|

Report from

North America

China¡¯s plywood import share expands

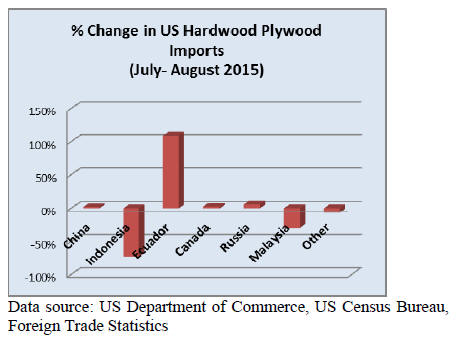

US imports of hardwood plywood fell 17% from July to

August. A total of 262,180 cu.m. were imported. Year-todate

imports were still 6% higher than in August last year.

China increased its import share to 58% of total hardwood

plywood imports (149,326 cu.m.). Year-to-date imports

were up 13% from August 2014.

Plywood imports from Indonesia declined in August

(24,239 cu.m.) but year-to-date imports remain higher than

in 2014.

Malaysian plywood shipments to the US fell 30% monthover-

month to 5,443 cu.m. Year-to-date imports from

Malaysia were 8% below August 2014 levels.

Uruguay has become a significant supplier of hardwood

plywood to the US market. Year-to-date, the US imported

30,705 cu.m. from Uruguay in August, compared to

53,321 cu.m. from Malaysia.

August moulding imports below 2014 levels

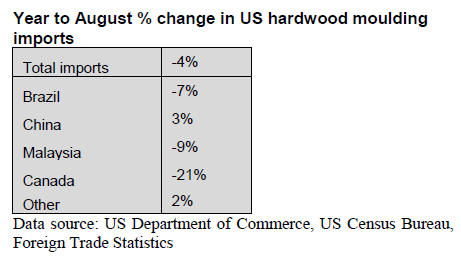

Year-to-date hardwood moulding imports were 4% lower

than at the same time last year, despite higher August

imports (US$19.5 million).

China was the only country to significantly increase

moulding shipments to the US in 2015. August imports

from China were worth US$7.6 million, up 15% from

July.

Moulding imports from Brazil increased by one third from

July to US$5.5 million. Imports from Malaysia declined

2% in August to US$1.1 million.

Malaysia and Indonesia dominate hardwood flooring

imports

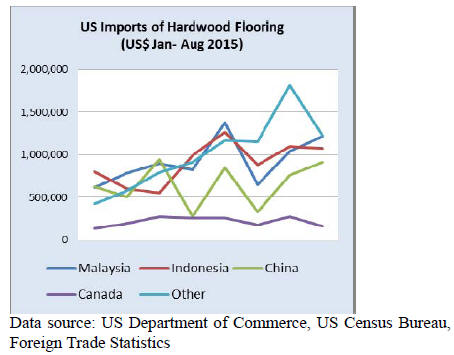

Year-to-date imports of wood flooring (hardwood and

assembled panels) increased in August compared to the

same time last year.

Monthly imports of hardwood flooring declined slightly to

US$4.6 million in August, but year-to-date imports remain

up by almost one third from 2014.

All major suppliers benefitted from higher US demand,

but Malaysia and Indonesia showed the strongest growth

in year-to-date shipments to the US market. Malaysia was

the largest supplier of hardwood flooring in August at

US$1.2 million, up 16% from July.

Imports of assembled flooring panels increased 3% monthover-

month in August to US$12.9 million. China

accounted for about half (US$6.4 million) of all imports in

August.

Indonesia and Brazil each shipped just over US$0.5

million worth of assembled flooring panels to the US in

August. Year-to-date imports from both countries

increased significantly from last year.

Decline in furniture imports from China in August

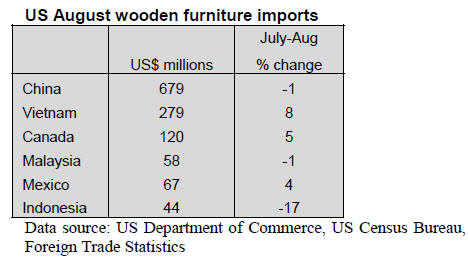

The value of wooden furniture imported in August was

unchanged from the previous month at US$1.44 billion.

Year-to-date imports were 11% higher than in August

2014.

The share of various suppliers shifted slightly in August.

US wood furniture imports from China declined by 1% to

US$678.8 million or 47% of total imports.

Vietnam¡¯s import share continued to grow. In August

Vietnam exported US$279.0 million of furniture the US,

accounting for 19% of total furniture imports.

Furniture imports from Malaysia and Indonesia fell in

August, but year-to-date imports were above 2014 levels.

Malaysia in particular increased exports to the US

compared to last year (+24%). Its share in total year-todate

imports grew from 3.8% to 4.2%.

Miscellaneous wooden furniture accounted for most

imports (US$494,040), followed by upholstered seating

(US$391,545) and bedroom furniture (US$298,965).

Federal Reserve expected to raise interest rates

The Federal Reserve is expected to raise interest rates in

December, following the release of positive economic

indicators in October. Job growth was higher than

expected, and unemployment fell to 5%, the lowest since

2008. Only the manufacturing sector showed no increase

in employment. Wage growth was higher than any other

time since the US recession. Some analysts already

speculate there could be a second rate hike in March 2016.

GDP growth was 1.5% in the third quarter of 2015,

according to the Department of Commerce¡¯s advance

estimate. In the second quarter real GDP increased 3.9%.

Personal spending increased in the third quarter, as well as

construction, exports and imports.

Manufacturing output expanded in October despite lower

employment in manufacturing, according to the Institute

for Supply Management. Furniture manufacturing

companies reported growth in production, while output

declined in the wood products sector in October.

Consumer and builder confidence highest in a decade

Consumer confidence rebounded in October, according to

the University of Michigan consumer sentiment index.

The gain was mainly among households with lower

incomes, while high income households were concerned

about financial markets.

The average level of the consumer sentiment index thus

far in 2015 was higher than any other year since 2004.

Builder confidence in the market for newly built, singlefamily

homes also grew in October. Confidence was the

highest since the end of the housing boom in 2005,

according to the National Association of Home Builders.

The main driver of the housing market recovery has been

the consistent growth in employment. The only downside

of an otherwise positive development is the strong growth

in service sector jobs, which usually pay lower wages than

manufacturing jobs.

Despite good demand for new homes, builders are

concerned about the supply side: the cost and availability

of labour and building lots, and the cost of building

materials.

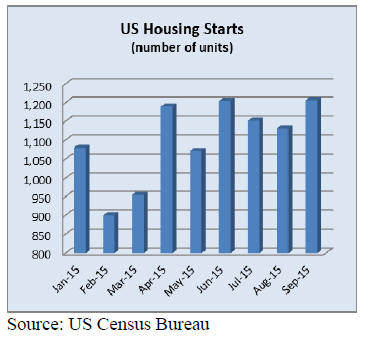

Housing starts over 1.2 million in September

Housing starts jumped in September to a seasonally

adjusted annual rate of over 1.2 million. Starts had been

over 1.1 million since June, according to US Census

Bureau data.

The growth was mainly in multi-family construction, but

single-family homes also increased slightly. In September

single-family homes accounted for 61% of total starts,

down from 65% to 67% earlier this year. Multi-family

starts increased 18% from August to September.

The National Home Builders Association expects a similar

pace of construction for the rest of 2015.

The number of building permits were at a seasonally

adjusted rate of 1.1 million in September, down 5% from

August. Much of the decline was in multi-family permits.

Higher home sales across the country

Sales of existing homes rebounded in September following

August¡¯s decline. Sales increased across the country,

according to the National Association of Realtors.

Home prices increased as well, but in some markets

affordability improved. Low mortgage rates continue to

support the housing market.

The number of homes on the market declined in

September, increasing inventory shortages. The share of

first-time buyers remains relatively low at less than one

third because of high home prices. Most home buyers

were current owners who sell their homes in these

favourable market conditions.

Consumer and business confidence down in Canada

Canadian housing starts grew to 231,304 in September at a

seasonally adjusted annual rate. It was the highest rate of

new construction since 2012. Low mortgage rates have

supported the housing market, despite a contraction due to

low oil prices.

Both single and multi-family construction increased in

September. Single-family homes accounted for just 25%

of total starts in September, compared to over 60% in the

US.

Foreign buyers might play a large role in the housing

market of Canada¡¯s urban centres, but reliable data on

overseas home owners is lacking. According to the central

bank, the lack of data makes it more difficult to understand

risks to the financial system and housing market.

For 2016 the Canadian Housing and Mortgage

Corporation expects little change from this year. Housing

demand will decline in oil-producing provinces, but

construction is forecast to increase in British Columbia

and Ontario where manufacturing benefits from the lower

Canadian dollar.

|