|

Report from

Europe

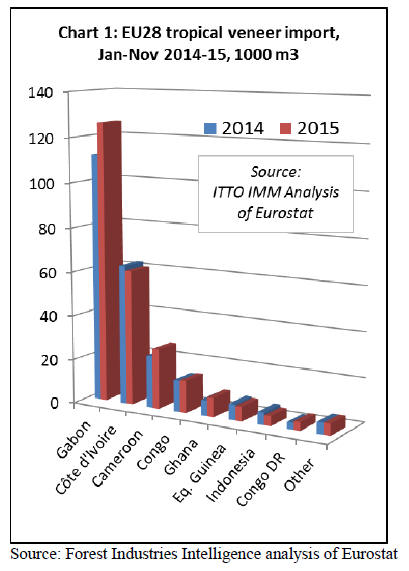

EU imports of tropical veneers rise in 2015

EU imports of tropical veneers increased by 7% to

257,700m3 in the first 11 months of 2015, with growth

driven primarily by rising trade between Gabon and

France. Growth in volume was matched by a 6% increase

in value to €162 million.

EU imports from Gabon increased 13% to 126,300m3

during the first 11 months of 2015. Since okoum谷 log

exports were banned by Gabon in 2010, the southern

European okoum谷 plywood sector 每 now much diminished

每 relies more heavily on imports of veneer.

Demand for okoum谷 plywood has picked up in Europe in

2015 due primarily to recovery in the Netherlands building

industry and slow improvement in the French market.

The French company Rougier which produces okoum谷

veneers and plywood in France and Gabon, booked an

11.8% increase in revenues in its European business

during the first nine months of 2015 and reports an

improved economic climate in Europe.

In addition to Gabon, EU imports of tropical veneer also

increased during the first 11 months of 2015 from

Cameroon (+16% to 27,100 m3), Congo (+2% to 14,500

cu.m), and Ghana (+22% to 8,600 cu.m). However imports

from Ivory Coast declined 3% to 60,800 cu.m (Chart1).

Imports into France and Italy, now the largest EU markets

for tropical veneer, both registered double-digit increases

between January and November 2015, rising 14% to

104,791cu.m and 16% to 60,737m3, respectively. There

were also significant increases in imports by Greece

(+25% to 14,467 cu.m) and Romania (+43% to 14,034

cu.m).

Of the five largest EU markets for tropical veneer, Spain (-

16% to 32,411 cu.m) was the only to report declining

imports in the first 11 months of 2015. However imports

also declined into Germany (-17% to 12893 cu.m) and

Belgium (-47% to 6343 cu.m) during the period.

The German veneer association IFN concluded during its

annual meeting in June 2015 that veneers were

increasingly becoming a niche product in the German

market 每 a startling conclusion in a country which little

more than a decade ago was at the very centre of the

global veneer industry.

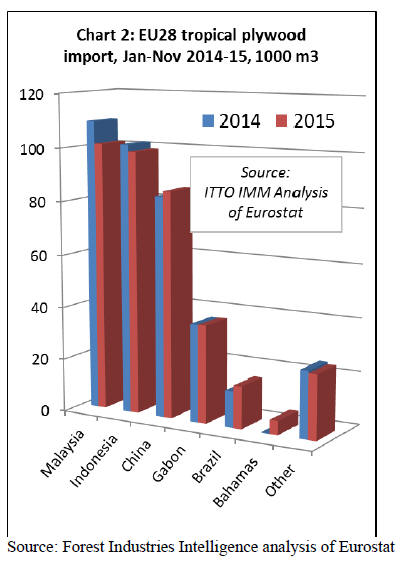

EU tropical plywood imports static in 2015

The EU imported 367,000 m3 of tropical plywood in the

first 11 month of 2015, the same as in the previous year.

However there was growth in EU import value of plywood

(+8.7% to €194.1 million) during the period as import

prices were higher in 2015 due to the weak euro. The euro

was on average 16% down on the dollar in 2015 compared

to 2014.

EU imports of plywood in the first 11 months of 2015

were down from both Malaysia and Indonesia, the two

largest suppliers. Imports from Malaysia were 7% less at

101,200m3 during the period.

EU imports from Malaysia were nearly matched by those

from Indonesia which, at 98,900 cu.m, were only 2% less

than the previous year.

China supplied 85,000 cu.m of plywood with a tropical

wood face to the EU in the first 11 months of 2015, 3%

more than the same period the previous year. There was

also a 16% rise in imports from Brazil but, at only 16,100

cu.m, the volume remains low.

Contrasting 2015 plywood market trends between EU

member states

EU markets for tropical hardwood plywood showed

contrasting trends in 2015. The relatively large UK market

was flat and the Netherlands was buoyant, but most other

markets were declining.

The UK imported 142,600 cu.m of tropical plywood in the

first eleven months of last year, 1% more than the previous

year. The latest data suggests a small surge in UK imports

in the last quarter of 2015. After the first three quarters,

UK imports of tropical plywood were 4% lower than the

year before.

Overall market conditions in the UK were not as buoyant

in 2015 as they were in 2014. The UK Timber Trade

Federation reports an overall reduction in wood product

imports by 3.1% for the period from January to November

2015, blaming a slow-down in UK construction as a main

factor behind this trend.

In relation to hardwood plywood, including both

temperate and tropical, the TTF records a 10.8% increase

in imports during the period.

This is mainly due to a rise in imports from China. UK

imports from Indonesia also increased slightly, from a

small base, but Malaysia suffered a significant loss of

share in the UK plywood market last year.

The frequently mentioned recovery in the Dutch economy

and building sector is reflected in a 23% jump in imports

of tropical plywood to 59,548 cu.m in the first 11 months

of 2016. As in the UK, there was an uptick in plywood

imports into the Netherlands in the last quarter of 2015.

Last year, the Netherlands overtook Belgium to become

the second largest EU importer of tropical plywood.

Other EU markets for tropical plywood were declining last

year. Imports fell into Belgium (-11% to 59,466 cu.m),

France (-1% to 42,034 cu.m), Germany (-17% to 21,859

cu.m) and Italy (-7% to 20,396 cu.m).

German importers interviewed at the timber trade

federation GD Holz*s Branchentag trade show in

November reported weakness in tropical plywood sales

last year. Raw plywood from Indonesia and Malaysia, in

particular, was replaced with more competitively priced

hardwood plywood from Russia and Eastern Europe.

The only grade from South-East Asia mentioned as selling

well in Germany was film-faced 4 mm panels from

Indonesia.

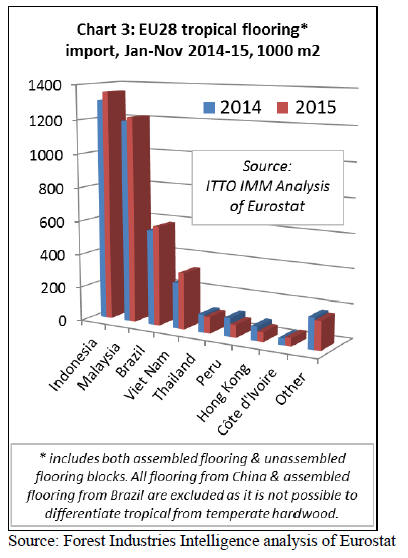

French imports drive rise in EU tropical wood flooring

imports

There was significant growth in EU import value of

tropical wood flooring (+18.7% to €89.7 million) in the

first eleven months of 2015. However, at 3.94 million

sq.m, EU imports of tropical flooring were only 2% more

than the year before.

Imports of wood flooring from tropical countries are also

small in relation to both domestic production (around 63

million sq.m in 2014) and imports from China (18.7

million sq.m in 2014).

There was a rise in imports from both Indonesia and

Malaysia, the two largest tropical suppliers of wood

flooring to the EU. Imports increased from Indonesia by

3% to 1.35 million sq.m and by 2% from Malaysia to 1.22

million sq.m in the first 11 months of 2015.

Between October to November EU imports from

Indonesia were slowing but picking up pace from

Malaysia.

EU imports of flooring from Viet Nam also gained ground

in the first eleven months of last year, rising 23% to

329,800 sq.m. Imports from Brazil also increased by 5%

to 588,200sq.m.

These gains offset a fall in imports from several smaller

tropical suppliers of flooring to the EU including Thailand

(-9%), Peru (-31%) and Hong Kong (-32%) (Chart 3).

The rise in EU tropical wood flooring imports in 2015 is

primarily due to France, by far the largest market for this

commodity accounting for around one quarter of all EU

imports. Imports into France increased 28% to

850,200sq.m in the first 11 months of 2015.

During the same period, there was a rise in tropical wood

flooring imports by the UK (+1% to 498,098 sq.m), Italy

(+6% to 408,855 sq.m) and the Netherlands (+39% to

330,440 sq.m). However imports declined sharply into

Belgium (-30% to 540,169 sq.m) and Germany (-13% to

381,565 sq.m).

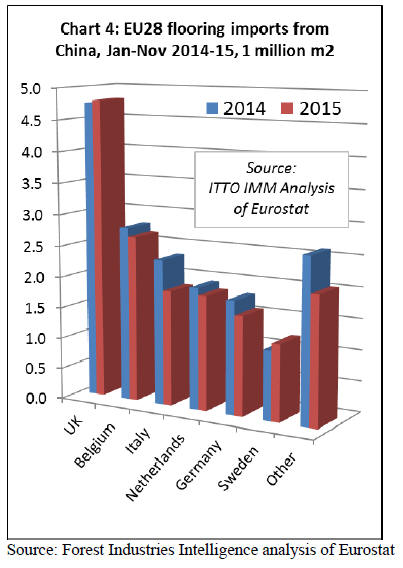

Imports of flooring from China are excluded from Chart 2

only because it is not possible to differentiate tropical from

temperate wood in the flooring statistics.

However China is by far the largest external supplier of

flooring products to the EU, much consisting of assembled

multi-layers panels, and volumes over-shadow imports

from tropical countries. An unknown proportion will

contain tropical wood.

EU imports of wood flooring from China (including all

products faced with real wood but excluding laminated

flooring) were 16.0 million sq.m from January to

November 2015, down 8% from 17.4 million sq.m in the

same period of 2014. This follows a 5% gain in EU

imports of Chinese flooring to 18.7 million sq.m for the

whole of 2014.

In the first 11 months of 2015, EU imports of Chinese

flooring were stable into the UK at 4.8 million sq.m and

increased 10% to 1.2 million sq.m into Sweden.

However Chinese wood flooring imports were down 4%

into Belgium at 2.7 million sq.m, down 21% into Italy at

1.9 million sq.m, down 6% into Netherlands at 1.8 million

sq.m, and down 12% into Germany at 1.6 million sq.m

(Chart 4).

The decline in EU imports of Chinese flooring in 2015

was therefore concentrated in euro-zone countries and is

most likely due to the weakness of the euro which boosted

the competitiveness of domestic producers.

|