|

Report from

Europe

European tropical wood imports up 16% on previous

year

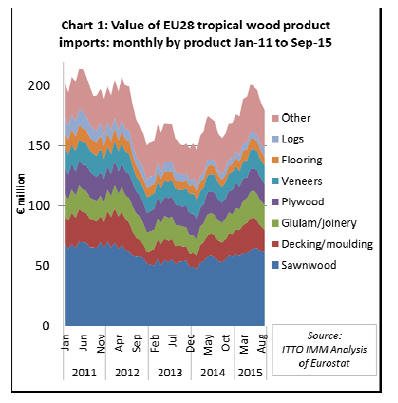

EU imports of tropical timber products increased sharply

between September 2014 and April 2015 but slowed again

in the four months to end September 2015 (Chart 1).

Nevertheless, the value of EU imports of tropical timber

across all product groups in the first 9 months of 2015

was, at €1.703 billion, 16% greater than the same period

the previous year. So far EU imports of tropical timber in

2015 have been close to levels last seen in 2012.

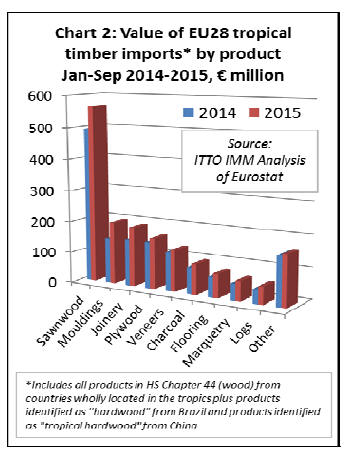

EU imports of all tropical wood products have increased

this year. With the exception of plywood (+8.6%), veneers

(+7.5%) and í░otherí▒ (+4.3%), all tropical product groups

showed double-digit import growth. Mouldings (+36.4%)

and joinery (+28.2%) experienced the highest growth

rates.

Imports of sawnwood, the most important tropical product

group in terms of import value, rose by 14.2% to €565.1

million. Imports of tropical logs (+24.1%) have also

continued their upward trend this year after several years

of steep decline (Chart 2).

Some of the increase in the euro value of tropical wood

imports is due to the relative weakness of the European

currency this year which has led to price inflation for

European importers.

However, this has been partly offset by producers

lowering their sales prices and by a steep fall in freight

rates as the year progressed.

Further analysis of the data also shows that the quantity of

EU tropical wood imports has increased across nearly all

product groups.

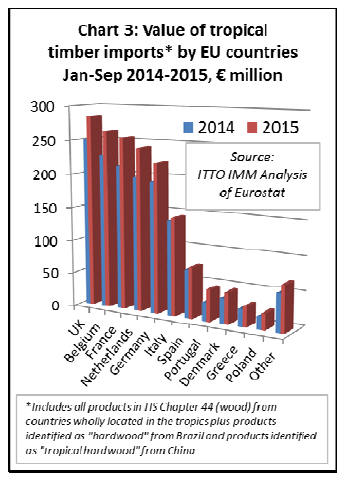

Increased imports into all major EU markets

A closer look at the individual EU countries reveals that

tropical timber deliveries to all important markets have

increased this year, in most instances by a significant

margin. Spain (+7.9% to €76.2 million) and Italy (+3.1%

to €144.4 million) were the only major markets to show

single-figure growth rates (Chart 3).

The UK has remained the most important tropical timber

market in Europe this year, with growth of 13.7% in

imports to €285.1 million across all product groups during

the first nine months. There was also substantial growth in

imports into Belgium (+15.6% to €263.9 million), France

(+19.4% to €255.1 million), and the Netherlands (+21.3%

to €241.9 million).

Deliveries of tropical wood to the German market

increased 13.8% to €221.1 million in the first nine months

of 2015. However, reports from German importers are

slightly less positive.

While some importers specialising in African timber

report satisfactory business this year, those focused on

Asian timber describe the market as difficult. The same is

true for tropical plywood from South-East Asia, which is

under intense competitive pressure from European and

Russian poplar and birch products.

The German timber trade federation GD Holz reports that

wood product sales in Germany have more or less

stagnated in the first nine months of this year. Moreover,

garden wood assortments, including decking, experienced

decline by around 5%.

The same is true for sawn timber. For building products

and joinery, on the other hand, GD Holz reports growth of

around 5%.

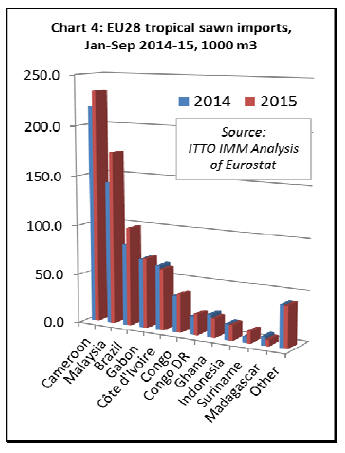

Sharp increase in EU sawn imports from Malaysia and

Brazil

EU imports of tropical sawn timber increased by 9% to

793,100 m3 in the first nine months of 2015. Imports from

Cameroon, the largest supplier, increased 7% to 233,000

m3. Import growth was even more rapid from Malaysia

(+22% to 173,800m3), Brazil (+21% to 99,500m3), and

the Democratic Republic of the Congo (+14% to

21,000m3).

Imports from Gabon (+1% to 70,400m3) and Congo (+6%

to 38,500m3) recorded below-average growth rates.

Meanwhile, imports from Ghana (-15% to 19,100m3) and

Ivory Coast (-5% to 62,200m3) have declined this year

(Chart 4).

Market recovery in Benelux and France

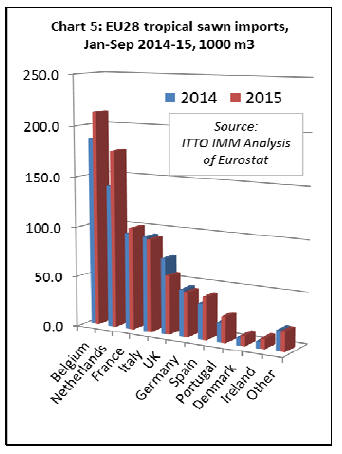

The rise in tropical sawn wood deliveries to Europe was

primarily due to higher imports into the Netherlands

(+25% to 176,100m3), Belgium (+14% to 213,300m3)

and, to a lesser extent, France (+6% to 101,400m3).

By contrast, imports into the UK, which increased sharply

in 2014, declined 22% to 58,100m3 in the first nine

months of 2015. Tropical sawn wood imports into

Germany (-5% to 44,400m3) and Italy (-2% to 92,000m3)

have also declined this year (Chart 5).

In their latest statistical report (covering the first 8 months

of 2015) the UK Timber Trade Federation (TTF) reports

í░all regions of the world except Central and South

America have exported less to the UK in 2015 to date.

Only a tripling of volumes from Guyana (from a relatively

low base) has provided regional growth in 2015í▒.

Hardwood deliveries to the UK from Asia declined 17%

while imports from Africa were down 28% in the first 8

months of 2015. Despite the sharp uptick in imports from

Guyana, UK hardwood imports from South and Central

America were no more than 8,000m3 in the first 8 months

of 2015.

Tropical log imports up 24%

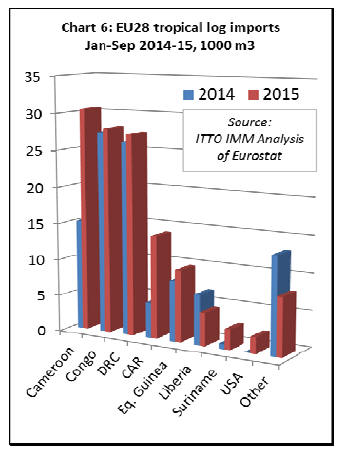

Following nearly a decade of continuous decline, EU

imports of tropical logs have recovered a little ground this

year. Imports increased 24% to 127,338m3 in the first nine

months of 2015. Much of this import growth was

concentrated in the first five months and the pace of

imports slowed between June and September.

EU tropical log imports from Cameroon doubled to

30,464m3 and deliveries from the Central African

Republic almost tripled to 14,122m3 in the first nine

months of 2015. Imports from Suriname also tripled from

a low base to 2,776m3. However imports from Liberia

declined 33% to 4,570m3 (Chart 6).

Rising EU decking imports from Indonesia, Brazil and

Malaysia

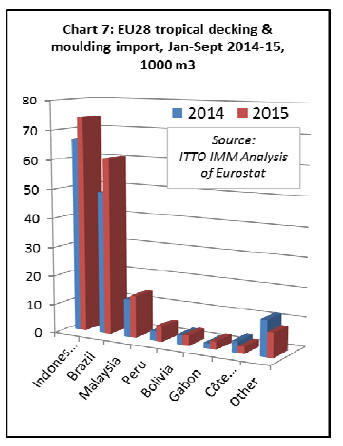

EU imports of tropical mouldings (which includes both

interior mouldings and exterior decking products) were

171,218 m3 in the first nine months of 2015, 12% more

than the same period in 2014.

Imports increased from all the major supply countries

including Indonesia (+10% to 74,059m3), Brazil (+24% to

60,672m3) and Malaysia (+10% to 14,307m3). Deliveries

from several other countries, including Peru, Bolivia and

Gabon, also increased from a low base. However imports

from Ivory Coast were much lower than last year (Chart

7).

Forecast for slow economic recovery

The EU continues to recover only gradually from the

financial and economic crisis. The European

Commissioní»s Autumn Economic forecast, published on 5

November, notes that the economic recovery in the EU is

now in its third year and that í░it should continue at a

modest pace next year despite more challenging conditions

in the global economyí▒.

The European economy continues to benefit from low oil

prices, accommodative monetary policy and the relatively

weak external value of the euro, which is helping boost

competitiveness, according to the EC.

Looking forward, the EC forecasts GDP growth to rise

from 1.9% this year to 2.0% in 2016 and 2.1% in 2017. In

making this assessment, the EC comments that í░the impact

of the positive factors is fading, while new challenges are

appearing, such as the slowdown in emerging market

economies and global trade, and persisting geopolitical

tensions.

Backed by other factors, such as better employment

performance supporting real disposable income, easier

credit conditions, progress in financial deleveraging and

higher investment, the pace of growth is expected to resist

the challenges in 2016 and 2017. In some countries, the

positive impact of structural reforms will also contribute to

supporting growth furtherí▒.

Recent reports from IFU, an economic research institute

based in Germany, are slightly less optimistic. IFUí»s index

of the economic climate in the euro area dropped by two

percentage points in the fourth quarter of 2015. IFU note

that í░while assessments of the current economic situation

brightened slightly, the six-month economic outlook

continued to cloud over. The euro area economy continued

its recovery at a subdued paceí▒.

Regarding the current economic situation, experts

surveyed by IFO in Greece, Finland, France, Italy, Spain,

Austria, Portugal, and Cyprus continued to assess the

situation negatively. In most other euro countries the

situation was described as satisfactory. IFUí»s six-month

economic outlook remains positive overall but was scaled

back in several countries, especially in France, Spain and

Portugal.

|