Japan Wood Products

Prices

Dollar Exchange Rates of

25th June 2015

Japan Yen 123.87

Reports From Japan

Falling energy prices undermine BoJ’s efforts to beat

deflation

The abrupt decline in oil prices is weighing heavily on

efforts by the Bank of Japan (BoJ) to stimulate the

economy.

The rate of inflation was almost zero in May despite the

huge amount of cash being circulated through the BoJs

stimulus measures. In addition job creation has remained

flat but the good news is that, for the first time in more

than twelve months, household spending picked up in

May.

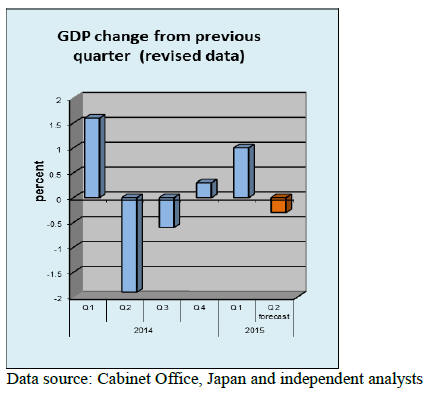

The most recent economic data is showing that domestic

demand, investment and manufacturing output are

wakening and this is leading analysts to fear second

quarter growth may be negative.

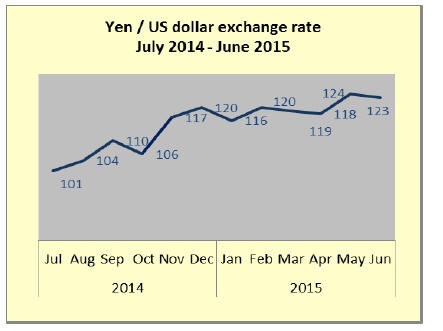

Yen set to weaken further when US rates rise

The yen has dipped to unprecedented lows recently and

this, while a boon for exporters, comes with serious risks.

A Japanese business association has pointed out that any

further decline in the yen exchange rate would drive up

production costs and thus impact the profitability of

exporters. The same business group also warned further

weakness in the exchange rate would undermine the

viability of small companies which are already suffering

as many of their raw materials are imported.

The yen exchange rate against the dollar has been falling

since 2013 when the BoJ started its stimulus measures and

more weakness is likely in the coming months as the U.S.

Federal Reserve has signaled US interest rates will rise

this year which will increase the appeal of dollardenominated

assets.

Expansion of public housing to solve evacuee problem

The prefectural government in Fukushima has been

providing free housing to families who had to evacuate

after the nuclear disaster but this support is set to end.

Initially the free home deal was scheduled to end in March

2016 but this has been extended for a year.

When the programme ends the prefectural government

will be offering financial assistance moving and will offer

rent subsidies for low-income households.

For those whose homes were destroyed by the earthquake

or tsunami individual arrangements with evacuees are

planned and much depends on the progress made in

constructing public housing.

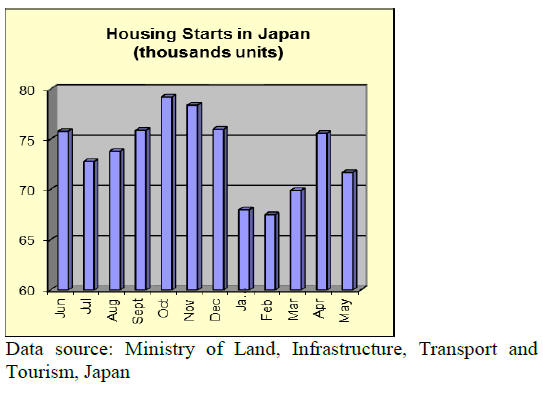

Japan's May housing starts were down on levels in April

but year on year were up almost 6% according to data

from the Ministry of Land, Infrastructure, Transport and

Tourism.

The May decline brings forecasts for the year down to

912,000 units, analysts had expected annualized rates to

rise in May.The Land Ministry also reported that orders

placed with the top house builders in May fell year on

year, the second monthly fall in orders.

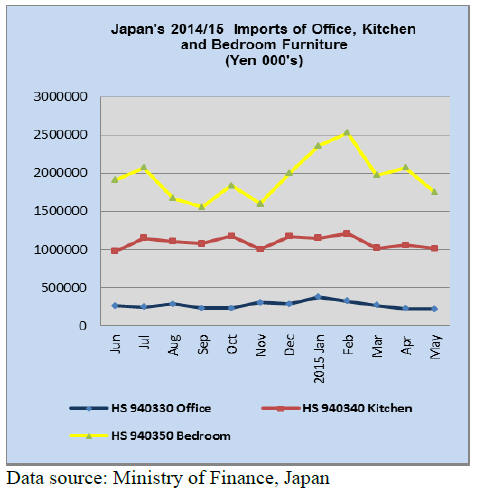

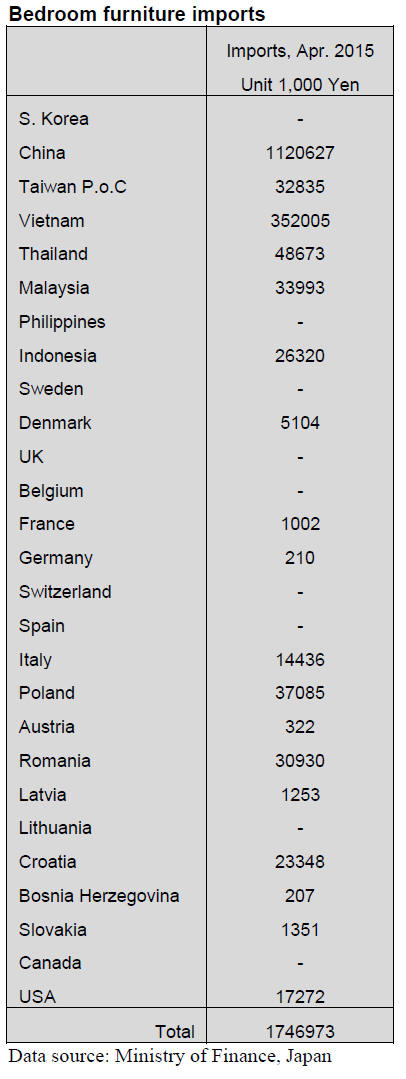

Japan’s furniture imports

From the graph below it can be seen that there has bees a

major correction in bedroom furniture imports. At the end

of last year imports climbed during the final three months

and this momentum continued into January 2015 but

between February and May there has been a steady decline

in the value of bedroom furniture.

However, the average value of imports for the first five

months of 2014 is almost the same as the average in the

same period this year. The steep decline in 2015 imports

corresponds to the period when the yen/dollar ecchange

rate was plummeting.

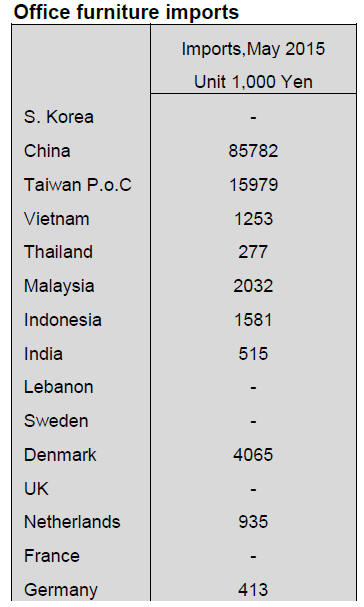

Office furniture imports (HS 940330)

The top suppliers office furniture remain China, Portugal,

Poland accounting for 76% of all office furniture imports

in May.

The total value of May imports was almost the same as

that for April but May 2015 year on year imports were

down 29%. But for the first five months the decline in

May 2105 imports was just 7%.

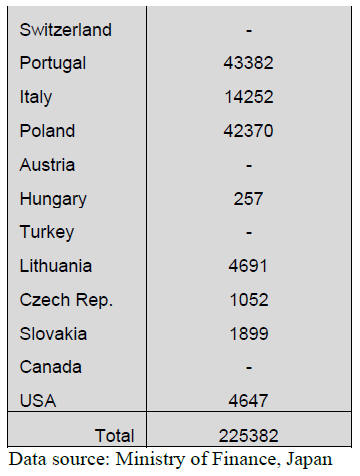

Kitchen furniture imports (HS 940340)

Amongst the top three suppliers of kitchen furniture in

May there were winners and losers. Vietnam is the number

one supplier but there was a 40% decline in Japan‟s

imports from Vietnam in May compared to April.

Japan‟s imports from China also fell in May (-13%) but

Philippine exporters saw the value of kitchen furniture

exports to Japan rise. May kitchen furniture imports were

4% down on the previous month and were down 6% year

on year.

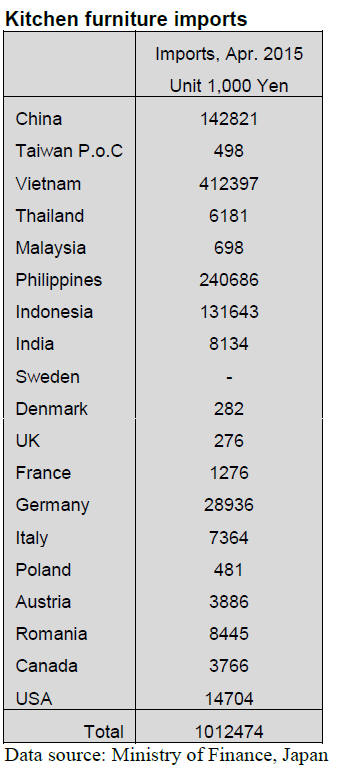

Bedroom furniture imports (HS 940350)

Each of the top three suppliers of bedroom furniture to

Japan posted losses in May. China is the top supplier but

May imports were down marginally on April on the other

hand Vietnam and Thailand, the other top suppliers posted

losses of 38% and 34% respectively.

Despite the sharp downturn in the value of bedroom

furniture imports in May, the average value of imports in

the first five months of 2015 is about the same as in the

first five months in 2014.

Other losers in May were Malaysia, Indonesia and

Philippines but both Italy and Romania saw a rise in

exports of bedroom furniture to Japan.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Forestry white paper – focus on utilisation of domestic

resources

White paper is the report that the government makes up to

explain present situation and future prospect of certain

industry. It describes issues and solution of the industry.

Forestry and Forest white paper is officially approved.

The main theme this year is wood industry since the

industry to process and distribute is vital and essential to

promote cyclical utilisation of forest resources.

After it sorted historical trend of main areas of the industry

by past period and categories such as lumber, plywood

woodchip, wholesale and trading firm in the industry. It

shows how each acted in different stages of the society.

History shows that there were different stages like wood

demand expansion period after the war until about 1973,

stagnant period from about 1973 to 1996 then declining

period after 1996.

Degree of self-sufficiency of wood largely dropped during

these periods then domestic trees planted after the war are

now matured for harvest and new development is possible.

In this situation, main task to the future is creation of new

demand of wood.

Recently large domestic wood sawmills, which consume

more than 30,000 cubic meters of logs a year, were built or

under construction in 18 different locations since 2010,

which should satisfy consumers‟ demand of stable supply

of lumber.

At the same time, on demand side, wood use is being

promoted by the law to use wood for public buildings,

which is new wood demand for non-residential buildings

then there is increasing demand of wood for mushrooming

biomass power generation facilities.

Also export of domestic logs and lumber has been

increasing. However, system to satisfy demand for

efficient and steady supply and for quality and

performance of the product has not been established yet.

On log production, intensification of operations, reduction

of cost of afforestation and rearing of nursing trees,

introduction of modern machines, preparation and

maintenance of forest road system to build up low cost and

efficient operations.

Japan to promote wood use for Olympic venues

Liberal Democratic Party‟s joint committees heard various

reports from related Ministries such as the Forestry

Agency and organizations for preparations of wood use for

the Olympic Game‟s facilities.

LDP considers the Olympic Games is the best opportunity

to appeal Japanese wood culture and traditional techniques

of utilisation of wood to the world.

It decides to appeal actively to the government and Tokyo

metropolitan government for building symbolic wooden

buildings and development of new wood products.

Wood Use Promotion Committee for year 2020, organized

by the industry groups strongly requests use of wood for

the Games and the Forestry Agency appeals use of wood

contributes revitalization of local villages by activating

forest harvest, prevention of global warming trend and

environment in forming sustainable society.

Then it also mentioned to recommend use of new

materials like CLT and fire proof laminated lumber. In

construction process, use of domestic product of softwood

concrete forming panel is promoted.

According to the Tokyo city government, it is considering

the use wood for athlete‟s quarters and other temporary

facilities, Olympic Eco-Village, shops and recreational

facilities. For the New National Sports Stadium, wood use

is expected for interior of main guest rooms and stadium

chairs and interior decoration.

Plywood

Market of domestic softwood plywood is weak. The

monthly shipments have been over 210,000 cbms since

last January except for February when the shipment

dropped down to 178,500 cbms. Therefore, average

monthly shipment for the first four months is 205,000

cbms. Meantime, the monthly production has been over

210,000 cbms for four straight months.

March production was over 220,000 cbms. Consequently,

the inventories continue climbing to 256 M cbms at the

end of April. With increasing inventories, the market

remains weak.

In late March, the manufacturers announced the higher

prices so the market momentarily reacted and bounced

back up then the momentum faded and the prices have

been softening little by little in April and May. In late

May, the price dropped down to 700 yen per sheet

delivered and downward pressure continues in June.

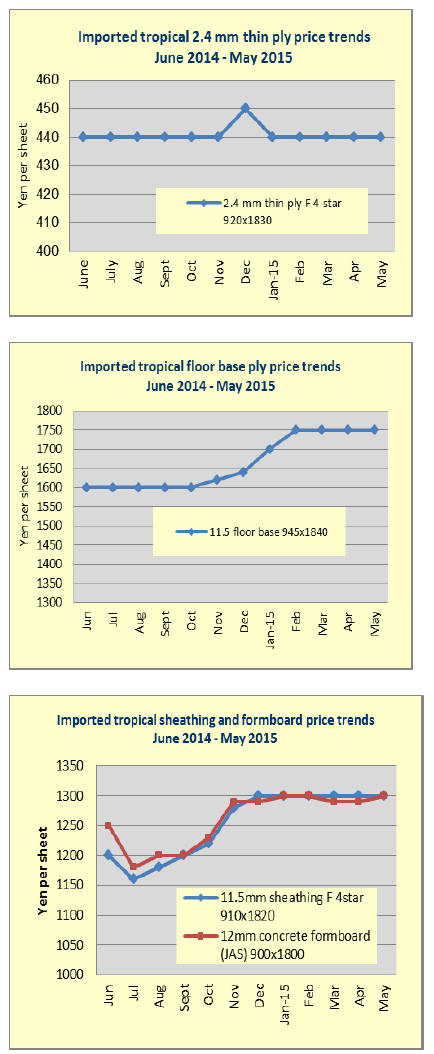

Imported plywood market, on the contrary, is very firm

because of decreasing arrivals.

Import curtailment has been continuing due to depressed

market in Japan. In particular, Malaysian supply declined

for four consecutive months. Orders to the supplying mills

have declined because of weak yen, dull demand and

higher export prices as a result of log supply shortage in

Malaysia.

Indonesian plywood suppliers reduced export prices by

declining orders so the Japanese buyers shifted to

Indonesia to buy standard plywood and floor base when

Malaysian supply is declining and the prices are high.

Result is four months decline of Malaysian supply and

three months increase of Indonesian supply.

Largest LVL plant completed

Three companies, Iida group holdings, First Plywood and

Kawai Ringyo built the largest LVL manufacturing plant

in Japan, which completed in late March in Aomori

prefecture.

This is named the First Plywood and the plant is test

running now. Monthly production is about 75,000 cbms

with log consumption of about 140,000 cbms. Total

investment is 8.4 billion yen.

Aomori prefecture has the fourth largest forest in Japan,

which trees were planted after the war and they are

matured for harvest now but there was no large log

consuming plant of more than 50,000 cbms a year in the

prefecture so that more than half of harvested logs have

been sold outside the prefecture and it has been earnest

wish to have large log consuming plant in the prefecture.

Total production of LVL in Japan is about 70,000 cbms so

with this new plant, the total volume will be more than

double. |