2. GHANA

AGI says business confidence continues to

fall

The inflation rate in Ghana rose to a record 19% in

January this year, up from 17.7% in December last year.

This was made known by the Deputy Government

Statistician, Mr. Baah Wiredu, who attributed the increase

mainly to a rise in non-food inflation components such as

water, electricity and transport. Late last year utility prices

were increased by more than 50%.

In a related development the Association of Ghana

Industries (AGI), which has members from timber

processing companies, said in a press release that its

business confidence index dropped from 97.3 in the third

quarter 2015 to 93.1 in the final quarter of the year. AGI

attributed the drop to major challenges that industries

faced including the high costs of electricity, inadequate

power supply and currency instability.

First FSC teak from Ghana

This year Form Ghana reached a milestone in plantation

forestry with the first harvest of 3,000 cubic metres of teak

from FSC certified plantations near Akumadan, the capital

of Offinso North.

The teak plantations are managed by Form Ghana and

have been certified since 2010. The plantations have been

established and are managed with the help of Form

International in the Netherlands.

The vision of Form Ghana is that reforestation of degraded

forest land should be conducted to the highest standards

for sustainable forest management, serving the needs of

the local communities and restoring vital environmental

services within an economically viable business model.

A recent press release from the company says it plans to

reforest around at least 20,000 hectares of degraded forest

reserve in Ghana, so far 7,000 hectares has been planted.

Finnish delegation discusses investments

Ghana¡¯s forest resource may soon receive a boost

following a meeting between the Minister for Lands and

Natural Resources and a business delegation from Finland.

Minister Nii Osa Mills emphasised the country¡¯s forest

potential with the visiting delegation.

The Minister said, though the country has lost much of its

forest cover due to illegal mining activities, slash-and-burn

agriculture and over-cutting for fuelwood efforts are being

made on reforestation. Ghana had over 8.2 million

hectares of forest cover, but this is currently estimated to

be only 4.6 million hectares.

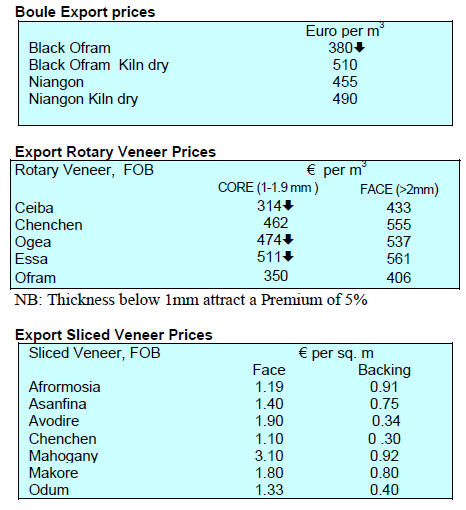

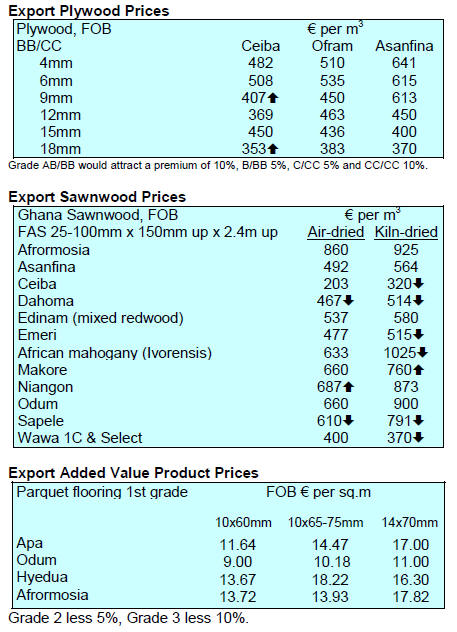

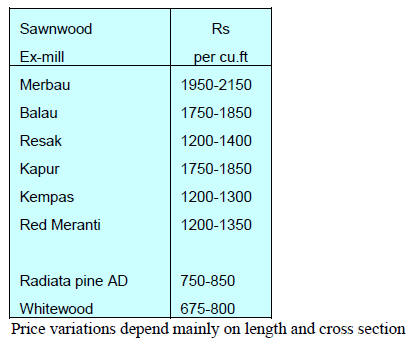

February prices

Prices for wood products remained unchanged as of 30

January.

3. MALAYSIA

Drop in oil revenues forces cuts to

government

spending

Logging operations, mills and factories ceased operations

for the annual holidays as Malaysia celebrated Chinese

New Year on 8 February, not in a very cheerful mood

however as the collapse in oil prices is rocking Malaysia¡¯s

economy. The country is the 26th ranked global oil

producers at around 700,000 barrels a day and oil revenue

is important for the economy.

In the face of falling revenues the government has been

forced to adjust the federal budget. In the revised 2016

budget revenues are expected to drop between 3-4%

which has forced a cut in spending which will have a

knock-on effect on GDP.

Companies secure government promise to review

foreign worker levy rate hike

Malaysia depends on foreign workers to sustain output in

the construction, plantation and manufacturing industries

and there are over 2 million registered foreign workers in

the country. Estimates put the number of illegal workers at

another 2 million.

The government has increased the levies on companies to

try and reduce their dependence on foreign workers. Most

hit will be the plantation and agriculture sectors.

Companies are complaining about the sudden steep

rise in

the levies and 55 business groups representing large and

small enterprises have urged the Government to give up on

its 300% rise in levies on foreign workers saying the

magnitude of the increase was too high.

In a press release the Sarawak Timber Association said

the timber industry ¡°is highly dependent on the export

markets, this sudden increase in the cost of doing business

would certainly lead to an increase in the prices of

Malaysian timber products and thus render them less

competitive compared to similar products from our

competitors such as Indonesia and Vietnam¡±.

The government has announced it will re-view the

proposed levy rates.

Orangutan habit protection brings results

Efforts by the Sabah State Administration to protect its

wildlife especially the iconic orangutan seems to be

successful as the number of orphaned animals arriving at

the state run rehabilitation centre in Sipilok has dropped

sharply.

Dr. Sen Nathan, the Centre¡¯s Director, said only two

orangutan were brought to the centre in 2015 whereas 10

years ago the annual number was around 20.

The decline is put down to enforced protection of the

animal¡¯s habitat such as in the Ulu Segama-Malua forest

reserve, Dermakot as well as the Lower Kinabatangan

wildlife sanctuary. Sen said that the Kabili forest reserve

adjacent to the rehabilitation centre is home to dozens of

saved orangutan which are now breeding.

Choose plantation species wisely says Chieg Minister

Sarawak Chief Minister, Adenan Satem, has called on

holders of Licenses for Planted Forests (LPF) to be

committed to establishing high quality plantations. In the

past the emphasis was on the area planted but this led to

the planting of species of low commercial value.

Adenan spoke on the need to select the correct species

suited to the site and of a type that will yield timber for a

wide range of products.

Nigeria and Ghana gateway to West African trade

growth

MATRADE¡¯s Commissioner to West Africa, Saifuddin

Khalid, said economic growth in West African countries is

offering an opportunity for Malaysian exporters and that

MATRADE will use English speaking Ghana and Nigeria

as the base for business development in ECOWAS

(Economic Community of West African States).

ECOWAS is a 15-member regional group with a mandate

to promote economic integration in all fields of activity of

the constituting countries. Member countries making up

ECOWAS are Benin, Burkina Faso, Cape Verde, Cote

d¡¯Ivoire, The Gambia, Ghana, Guinea, Guinea Bissau,

Liberia, Mali, Niger, Nigeria, Sierra Leone, Senegal and

Togo.

Saifuddin noted that Malaysia enjoyed good relationship

with countries in West Africa before the region was hit by

political uncertainties in the 1990s, which led to Malaysian

companies divesting their investments.

For more see:

: http://www.nst.com.my/news/2016/02/126307/matrade-expandmalaysian-

products-west-africa

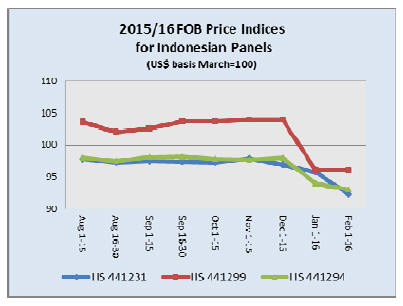

4. INDONESIA

EU says annul exclusions to allow FLEGT

licensing

scheme to go ahead

The EU has alerted Indonesia to the risk that the country

would miss the opportunity to become the first in the

world to achieve recognition of FLEGT licensed exports if

the Ministry of Trade continues to allow the export of

many wood products without the national SVLK license.

An extensive list of products were initially included in the

VPA/FLEGT negotiations between Indonesia and the EU

but the Ministry of Trade has removed the requirement for

SVLK certification from several items produced by small

and medium sized companies arguing they could neither

afford nor have the capacity to cope with the requirements

of the SVLK.

Indonesia had agreed to reinstate the SVLK to products

earlier agreed by the end of 2015 but this deadline was not

achieved.

Agus Sarsito, Indonesia¡¯s chief negotiator for the VPA and

for the items included in the FLEGT scheme said the EU

is ready to fully implement the VPA when Indonesia

annuls the changes made to the product list.

Asmindo, the Indonesian Furniture Entrepreneurs

Association says it recognises the benefits of SVLK

certification since this will lead to FLEGT licensing and

easy access to EU markets but wants furniture SMEs to be

offered an easy and low cost way to comply.

AEC to bring tough competition to domestic furniture

market

Domestic furniture producers see that they could lose their

share of the domestic furniture market to ASEAN and

other county exporters if the cannot become more

competitive.

The launch of the ASEAN Economic Community (AEC)

jolted Asmindo to begin gearing up for strong competition

in the domestic market.

Asmindo will host the four-day Indonesia International

Furniture and Craft Fair (IFFINA) in March targeting both

local and global buyers and is aiming for contracts worth

over US$400 million.

Cut in rubber exports could lead to fall in log

availability

Indonesia, Malaysia and Thailand are the main exporters

of natural rubber but as prices have plummeted the three

have agreed to cut production and exports.

The three countries are strongly represented in the

International Tripartite Rubber Council (ITRC) and will

begin reducing exports by 615,000 tons in the six months

to the end of August.

This cut could have a major impact on the availability of

rubberwood logs harvested as plantations are replaced. If

the pace of plantation replacement drops lower volumes of

rubberwood logs will be available to millers and could

send prices rising.

Chinese delegation examines SVLK

Putera Parthama of the Ministry of Environment and

Forestry recently hosted a visit by a delegation from China

led by Dr. Chen Shao Zhi, Director General of the

Research Institute of Forestry Policy and Information,

Chinese Academy of Forestry.

The Chinese government has an interest in Indonesia¡¯s

timber legality assurance system (SVLK) and Indonesia

proudly explained the working of the SVLK to the

Chinese delegation.

¡¡

5. MYANMAR

Myanmar forestry and timber sectors to

benefit from

transparency

The Extractive Industries Transparency Initiative (EITI)

has announced that Myanmar has been accepted as a

¡®Candidate¡¯ country to the EITI, the global

transparency standard. Myanmar now joins 44 countries

that have signed up to the EITI Standard which requires

extensive information disclosure and measures to

improve accountability in how natural resources are

governed.

It is understood that Myanmar¡¯s timber sector will be

included in the list of EITI and as such all statistics related

to the sector will be provided to an independent auditor.

In an on-line statement Clare Short, Chair of the EITI,

said: ¡°Myanmar¡¯s admission to the EITI comes at a critical

time as the country is now opening up its vast natural

resources for foreign investment.

By implementing the EITI, the government has made a

commitment to the people of Myanmar: that they will have

the right see how these resources are managed. I

encourage the government to make use of the EITI as a

tool to inspire wider reforms and to enshrine transparency

in government institutions.¡±

For more see:

https://eiti.org/news/myanmar-admitted-eiticandidate

VPA and Myanmar/China MOU explained

On 1 February the Director General of Forest Department

called a meeting of senior officials of MOECAF to explain

the VPA negotiation. At the meeting the Deputy DG

revealed the ultimate goal is a logging Ban. However, he

did not clarify when such a ban would be introduced.

Analysts point out that the election manifesto of the new

government addressed timber extraction and indicated it

will be reduced but a logging ban was not mentioned. The

timber industry plays a vital role in providing for domestic

demand and in generating export earnings and a ban on all

harvesting would have far reaching consequences.

Analysts point out that even now there many redundant

working elephants and owners are facing a tough time

supporting them.

The Deputy DG also provided details of the

Myanmar/China MoU which he said has three objectives -

to eliminate the illegal timber trade, to prevent forest fires

along the border and to establish wood processing

industries.

In another development, MOECAF has terminated

cooperation with EcoDev, an outspoken environmental

NGO. EcoDev played an important role in providing a

means for civil society organisations to participate in the

VPA preparation phase.

Sales in the local market

The Local Marketing and Milling Department of the

Myanma Timber Enterprise recently sold teak logs (mixed

Quality SG7 and lower) and hardwood logs to local mills.

Average price (Kyats) were as follows, teak logs (reject

quality) 1,003,841, pyinkado logs 381,194, hnaw logs

317,849, thinwin logs 252,912 and kanyin logs 340,000.

6.

INDIA

Business conditions now easier for the

construction

sector

Considerable progress has been reported towards

enhancing the ease of doing business the construction

sector especially in urban areas. This, says a press release

from Credai, stems from streamlining procedures,

adoption of appropriate technology and by empowering

urban local bodies to provide a wide range of approvals.

Progress on reforms were recently reviewed at a high level

meeting convened by the Minister of Urban Development

and Housing and Urban Poverty Alleviation Shri

M.Venkaiah-Naidu.

Defence Minister, Shri Manohar Parrikar, Civil Aviation

Minister, Shri Ashok Gajapati Raju, Minister of

Environment, Forests and Climate Change, Shri Prakash

Javdekar and the Minister of Tourism and Culture,

Dr.Mahesh Sharma participated in the review meeting.

The Ministry of Environment, Forests and Climate Change

has revised and simplified environmental standards that

must be met. These will be made available after

consultations with the Ministry of Urban Development.

For more see: http://www.credai.org/significant-progressmade-

towards-improving-ease-doing-constructionbusiness-

urban-areas-pib

Private consortium to lead affordable housing drive

The International Finance Corporation (IFC) is leading a

collaborative effort with major Indian housing sector

companies to form an industry-led Sustainable Housing

Leadership Consortium the focus of which will be on the

affordable housing sector. The effort is part of IFC's Ecocities

programme supported by the European Union.

The Economic Times of India reports that Mahindra

Lifespace Developers Limited, Shapoorji Pallonji Real

Estate, Tata Housing Development Company, and VBHC

Value Homes Private Limited will participate.

Johann Hesse, Head of Cooperation of the European

Union in India said "Buildings contribute to about 30-40

percent of energy consumption in many Indian cities and

about 22 percent of the country's annual greenhouse gas

emissions.

The founding members of the consortium have committed

to make 100 percent of their housing portfolio sustainable

by 2017 through appropriate green-building certifications.

For more see:

http://economictimes.indiatimes.com/articleshow/50838711.cms

?utm_source=contentofinterest&utm_medium=text&utm_campa

ign=cppst

Plywood industry sourcing alternatives to gurjan

Indian consumers are accustomed to red colored face and

back veneers, mostly imported gurjan, for the panel

products. Plywood manufacturers depended on imports of

gurjan from Myanmar since domestic sources of suitable

Dipterocarpus timbers were insufficient to meet the

requirements of the plywood sector.

Now that Myanmar has banned log exports Indian

manufacturers are facing a problem in securing peeler logs

of a colour to satisfy consumer preferences.

There are two ways to overcome this problem; encourage

consumers to accept domestic and imported timbers of

another colour with properties similar to gurjan or identify

alternative large sized, red coloured timbers suitable for

peeling.

Trials have been conducted with okoume and sapelli and a

measure of market acceptance has been reported. In

addition some timbers from Malaysia, Papua and New

Guinea and Solomon Islands have been found acceptable.

The timbers being assessed include amoora antiaris,

calophyllum, campnosperma, erima, grey canarium, hoop

pine, klinki pine, labula litsea, lophopetalum, mersawa,

pink satinwood, red cedar, planchonella, silkwood, maple,

silver ash and sloanea.

Currently alternatives to gurjan account for around 40% of

the timbers used for peeling.

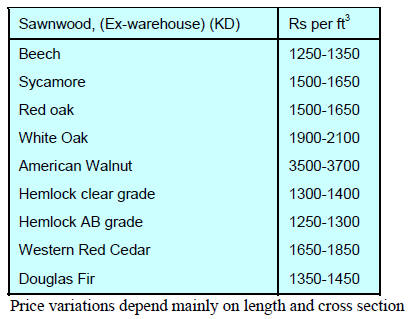

Prices for locally sawn hardwoods

Some price changes have been observed due to the

depreciation of Rupee.

Prices for imported plantation teak, C&F Indian

ports

Analysts report several price changes reflecting variation

in the size of the logs shipped.

Mexico has joined the ranks of plantation teak shippers to

India.

Recent weakness in the rupee exchange rate has raised the

landed cost and manufacturers are attempting to pass on

price increases.

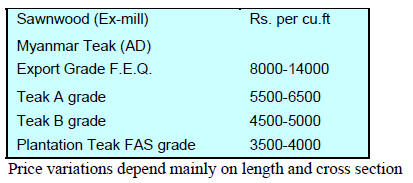

Myanmar teak flitches resawn in India

There has been no change in pricing over the past two

weeks. Imports of large sized flitches from Myanmar are

helping sustain teak stocks.

Prices for imported sawnwood

The depreciation of rupee has resulted in changes in

domestic prices.

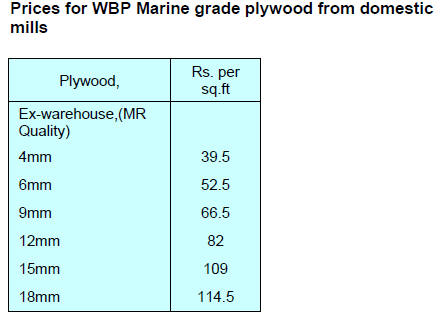

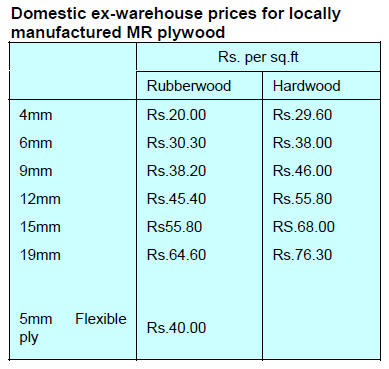

Plywood market trends

The cost of imported plywood is rising as the rupee

weakens but prices for locally manufactured plywood

remained unchanged.

As reported earlier gurjan a face and back veneer is being

replaced such that at present gurjan accounts for only 40%

of total veneer production.

7.

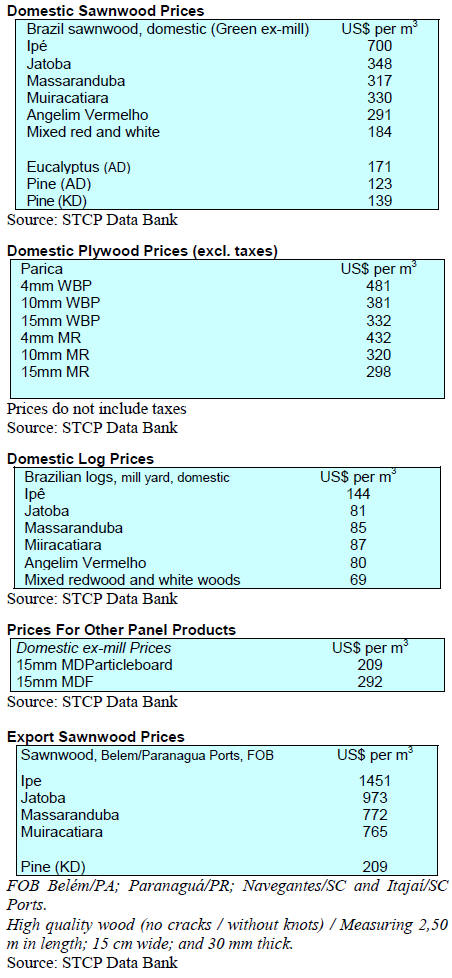

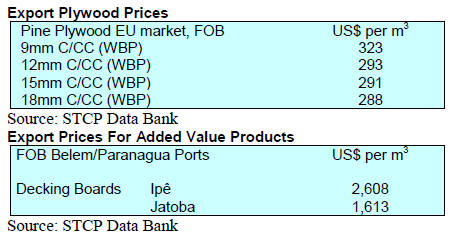

BRAZIL

¡®Orchestra Brazil¡¯ a success story

Companies participating in ¡®Orchestra Brazil¡¯ increased

exports by 9% in 2015 compared to 2014.

The ¡®Orchestra Brazil¡¯ project supports the furniture sector

and has grown out of cooperation between the Bento

Gonçalves Furniture Industry Union (Sindm¨®veis) and the

Brazilian Trade and Investment Promotion Agency (Apex-

Brazil).

One factor explaining the growth was the number of

markets targeted through the project and the rise in the

number of companies participating in the project.

The markets which contributed most to the positive

performance in 2015 were the United States, the main

destination at 13.7% and Bolivia for which exports more

than doubled making Bolivia the second most important

market within the Orchestra Brazil Project. Other

significant markets were Mexico (9% growth), Uruguay

(11% growth), Canada (120% growth), Guatemala (4.2%),

Turkey (72.6%), Spain (277.8%) and Belgium (63.6%).

The Orchestra Brazil Project has functioned since 2006

and promotes competitive furniture suppliers in

international markets. Market studies, prospecting

missions as well as participation in major trade fairs have

been conducted. Currently, 62 companies are associated

with the Project and for 2016 the priority markets are

South Africa, Argentina, Bolivia, Chile, Colombia, the

United States, Mexico, Peru, Turkey and Vietnam.

Rio Grande do Sul Furniture exports down in 2015

2015 was not good for furniture exporters in Rio Grande

do Sul State, as exports dropped over 15% according to

the Ministry of Development, Industry and Foreign Trade

(MDIC). In 2015 the furniture industry earned US$183.5

million from exports compared with the US$216 million

in 2014.

The main export destinations were the UK, Peru and

Paraguay. The US market was ranked fourth and

accounted for just over 10% of total state furniture

exports.

Rio Grande do Sul lost the leadership in the ranking of

furniture exporters in the country. Manufacturers in the

state closed 2015 in second place accounting for 30.5% of

foreign sales compared to the 34.3% achieved by

manufacturers in the state of Santa Catarina. Other top

states in terms of furniture exports were the State of

Paran¨¢ (13.7%) and the State of São Paulo (11.5%).

Weak international demand coupled with the tough

economic conditions in the country and the impact of these

on production has been cited as the reason for the decline

in export furniture output.

The furniture industry in Brazil faces many uncertainties

and challenges in the year ahead. To offer competitive

products analysts point out that there is a need for the

sector players to invest in product differentiation, added

value production technology and design innovations..

Inspection nets illegal timber

Agents of the Jaru Biological Reserve, with support from

the Amazon Region Protected Areas Program (ARPA), the

Brazilian Institute for Environment and Renewable

Natural Resources (IBAMA) and the Rondônia Military

Police, conducted operations in the eastern part of the

Amazon Reserve spanning Rondônia and Mato Grosso.

The operation resulted in the seizure of almost 1,000 cubic

metres of illegally logged timber.

The aim of this operation was to monitor the

implementation of management plans in the area and to

clamp down on any offenses such as illegal logging,

deforestation, illegal mining and hunting.

The inspection team decided the seized timber had to be

destroyed because it was too expensive to transport the

timber to the nearest mill (240km) because of the poor

condition of the road due to heavy rains.

Usually the seized timber is auctioned but in this case

IBAMA chose to destroy the timber to prevent it being

recovered if left on-site.

Digital aid for forest management

The Brazilian Agricultural Research Corporation

(EMBRAPA) will conduct a training course on the Digital

Modelling of Logging (MODEFLORA) for professionals

of the Institute of Management and Forest Certification

(IMAFLORA), the agency responsible for forest

certification in Piracicaba, São Paulo.

The MODEFLORA model was developed by EMBRAPA

in 2008 and it has been tested on 32,000 ha of forest areas

designated for logging. One of the main advantages of the

technology is accuracy of information generated in forest

management activities.

The technology uses the Global Positioning System

(GPS), the Geographic Information System (GIS) and

Remote Sensing (RS) for the location of trees and provides

for micro-zoning of the area. This is of great help for

forest management planning.

The information contributes to activity planning and

accurate execution of fieldwork.

Another advantage is that working with accurate digital

data reduces the incidence of inventory errors and cuts the

cost of conducting mapping. EMBRAPA says cos saving

can be as much as 30%.

¡¡

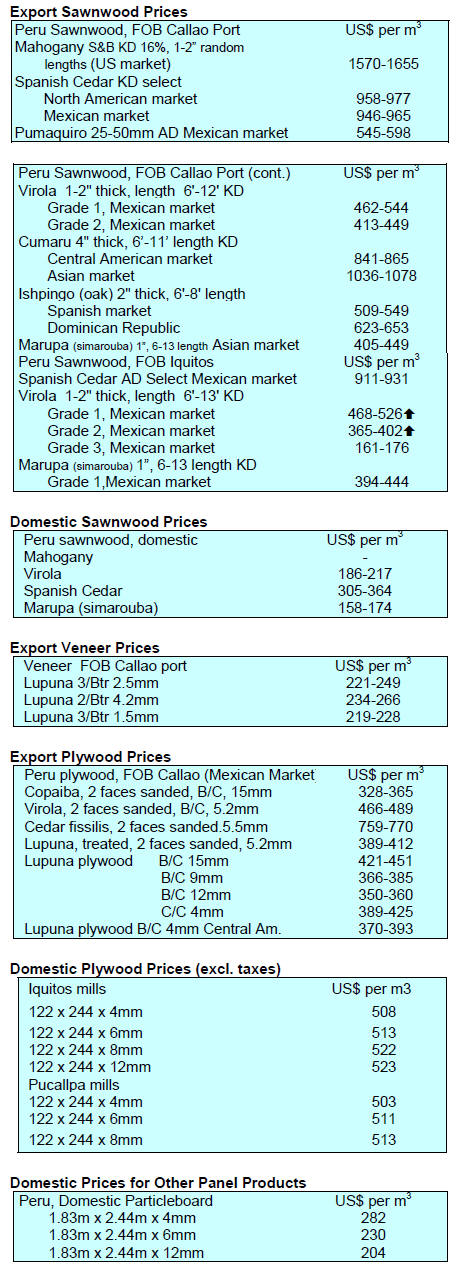

8. PERU

ADEX arranges furniture technology

mission to Brazil

In support of domestic furniture manufacturers the

Association of Exporters (ADEX) is arranging to guide a

group of company representatives to visit machinery

manufacturers, suppliers of finishes and designers in

Brazil.

From 30 April to 7 May this year the group will visit

suppliers in the city of Beto Goncalves in Southern Brazil.

The aim is to lay the foundation for cooperation for

training and technology exchange.

FENAFOR 2016 Lima

Registrations are now open for the biannual furniture fair

FENAFOR which will run from 27 to 29 October 2016 in

Lima. The organisers are optimistic that the years¡¯ fair will

be the biggest yet. According to the statement from the

organizers there will be business delegations from Italy,

Germany, Taiwan P.o.C, Turkey, Brazil and Argentina

amongst others.

During the fair there will be business conferences,

presenations by specialists, consultants and forest

entrepreneurs.

Productivity and competitiveness to be raised

The World Bank Board has approved two projects to

promote productivity in Peru. This comes at a time when

international demand is weakening so it becomes more

important for the country to raise productivity and

improve competitiveness.

The Bank initiative will focus on private sector training

and competitiveness as well as on strengthen n publicprivate

communication and partnerships.

The Bank project can draw on over US$1 billion from its

fund for Boosting Human Capital and Productivity

Development Policy Financing which seeks to support the

Government of Peru in its efforts to strengthen the quality

of public education and improve the business environment

for enterprises. Project resources can also be used to

implement simplified customs procedures that facilitate

exports and access to international markets.

For more see: http://www.worldbank.org/en/news/pressrelease/

2016/02/11/world-bank-supports-peru-to-promoteproductivity-

and-strengthen-fiscal-management

YANA

YANA