decking, notably from Brazil.

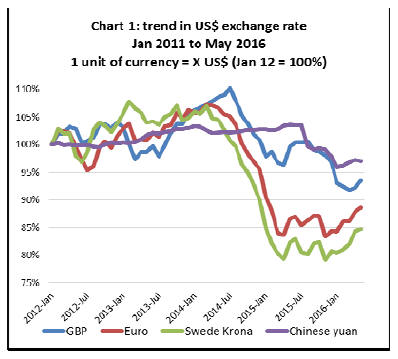

Recent trends in the EU import trade should be viewed

against the background of the sharp fall in the value of the

euro against the dollar and other international currencies

between mid-2014 and early 2015. The euro has remained

relatively weak since then (Chart 1).

The higher value of EU imports in 2015 is due not only to

better consumption in the EU but also to rising euro prices

of imported products. Most exporters of wood products

into the EU will only have noted a relatively minor uptick

in the dollar value of sales to the region.

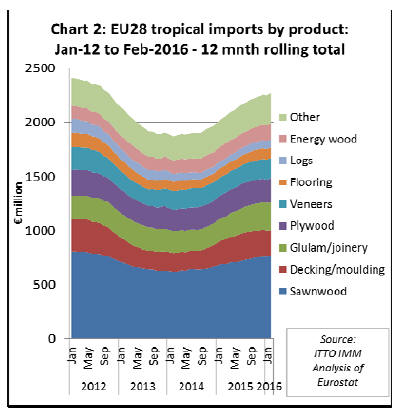

Charts 2 to 4 below show the monthly trend in imports of

tropical wood products into the EU to February 2016 using

12 month rolling totals. This is calculated for each month

as the total import of the previous 12 months.

The data removes short-term fluctuations due to seasonal

changes in supply and shipping schedules and provides a

clear indication of the underlying trade trend.

Chart 2 shows total EU Euro import value of all wood

products listed in Chapter 44 of the HS codes sourced

from tropical countries. Total imports in the 12 months to

February 2016 were Euro2.27 billion, which compares to

only Euro1.87 billion in the same month of 2014 when the

12 monthly total hit bottom in the wake of the euro-zone

crises.

The pace of the rebound in imports from that low

accelerated throughout 2014 and most of 2015,

particularly for sawn wood, decking/mouldings and

joinery products, but has levelled off this year.

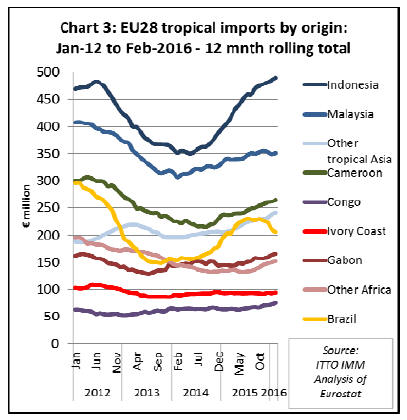

Chart 3 shows how imports from the major supply

countries have developed during this period. The increase

in imports from Indonesia, now the EU¡¯s largest supplier

of tropical wood products by a significant margin, has

been particularly notable.

Indonesia has significantly outperformed other suppliers

and growth has continued into 2016.

Indonesia may be benefitting from efforts to develop and

expand SVLK, recently rewarded by the announcement

that the certification system is ready to become the first to

deliver FLEGT licenses into the EU market. When those

licenses are issued, expected later in 2016, all Indonesian

wood products sold into the EU will no longer be subject

to legality due diligence requirements.

The trade data suggests that even before that

announcement, Indonesia has been benefitting from the

added confidence associated with its domestic SVLK and

the commitment to long-term market development in the

EU that it implies.

The fortunes of other tropical suppliers in the EU market

have been mixed. Imports from Malaysia were rising

slowly throughout most of 2015, particularly benefitting

from better demand in the Netherlands, but have dipped

again in the opening months of 2016.

Imports from Brazil have been particularly volatile, rising

sharply in the first half of 2015 on the back of improved

French demand for sawn wood and decking, but falling

away again equally sharply in the second half of last year.

The downward trend in EU imports from Brazil has

continued into 2016.

The value of EU imports from Cameroon has risen quite

steeply and consistently since the low in summer 2014, but

still remains well below the level of 2012 and is now little

more than half that of Indonesia.

Imports from Gabon and Congo Republic have continued

to rise slowly while imports from Ivory Coast have been

flat at a low level.

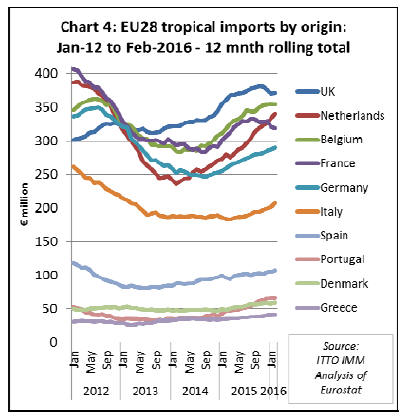

Chart 4 shows how the value of tropical wood imports into

the main EU consuming countries has developed

throughout the last 4 years. The UK has been the largest

EU market for tropical wood since the start of 2013 when

demand fell sharply in the euro-zone countries. Imports

into the UK fell less sharply and began to rise earlier than

into other European countries hitting a peak in the third

quarter of 2015. However UK imports have dipped again

since then.

Chart 1 suggests that exchange rates may have been an

important factor driving this trend. The dollar exchange

rate of the British pound remained stronger than that of the

euro throughout 2014 and 2015 but the rate has been

sliding since the third quarter of 2015.

Belgium and the Netherlands are currently the second and

third largest destinations for tropical wood imported into

the EU respectively. The euro value of imports into both

countries increased sharply in 2015. The pace of growth

slowed into Belgium in the first two months of 2016 but

remained high into the Netherlands.

Recent growth in imports is partly owing to the role of

large Belgian and Dutch distributors in supply to other

parts of the continent.

The long term trends towards greater just-in-time trading

of smaller mixed consignments, together with EUTR

which has discouraged smaller operators to buy direct, has

tended to increase the role of larger distributors in

Belgium and the Netherlands. Domestic consumption is

also rising, particularly in the Netherlands where

construction sector activity continues to recover strongly.

Recent trends in the French tropical wood import trade

have been heavily influenced by trade with Brazil. After

importing very little from Brazil in 2013 and 2014, French

imports of joinery and decking timbers from the South

American country increased sharply in early 2015 before

falling to a low level in September last year where they

have remained ever since.

French imports from African countries, led by Gabon and

Cameroon, were rising slowly in the twelve months to

February 2016.

Tropical wood imports into all other leading EU markets -

including Germany, Italy, Spain, Portugal, Denmark and

Greece - were also rising consistently in the 12 months to

February 2016.

In Italy, the upward trend began later than elsewhere in

Europe but picked up pace in the opening months of 2016,

an encouraging trend in a traditionally large tropical

timber consuming country which has suffered a

particularly deep and protracted downturn.

Upturn in EU construction sector activity

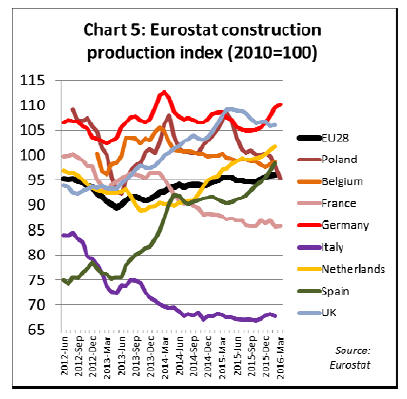

The Eurostat Construction Production Index shows that

EU construction sector activity turned upward in the last

quarter of 2015 and the rising trend continued into the first

quarter of 2016.

Strong growth in activity in Germany, Netherlands, and

Spain offset weakening activity in the UK and Poland.

Activity in France and Belgium remained flat during this

period. Activity in Italy remains at a very low level but

there were some minor gains in the last quarter of 2016

(Chart 5).

Further insight into the EU construction market is

provided by the 2015 European Architectural Barometer

report published by independent research agency Archvision

in March 2016 based on a survey of 1,600 architects

in eight European countries.

The order books, turnover and perceptions of European

architects provide a leading indicator for construction

activity. The survey indicates slow but consistent growth

in European construction activity in 2015 with faster

recovery expected in 2016 and 2017.

Key conclusions for each of the eight countries are as

follows:

Construction activity in Belgium

has been Construction activity in Belgium

has been

improving slowly and consistently since the end

of 2014. Architects order books and turnover

were higher in 2015 than in 2014. Building

permits for both residential and non-residential

construction increased in 2015 after falling in

2014. The construction confidence indicator

improved in the last quarter of 2015. Achi-Vision

forecasts solid growth in Belgian construction

activity of 2% in 2016, a rate expected to

continue into 2017.

In France the construction sector

is still in In France the construction sector

is still in

recession but slowly improving. In the last

quarter of 2015 architects order books grew for

the first time since the first quarter of 2011.

Architects turnover is also stabilizing. The

Eurostat construction confidence and building

permits indicators have improved slightly. Arch-

Vision predict that construction activity in France

will decline 2% in 2016 before stabilising in 2017

and recovery from 2018 onwards.

In Germany, confidence amongst

architects has In Germany, confidence amongst

architects has

been rising steadily over the last 4 years against a

background of gradually improving order books.

The level of building permits for both residential

and non-residential construction was very stable

throughout the years 2014 and 2015 suggesting

continuing improvement. There is good demand

for housing and macroeconomic forecasts are

quite positive. But while construction confidence

is increasing, confidence in other industry sectors

and amongst consumers is lagging in Germany.

Arch-Vision expects 2% growth in German

construction in 2016.

The construction market in Italy

remains the The construction market in Italy

remains the

worst performing in Europe, although it is

beginning to stabilise and should start to recover

in 2017. Architects order books and turnover

continue to decline but the rate of fall slowed in

the second half of 2015. Building permits and

construction confidence indicators are declining

but at a slower rate. Arch-Vision predicts a

further 2% decline Italian construction activity in

2016 with the possibility of stabilisation in 2017.

The Netherlands construction sector

grew more The Netherlands construction sector

grew more

rapidly than elsewhere in Europe in 2015 and

growth is expected to remain at a high pace in

2016 and 2017. Dutch architects¡¯ order books and

turnover are at their highest level since 2011. The

Eurostat construction confidence indicator

increased rapidly and continuously between the

end of 2012 and end of 2015. However it

stumbled a little at the end of last year on news of

a decrease for in building permits for both

residential and non-residential construction.

Nevertheless Arch-Vision predicts that

construction activity will increase 4% in 2016

and that this rate will continue or even strengthen

in 2017.

Construction activity in Poland,

the largest Construction activity in Poland,

the largest

Eastern European economy, remains relatively

high. The Eurostat construction production index

suggests some decline in construction activity in

the last three quarters of 2015, a trend which

continued into the first quarter of 2016. However

according to Arch-Vision, architects order books

and turnover have continued to rise slowly

throughout this period. Arch-Vision expects

Polish construction activity to expand 2% in 2016

and this rate to be maintained in 2017.

Although still well below

pre-crises levels, Although still well below

pre-crises levels,

construction activity in Spain continues to

recover. Architects order books and turnover

were rising in the last quarter of 2015. Despite

some fluctuation, residential building permits

seem to be slowly recovering while permits for

non-residential construction increased rapidly in

2015. The Eurostat construction confidence

indicator is still in negative territory and fell at

the beginning of 2016, but after big gains in 2015

is still significantly higher than two years ago.

Arch-Vision predict 4% growth in Spanish

construction activity in 2016, possibly rising to

5% in 2017.

The UK construction market

continues to The UK construction market

continues to

improve but the increase has become less

consistent. Building permits for new residential

construction were rising in 2014 and the first

quarter of 2015 but weakened in the second half

of the year. Confidence indicators have also been

more variable in the UK. Nevertheless confidence

within architectural firms was still good in the

last quarter of 2015 and order books and turnover

development was quite positive. The latest British

Woodworking Federation quarterly report

showed that while the first quarter of 2016 was a

testing time for many joinery manufacturers,

most were confident of rising sales in the second

quarter. Arch-Vision predicts growth of the

overall UK construction market of 3% in 2016.

|