|

Report from

North America

US March imports of processed wood products increased

significantly from a month earlier. The growth in imports

signals that the decline in February was mostly related to

the severe winter weather in parts of the country.

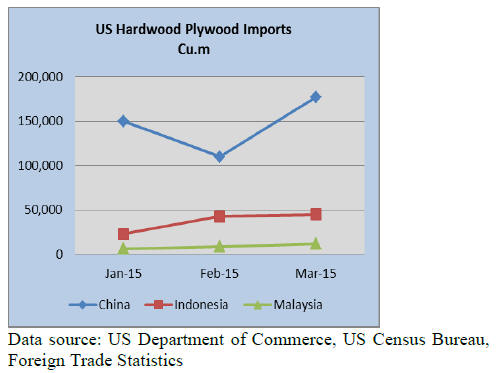

China leads hardwood plywood shipments to US

US imports of hardwood plywood grew by over 40% from

February to March. Total imports were 300,705 cu.m. in

March with over half coming from China.

At 177,074 cu.m. hardwood plywood imports from China

were higher than any time in 2014 . Year-to-date imports

(January to March) were 28% higher than in 2014.

Imports from other hardwood plywood suppliers also grew

in March, but at a slower pace than imports from China.

Indonesian shipments to the US increased 5% month-onmonth

to 44,701 cu.m.

Hardwood plywood imports from Malaysia were 12,114

cu.m. in March and year-to-date imports were unchanged

from the same time last year. Year-to-date imports from

Russia, Canada and Ecuador were lower than in March

2014.

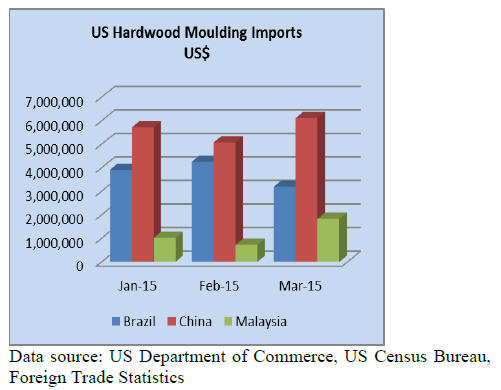

China secures major share of market for imported

mouldings

Imports of hardwood mouldings grew 15% to US$16.0

million. China increased its share of total US imports of

hardwood mouldings to 37% based on the value of imports

year-to-date 2015. Moulding imports from China were

worth US$6.1 million in March.

Hardwood moulding imports from Brazil declined from

February to US$3.2 million, but year-to-date imports are

still higher than at the same time last year. Moulding

imports from Malaysia were also higher (+19%) compared

to 2014, while imports from Canada declined.

Vietnam becoming major flooring supplier to US

US hardwood flooring imports increased by 30% in March

from February to US$3.5 million, while imports of

assembled flooring panels increased 20% to US$12.6

million. Imports from all major suppliers increased

compared to last year.

China surpassed Malaysia and Indonesia in March at just

under US$1million in hardwood flooring shipments.

Imports from Malaysia were worth US$895,686 in March.

The largest month-on-month growth was in flooring

panels from Vietnam.

Historically Vietnam exported little flooring to the US

market, but shipments of engineered flooring and similar

assembled panel flooring surpassed the US$1 million mark

in March this year.

Almost half of all assembled flooring panels came from

China in March (US$6.2 million), a year-to-date increase

of 44%. Indonesia shipped almost 800,000 worth of

flooring panels and increased its share in total imports

compared to the same time last year.

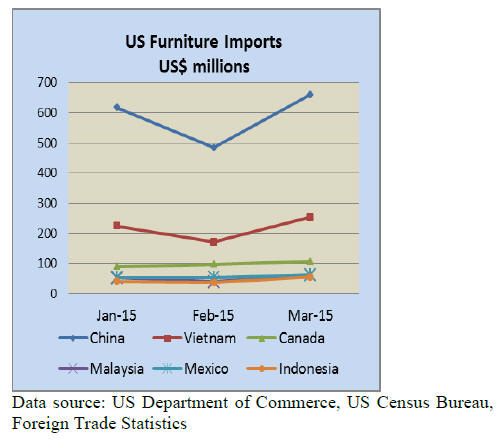

China and Vietnam regain furniture market share

US wooden furniture imports recovered from the decline

recorded in February. March wooden furniture imports

were worth US$1.40 billion, up 37% from February. Yearto-

date imports were 13% higher than in March 2014.

Both China and Vietnam regained the market share they

had lost in recent months. Furniture imports from China

were worth US$660.3 million in March. Year-to-date

imports were 16% higher than in March 2014. China‟s

share in total US furniture imports to date in 2015 was

48%, up one percentage point from 2014.

Vietnam‟s furniture import share was 18%, up from 17%

in March 2014. Imports from Vietnam were US$254.0

million in March.

Wooden furniture imports from most other countries grew

as well from the previous month, including imports from

Europe. However, year-to-date imports from Malaysia and

Indonesia were slightly lower than at the same time last

year.

Spring increase in furniture retail sales

Retail sales at furniture stores in the US increased

significantly from February to March (+11%), according

to US Census Bureau data. Furniture sales were 3% higher

than in March 2014.

Unemployment unchanged, GDP growth down

In April, both the unemployment rate (5.4%) and the

number of unemployed persons (8.5 million) were

essentially unchanged from the previous month. However,

the number of jobs in construction increased.

In the first quarter of 2015 US GDP increased at an annual

rate of 0.2%, according to the preliminary estimate from

the US Department of Commerce. Economic growth

slowed from 2.2% in the fourth quarter of 2014.

Imports increased in the first quarter, which contributed to

the lower GDP growth. Similar to last year, severe winter

weather has had a negative effect on the economy in the

first quarter of the year.

Higher output in wood products and furniture

manufacturing industries

Economic activity in the manufacturing sector expanded in

April, according to the Institute for Supply Management.

Both production and new orders increased from March.

Lower energy prices in April supported growth in

manufacturing.

The wood products and furniture manufacturing industries

reported production growth. In the furniture industry,

finding qualified employees remains difficult for some

companies.

Interest hike likely to affect wood product demand

Consumer confidence in the US rebounded in April

following the decline in March. Despite low economic

growth in the first quarter, consumers expect higher

personal incomes in 2015. Lower gas prices also supported

consumer confidence.

A growing majority of economists expects that US interest

rates will start to increase in September. The Wall Street

Journal surveys economists every month, and in May 73%

of the economists expected a rate increase in September.

Higher rates will have a negative effect on construction

and therefore wood product demand. It is difficult to

predict how significant the effect will be for the housing

market and non-residential construction.

Housing starts up in March

The gradual recovery in the housing market continued in

March. Housing starts rose by 5% to a seasonally adjusted

annual rate of 944 million units in March, according to

data from the Commerce Department. Single-family starts

grew 6% to 628 million homes.

Home construction increased in the Northeast and

Midwest, but declined in the South and West.

Builders‟ confidence in the market for newly built singlefamily

homes improved in April, according to the National

Association of Home Builders. Home sales are expected to

increase in spring, supported by low interest rates and

growth in jobs. Builders are confident the market will

continue to improve throughout 2015.

Tight credit conditions hinder home sales

While home construction grew, sales of new homes

declined despite low mortgage rates and a stronger

economy. Sales of newly built, single-family homes fell

15% in March (seasonally adjusted annual rate), according

to data by the US Department of Housing and Urban

Development and the US Census Bureau.

Tight credit conditions prevent many first-time buyers and

young people from buying homes, according to the

National Association of Home Builders.

Resilient Canadian construction sector despite

shrinking economy

Canada‟s economy shrank 0.6% in the first quarter of

2015, the first decline in GDP in four years. Mining, oil

and gas extraction fell 30% in the first quarter because of

low oil prices. Business investment also declined.

Manufacturing and exports decreased despite a weaker

Canadian dollar.

The forestry sector was among the few industries that

expanded in the first quarter.

Canadian housing starts increased 25% in March to

190,000 at a seasonally adjusted annual rate. However, the

overall trend in home construction has moved lower since

last year.

The March increase was entirely in multi-family

construction, while single-family home starts declined.

Multi-family starts are expected to grow even more this

spring, based on the number of building permits issued.

Growing flooring market share forecast for domestic

producers

US demand for hard surface flooring is forecast to grow

over 6% per year to 2019. A new market research report

by Freedonia (Hard Surface Flooring, Study # 3284)

forecasts higher demand due to new construction,

renovation and repair of buildings.

A second demand driver is replacement of carpeting for

better durability, appearance and lower maintenance.

Freedonia estimates total hard surface flooring demand in

2019 at US$16.7 billion or US$1 billion sq.m. However,

the largest growth will not be in wood flooring, but in

vinyl flooring. Luxury vinyl tiles are very popular in

residential and non-residential buildings for their ability to

copy the appearance of hardwood flooring and tile.

Demand for hardwood flooring will also grow, but at a

lesser rate than vinyl. Laminate flooring is expected to

lose market share to vinyl wood imitation flooring.

New residential construction and renovation will account

for the largest share of total wood flooring demand. The

continuing recovery in the housing market will fuel

demand for all types of hard surface flooring, including

wood.

Non-residential construction, such as offices and

commercial buildings, will also increase. Wood flooring

demand for non-residential applications will grow in the

next five years, but at a lesser rate and from a smaller

volume than residential flooring.

Wood flooring imports have recovered since the US

economic recession. The import value of hardwood

flooring and assembled wood flooring panels was

US$168.8 million in 2014, an increase by one third from

2010.

However, the market share of domestically produced hard

surface flooring is expected to increase, according to the

Freedonia report. Favourable costs of production in the

US, including low energy cost, will encourage companies

to expand existing plants or open new plants in the US.

US retailer Lumber Liquidators suspends sales of

laminate flooring from China

Lumber Liquidators is conducting a review of their

purchasing programme for laminate flooring from China.

This includes the formaldehyde emission certification and

labelling process by their suppliers in China.

The review is not yet complete, but in early May Lumber

Liquidators decided to suspend sales of all laminate

flooring made in China.

The decision was made because of growing industry and

consumer concerns. The company is purchasing laminate

flooring from other suppliers until the review is complete.

From March Lumber Liquidators has provided indoor air

testing kits to customers who bought laminate flooring

made in China.

This was in response to a media report earlier this year that

found elevated levels of formaldehyde in laminate flooring

sold by Lumber Liquidators. About 11,000 households

used the free test kits.

The majority of households had formaldehyde emissions

that were within the guidelines set by the World Health

Organization. However, around 2% of tested households

exceeded the safe formaldehyde level.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

|