|

Report from

North America

Imports of all major wood products improve

The growth in home construction and sales is improving

demand for wood building materials and furniture, both

imported and manufactured or assembled in the US.

Hardwood plywood and hardwood mouldings were the

only product categories with lower year-to-date imports

compared to the January to May period in 2014.

But, lower hardwood plywood imports from Indonesia

and Malaysia

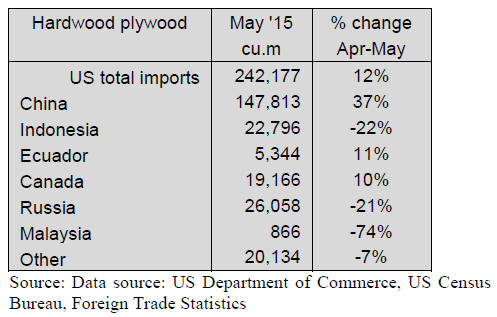

US imports of hardwood plywood grew 12% month-onmonth

in May to 242,177 cu.m. However year-to-date

imports were 5% lower than in May 2014.

Hardwood plywood imports from China recovered from

the low April import volumes. May imports from China

were 147,813 cu.m., up 15% compared to may 2014.

China‟s share of US total hardwood plywood imports

increased from 50% in April to 61% in May.

The largest decline was in imports from Indonesia and

Malaysia. Indonesian May plywood shipment to the US

fell 22% from April to 22,796 cu.m.

Year-to-date imports from Indonesia were one third lower

than in the January to May period. May imports from

Malaysia were just 866 cu.m. with year-to-date imports

16% lower than up to May 2014. Year-to-date hardwood

plywood imports from Russia and Canada were slightly up

in May.

Hardwood moulding imports from China surge

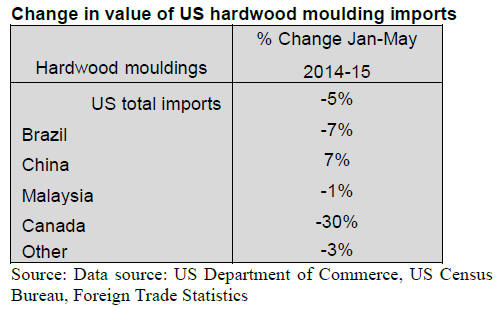

US hardwood moulding imports were worth US$16.7

million, up 26% in May from the previous month.

However, compared to 2014, year-to-date hardwood

moulding imports are still down by 5%.

The month-on-month growth in imports of mouldings was

primarily from Brazil (US$4.8 million) and China (US$5.3

million). Year-to-date imports from China were up 7% in

May, while imports from Brazil (-7%) and Malaysia (-1%)

declined.

Increase in flooring imports from Malaysia and

Indonesia

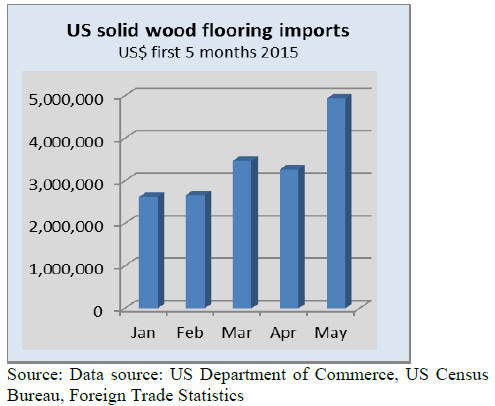

US hardwood flooring imports grew by 51% in May from

the previous month, while growth in assembled flooring

panels was more moderate at 2%.

Hardwood flooring imports from Malaysia, Indonesia and

China increased significantly compared to last year, while

imports from most other countries, except Canada,

declined.

Imports from Malaysia and Indonesia were worth US$1.4

million and US$1.3 million respectively in May. Year-todate

imports from those two countries increased by over

50% year on year.

The growth in assembled flooring panel imports mainly

benefited Canada this year, although imports from China

and Indonesia were also up. Imports from China were

US$3.6 million in May, compared to US$3.4 million from

Canada. China remains the leading source of flooring

panels.

Wooden furniture imports highest since US recession

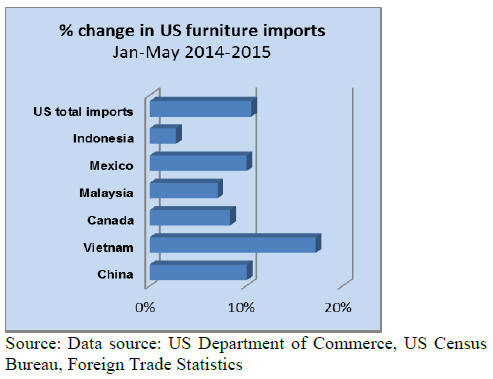

Wooden furniture imports recovered from the brief decline

in April. At US$1.38 billion, May imports were the

highest since the US financial crisis. Year-to-date imports

were 11% higher than the January to May period in 2014.

All major suppliers increased furniture shipments to the

US in May, with the exception of Indonesia and Malaysia.

Wooden furniture imports from China increased 32%

month-on-month and China‟s share in total imports

increased to 48% in May.

Furniture imports from Vietnam grew less than China‟s

from the previous month, but at +17%, Vietnam has the

highest growth rate in year-to-date shipments to the US.

Retail sales at furniture stores in the US increased 12% in

May from the previous month according to US Census

Bureau estimates. Furniture sales were low this spring, but

May sales indicate a recovery and higher consumer

confidence in the economy. May 2015 furniture sales were

5% higher than in May 2014.

Consumer and builder confidence consolidated

US consumer confidence increased significantly in June,

according to both the University of Michigan‟s consumer

confidence index and the Conference Board consumer

index.

The University of Michigan index increased to a fivemonth

high. Consumers were mostly positive about the job

market. Many plan larger purchases this year ahead of

expected higher interest rates.

Builder confidence in the market for new single-family

homes reached the highest level in June since 2005,

according to the National Association of Home

Builders/Wells Fargo Housing Market Index.

Home sales and home prices are rising and builders were

most positive about market conditions in the South and

West.

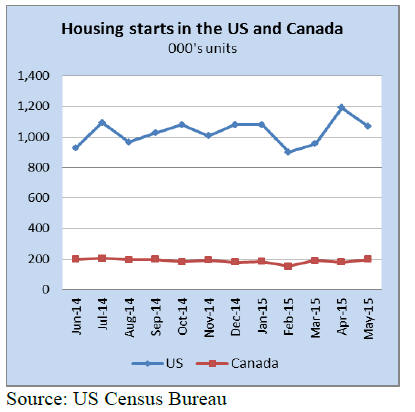

Home construction down, sales and prices up

Housing starts declined by 11% in May from the revised

April estimate. The seasonally adjusted annual rate of

residential construction was 1,036,000 in May but this is

still 5% above the May 2014 rate.

Both single-family and multi-family housing starts fell in

May but the decline was stronger in multi-family

construction.

However, sales of existing homes show a more positive

development in the housing market. May sales of existing

homes were at their highest in almost six years according

to the National Association of Realtors.

Window market to grow 6.2% in 2015

The residential window market will grow 6.2% in 2015

and 3.9% in 2016, according to a recent Window and

Entry Door Industry Market Study. In 2014 market growth

in windows was even higher at 12.7% due to the recovery

in new home construction.

Vinyl windows accounted for more than two thirds of the

residential market (67.6%) in 2014. Wood-clad windows

were in second place at 20.5%. The market share of solid

wood frame windows was small at just 1.3%. Aluminium

windows accounted for 5.2% and composite materials

3.6% of the residential window demand in 2014.

The study was published by the Window and Door

Manufacturers Association and is available for purchase

through the association‟s online shop: https://wdma.siteym.

com/store/ListProducts.aspx?catid=265369&ftr=

US homeownership at record low ¨C a trend that could

impact demand for wood products

US homeownership is at its lowest rates since 1967. In the

second quarter of 2015 the share of Americans owning

their homes was 63.4% according to the US Census

Bureau. The homeownership rate declined 0.4 percentage

points from the previous quarter.

In general a high homeownership rate is regarded as a

positive sign for the US economy. The current decline in

homeownership may be related to low income growth

which is not keeping up with the increase in home prices.

The financial crisis led to many foreclosures and some

homeowners are still losing their homes. The number of

foreclosures has declined but they still accounted for 10%

of all existing home sales in May according to the

National Association of Realtors. On the other hand, the

number of households renting has increased.

The number of homeowners declined by 400,000 in the

second quarter, compared to 2 million more renters. While

this is a good sign for the rental market, it also indicates

that young people may have difficulties affording a

mortgage and buying a home.

The changes in homeownership are likely too small at this

time to affect wood product demand. If a higher share of

Americans continues to rent, demand for wood building

materials and wood for interior finish, such wood flooring

and wood kitchen cabinets, will likely decrease.

Single-family homes and owner-occupied homes use more

wood products than rental multi-family buildings where

price and maintenance are often the most important factors

in material choice. However, population growth will boost

overall demand and should buffer wood product

manufacturers from any changes resulting from the growth

in rental housing.

|