2. GHANA

Third quarter exports up 21%

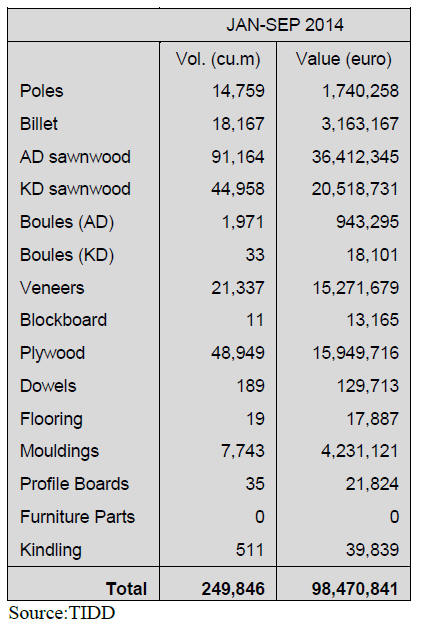

The Timber Industry Development Division (TIDD) of the

Ghana Forestry Commission (FC) has released its Timber

Export Report for the first nine months of 2014.

In the first nine months of the year Ghana exported a total

of 249,846 cu.m of timber and wood products worth euro

98.50 million. This represented increases of 21% in

volume and 7.8% in value compared to same period in

2013.

Products for which increases were recorded included kiln

and air dry sawnwood, poles and billets. A large volume

of gmelina poles were exported to India.

Table below shows the products exported during the

period and the corresponding volumes and values.

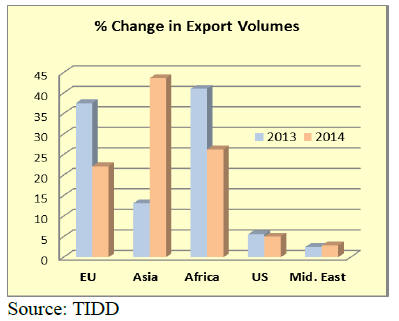

The major markets for Ghana‟s wood product exports

in

the first three quarters of 2014 were Asia/Far East 44%,

Africa 26% with the balance going to Europe. Other

markets included the US (5%), Middle East (3%) and

Oceania.

The Average Unit Price for 2014 exports to the

ECOWAS

market was in the range of euro 229-434 per cu.m, up

slightly on the euro 223¨C392 per cu.m in the same period

in 2013. Exports to Niger were the lowest priced while

export prices in the Togo and Gambia markets were the

highest.

The main export species included wawa, Mahogany,

gmelina,teak, papao, koto, odum, ceiba, walnut, ofram.

Manufacturers continue to struggle with power

rationing

The National Petroleum Authority (NPA), the regulator of

fuel prices in Ghana, lowered the prices of petroleum

products by 10%, as off 1 January 2015. The price

reduction followed a public outcry on delayed petroleum

price reviews since world crude oil prices began to fall in

June 2014.

Many have argued that the 10% reduction in prices by the

regulator is woefully inadequate judging the drastic

reduction of world crude prices by about 50%.

Meanwhile, manufacturing businesses continue to battle

with power rationing and can only manage production by

using independent generators which pushes up production

costs.

3. MALAYSIA

Low oil prices to impact GDP

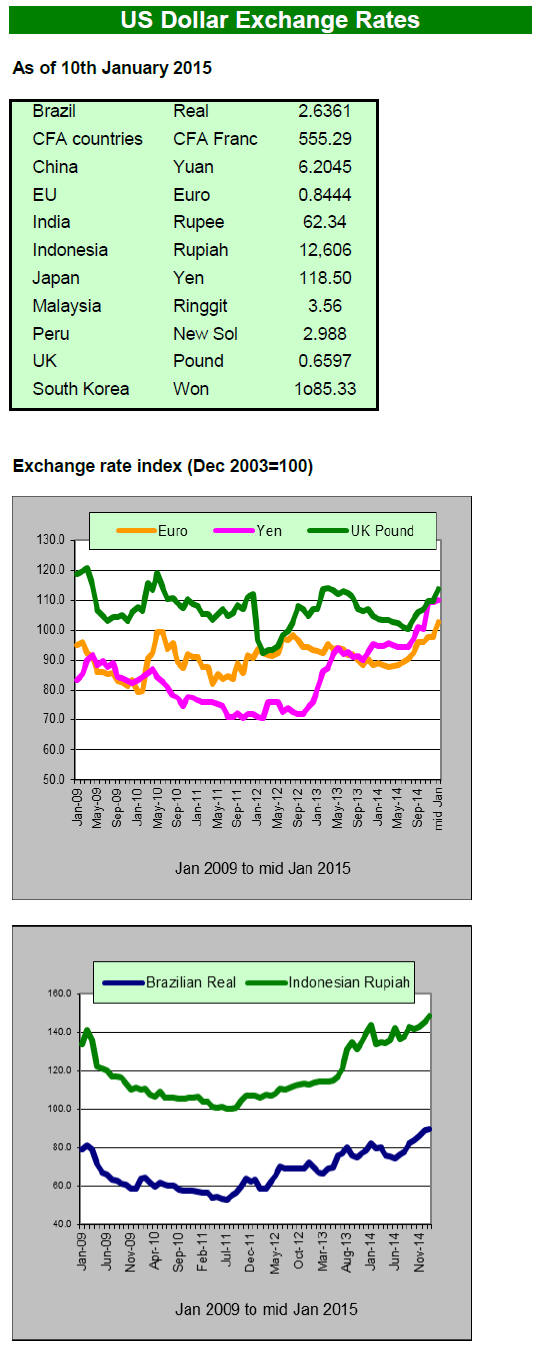

The falling price of crude oil continues to put pressure on

the Malaysian currency the ringgit which was the worst

performing currency in ASEAN last year. If the low crude

prices persist then the outlook for Malaysia‟s economic

growth in 2015 will dim.

Malaysia is the only net oil exporting country in ASEAN

and analysts expect that the country will lose out most

from plunging oil prices. The oil and gas sector

contribution to the Malaysian economy is projected at

11% of gross domestic product in 2015.

New tax regime

The Goods and Service Tax (GST) will come into force on

1 April this year and businesses are concerned on how this

will impact consumer sentiment, especially when it comes

to the property market. Most analysts say property prices

are sure to dip immediately after the new tax is introduced

but should rebound once the initial shock subsides.

Timber traders are watching development closely and

trying to anticipate how the GST will impact the industry.

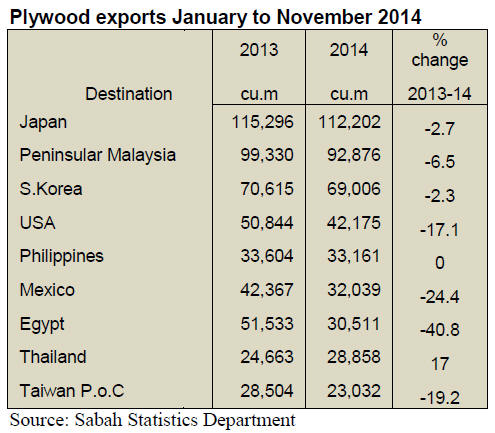

Sabah plywood exports

The Sabah Statistics Department has released its January

to November 2014 trade data.

In the first eleven months of 2014, Sabah exported

523,098 cu.m of plywood worth RM865 mil.

(approx.US$240 million). By comparison, in the same

period in 2013 Sabah exported 594,948 cu.m of plywood

worth RM949 mil.

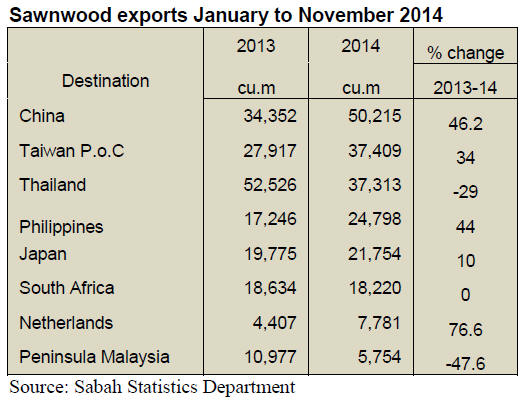

Sabah sawnwood export data

In the first eleven months of 2014, Sabah exported

236,625 cu.m of sawnwood worth RM358 mil.(approx.

US$99 million). In the same period in 2013 223,041 cu.m

of sawntimber worth RM 333 mil. was exported.

Sarawak Forestry enlists help on plantation

development

Sarawak is refocussing its attention on plantation forests

as the rate of planting in recent years has been falling. The

State Government has stepped in to help the industry move

forward. Sarawak Forestry Corp. recently signed a three

year contract with Forest Solutions Services Pvt Ltd (FSS)

as part of the corporation‟s ambitious Planted Forest R&D

programme.

Dr. Yusoff Hanifah, chairman of the Sarawak Forestry

Corp (SFC) said this project, fully funded by the

Government of Sarawak, has been designed to achieve fast

track acquisition of R&D capacity and to address the

shortage of high-quality planting materials and resolving

pressing technical issues.

Glen MacNair, Managing Director of FSS, said that the

company will provide a team of international specialists in

various fields such as tree breeding and forest genetics to

assist the state government achieve its aims.

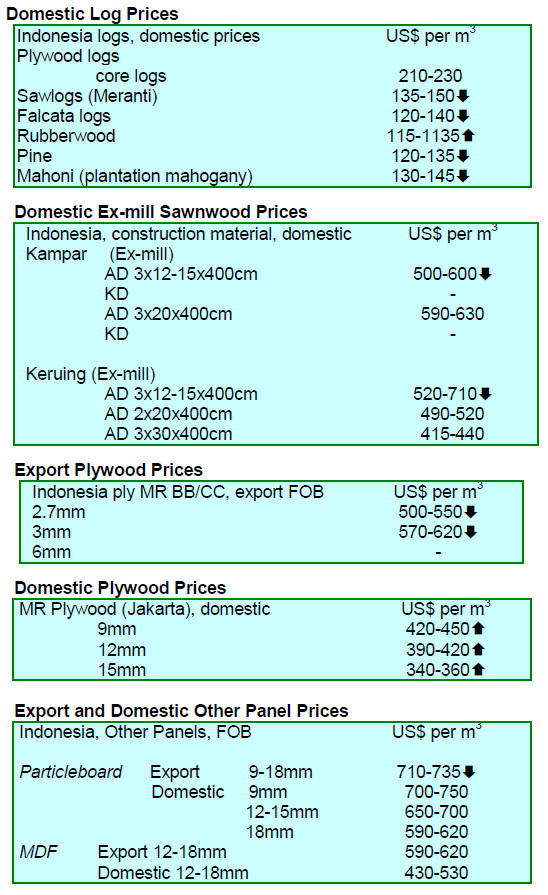

4. INDONESIA

PEFC certification

Indonesian timber companies will see improved access to

international markets after the Programme for the

Endorsement of Forest Certification (PEFC) endorsed the

domestic „Indonesian Forestry Certification Cooperation

Programme (IFCC).

The PEFC requires standards to be developed through

multi-stakeholder and consensus-based processes at the

national level and IFCC IFCC chairman, Dradjad

Wibowo, said his organization will work to maintain the

high standards demanded to ensure the endorsement by

PEFC remains valid.

Revised regulations for wood product export

controls

The Indonesian Ministry of Forestry has issued a press

release on revised regulations for wood product export

controls.

This says, beginning 1 January this year, the revised

regulations for Indonesia‟s domestic Timber Legality

Assurance System (TLAS) came into effect. The revisions

were agreed by the Ministry of Environment and Forestry,

the Ministry of Trade and the Ministry of Industry and are

aimed at supporting export growth through simplifying the

TLAS requirements for small and medium sized

enterprises.

The changes are defined in a regulation of the Ministry of

Environment and Forestry, P.95 / Menhut-II / 2014 of

December 22, 2014 and an Amendment to regulation No.

P.43 / Menhut-II / 2014.

Changes have also been made to the regulation on

Performance Assessment of Sustainable Production Forest

Management, Timber Legality Verification and a

Regulation on Export Control of forest products.

Under the previous regulations exports of wood product

were only permitted from Registered Exporter of Forestry

Product Industry (ETPIK) i.e. those that had valid TLAS

certificates.

However, under the new system the requirements for

SMEs and furniture manufacturers the ETPIK regulations

have been simplified.

See:

http://www.dephut.go.id/index.php/news/details/9701

Despite the simplified arrangements for small companies

as many as 40% of the larger furniture manufacturers in

Indonesia as yet do not have TLAS certificates said David

Wijaya, Counsel for the Association of Indonesian

Furniture and Handicraft Industry (Asmindo).

The Chairman of Asmindo - Surakarta, Yanti Rukmana,

noted that implementation of the Indonesian TLAS can no

longer be postponed and that Asmindo is ready to assist

exporters through the TLAS process.

Forestry administration re-organised

The Ministry of Environment and Forestry has completed

preparations for their organizational restructuring. Under

the new structure, the management of the Reduced

Emissions from Deforestation and Forest Degradation

Programme (REDD + BP) has been merged into the

Directorate General for Control of Climate Change.

The Minister of Environment and Forestry, Siti Nurbaya

Bakar, explained the ministry now coprises a Secretariat-

General, Inspectorate General, and 9 Directorate General,

namely:

1) Forestry Planning and Environmental Management,

2) Natural Resources Conservation and Ecosystems,

3) Watershed Management and Protection Forests,

4) Sustainable Forest Management,

5) Pollution Control and Environmental Degradation,

6) Management of Residues, Waste and Hazardous and

Toxic Materials,

7) Control of Climate Change,

8) Social Forestry and Environmental Partnership,

and 9) the Environment and Forestry Law Enforcement.

5. MYANMAR

A memorable year for MTE

2014 was a memorable year for the Myanma Timber

Enterprise (MTE). The log export ban came into effect at

the beginning of fiscal 2014 and this was followed by

news of corporatisation of the enterprise. MTE sawmills

are to be either being auctioned or leased and there is

concern on the fate of the staff and workers.

In addition the year saw MTE being blamed for

deforestation because they exceeded the annual allowable

cut but local analysts point out that most of the

deforestation has been caused by illegal felling.

Many of the areas with the worst record for illegal felling

are those where armed conflict continues such that

unarmed forestry officials are helpless to combat the

problem.

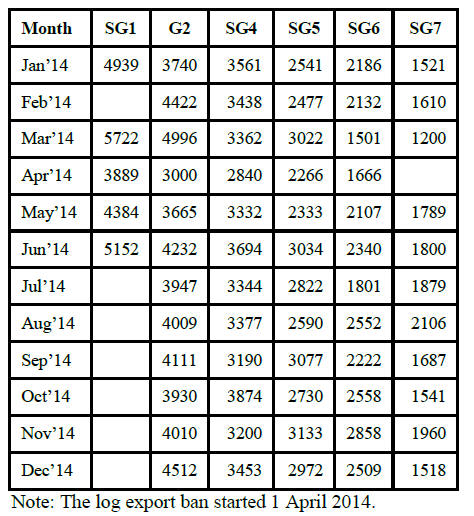

No decline in auction prices after log export

ban

Most analysts expected a sharp decline in the price of teak

logs sold by the MTE after the export ban, in fact as can

be seen from the table below they were wrong as prices

have been sustained even though the supply of logs in the

monthly sales by MTE remained almost at the same level

as in the previous year.

The following table shows average tender prices for teak

log sold by MTE. Prices are US$ per ton hoppus measure.

With the domestic boom in the building and

construction

sector there is a need for more timber which will help

maintain price levels. However, Aluminum and steel are

now replacing timber for structural use in construction of

homes and bridges but for interior use decorative species

are in demand.

Fatal shooting of foresters

The state run English newspaper, Global New Light of

Myanmar, reported on a press conference held by the

Forest Department (FD) on the fatal shooting of four forest

officers in Langkho Township in Southern Shan States. It

appears that on receiving news about illegal felling in the

area the officers went over to Wansalaung village and

during their inspection seized 202 tons of padauk logs.

On their return to Langkho they were fired upon by an

armed group and four forestry officers, including the

Assistant Director of the Shan State Forest Department

were killed.

Army seizes illegal logs and vehicles

Between 2 and 5 January the Myanmar Army in

operations in the north of Myanmar bordering China

seized 472 vehicles and logging equipment.

Fourteen trucks were loaded with timber at the time and

20 Myanmar citizens and 119 foreigners were

apprehended. In addition to the seized logging equipment

the officers found stimulants and raw opium in the

belongings of those held.

The army continued its search and seized a further

collection of logging equipment along with 240 high value

logs. Some 17 workers from a neighboring country were

detained.

According to Pyi Soan Myo of the FD, this operation

netted the largest ever single haul of equipment and logs

over the previous five years. According to FD statistics,

134 Chinese and 23,000 Myanmar nationals along with

more than 140,000 tons of illegal timber, weapons, 3500

trucks and ancillary equipment were seized between April

2011 and November 2014.

It has been reported that a new round of talks will be held

with Chinese officials during January which will focus on

cross-border issues and matters relating to Chinese

nationals being held by the Myanmar authorities.

Open tender sales by MTE

MTE will sell timber by open tender on the 23 and 26

January. About 900 tons will be sold at the first auction of

2015.

6.

INDIA

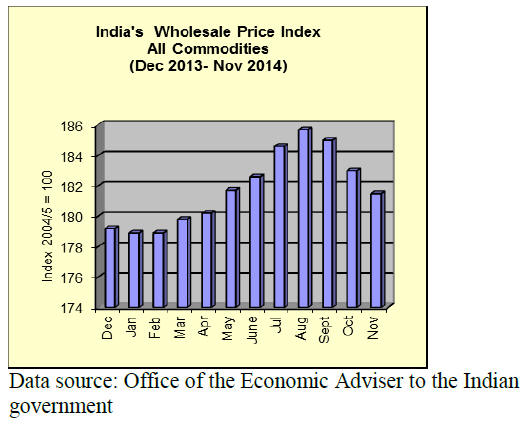

Wood product price index drops

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for „All Commodities‟

(Base: 2004-05 = 100) for the month of November 2014

fell to 181.5 (provisional) from 183 for the previous

month.

The annual rate of inflation, based on the monthly WPI,

remained at 1.77% (provisional) for November 2014.

For more see:

http://eaindustry.nic.in/display_data.asp

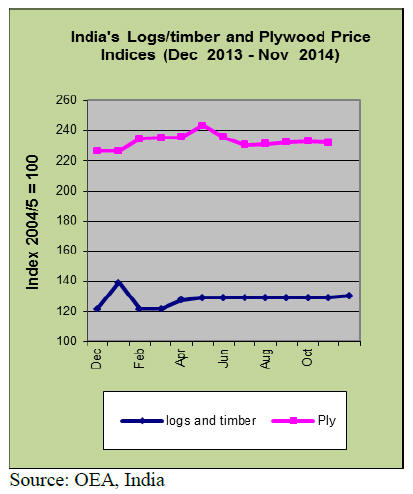

Timber and plywood wholesale price indices

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Logs/timber and Plywood are shown below.

The November index for the 'Wood and Wood Products'

group rose by 0.2 percent to 186.5 (provisional) from

186.1 (provisional) in October due mainly to higher price

of veneered particleboard.

See:

http://eaindustry.nic.in/display_data.asp

Development and environmental protection to go

hand-in-hand

The Indian government is examining a range of options to

achieve its twin goals of economic growth and

environmental protection.

Most of the new suggestions have come from the Ministry

of Environment and could be incorporated into existing

legislation or included as part of a new law which could be

introduced in parliament next month.

The suggestions include new measures to deal with air

pollution, environmental risk mapping of the country,

solid waste disposal, noise pollution as well as regulations

on animal trapping.

Environmental mapping of the country would provide the

basis for identifying sensitive areas where developments

would be restricted. Such areas could include forests with

as much as 70% tree cover, wildlife protected areas, ecosensitive

zones and bio-diversity hotspots.

The creation of a National Environment Management

Authority (NEMA) at the national level and State

Environment Management Authorities has been proposed.

Western region actions ¨C e-action style resisted by

traders

Log stocks at various depots in the north and south

divisions of the Dang Forests District are abundant and log

auctions will take place this month. Approximately 12,000

cubic metres of mostly newly harvested teak logs and

about 1,000 cubic metres of hardwoods are expected to be

sold.Additional logs are arriving in readiness for auctions

in February and analysts expect around 20,000 cubic

metres will be available.

The e-auction method adopted in recent sales has not been

well received by buyers who prefer the old system where

logs were sold by on the spot bids. But the Forestry

Department wants to continue with the e-auction method.

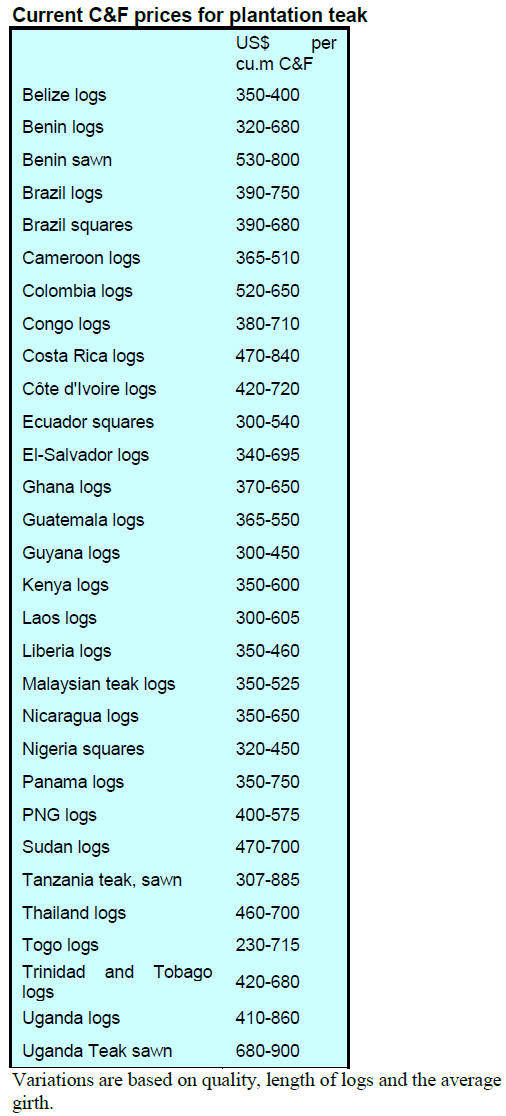

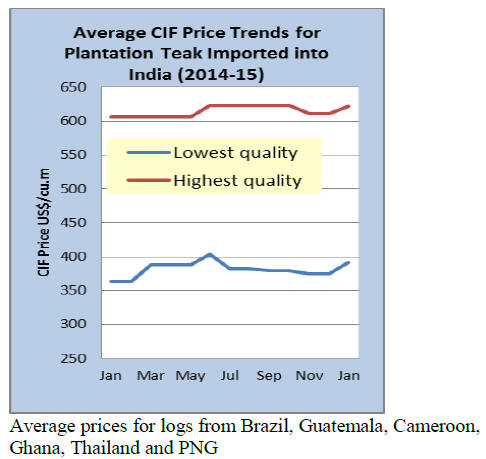

Plantation teak imports

The level of imports and domestic consumption of

imported plantation teak are currently well balanced such

that stock levels remain steady. Importers have reported a

general improvement in the size and quality of the logs

that have been arriving recently and this has lifted some

price levels.

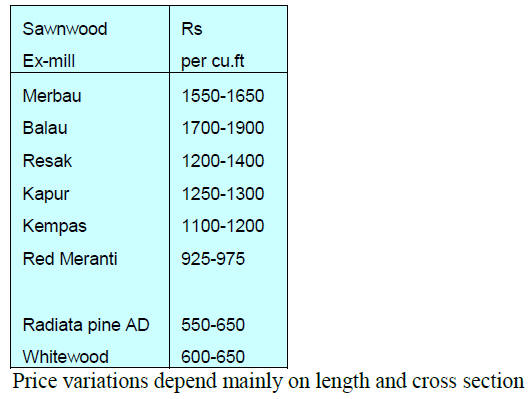

Prices for domestically milled sawnwood from

imported logs

Current exmill prices for air dried sawnwood are shown

below. As the housing market has weakened recently,

sawnwood prices are not expected to change in the short

term.

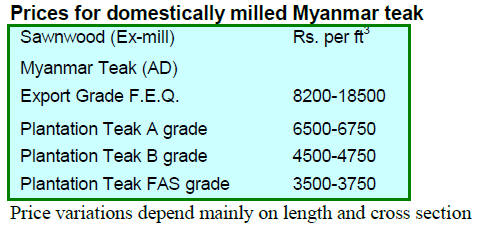

Sawn teak prices up slightly

Indian importers of sawn teak from Myanmar are

optimistic that with some relaxation of the export

regulations for sawn teak the flow of imports from

Myanmar could improve.

Indian traders holding stocks of Myanmar teak logs have

been pushing for price increases and have had some

success in lifting prices during recent weeks.

Housing development to boost plywood sales

The CREDAI e-newsletter of 16 December 2014

(http://credai.org/sites/default/files/Issue-19-Real-Estateat-

Glance-16-12-2014.pdf) reports on changes to FDI

investment rules that could boost the housing market. The

newsletter says ¡°The government on has eased foreign

direct investment (FDI) norms for the construction sector

which is expected to provide a substantial boost to the

sector in terms of greater foreign capital inflows.¡±

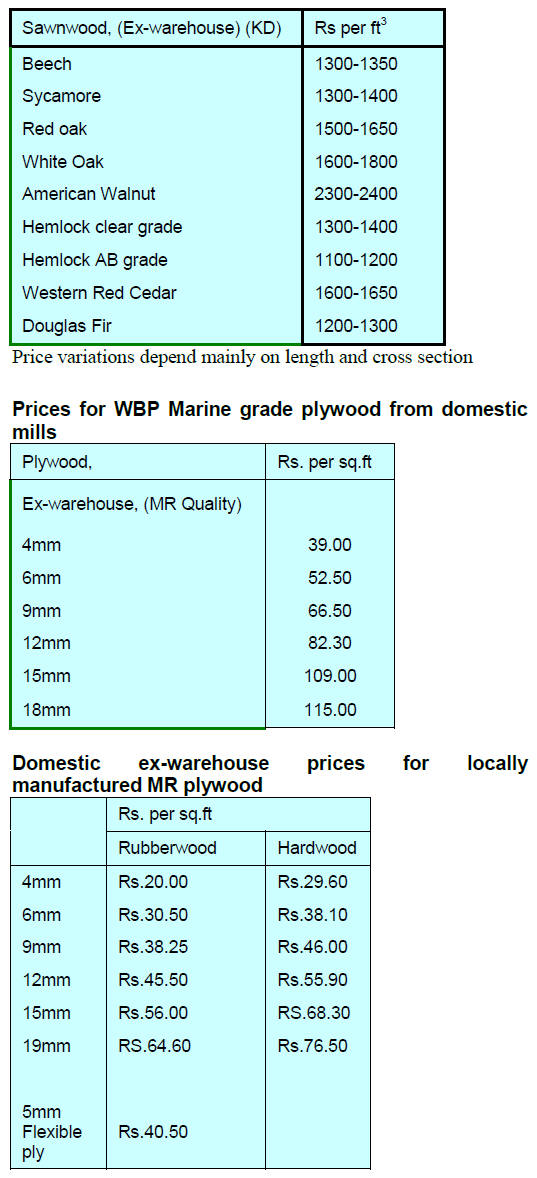

Imported 12% KD sawn wood prices per cu.ft

exwarehouse

Demand in India for imported hardwoods remains slow

and prices are unchanged.

¡¡

7.

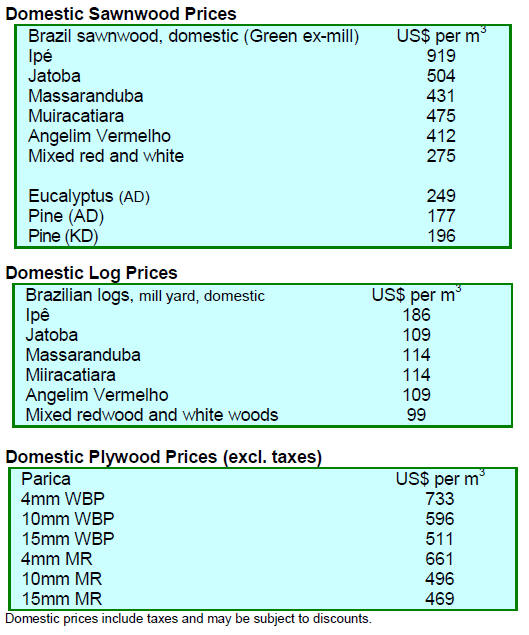

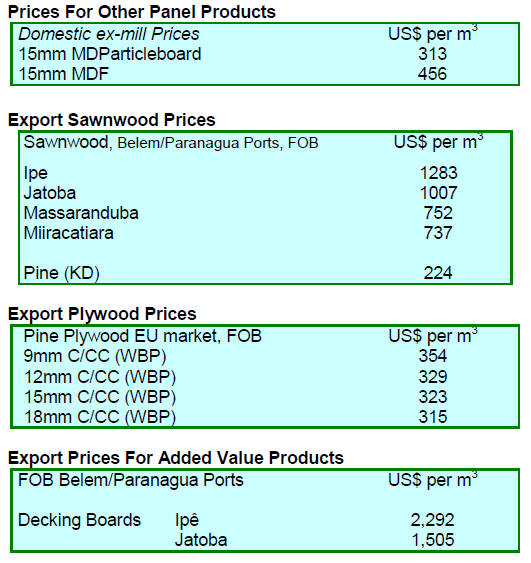

BRAZIL

Furniture industry braces for tough

competition

The value of furniture output in Mato Grosso do Sul

increased by over 70% in 2014 compared to the previous

year, from R$ 116.1 million to R$ 201.3 million,

according to the Inter-municipal Union for the Furniture

Industry in Mato Grosso do Sul (SINDIMAD/MS).

However, production in 2015 is expected to expand by just

4% to R$ 209.3 million mainly because of the negative

impact of rising interest rates and a stagnant domestic

economy.

According to SINDIMAD, the industry would benefit if

the government simplified and lowered the tax burden,

invested in infrastructure and encouraged innovation.

In 2015 the furniture industries in Brazil expect to face

stiff competition from Chinese manufacturers so plan to

investment in innovation, advanced technology and

training.

The Mato Grosso do Sul furniture sector comprises of 405

industries and employs almost 3,000 workers.

Address efficiency and design to remain competitive

The Bento Gonçalves furniture cluster reported a

disappointing 2014 as furniture output fell. The weak

domestic economy hit sales in 2014 and prospects for

2015 are not positive as the Brazilian economy is forecast

to expand by just 1% in the year. The Brazilian National

Confederation of Industry (CNI) expects low demand and

anticipates a tough time for the furniture industry in the

country in 2015.

Up to 2014 the Brazilian furniture industry recorded four

consecutive years of growth after the 2009 financial crisis.

However, between January and October 2014 the furniture

sector in Bento Gonçalves faced serious problems; the

labour force fell 3.6%, revenues dropped almost 4% and

exports plummeted 14%.

According to SINDMÓVEIS, companies must address

efficiency and improve their competitiveness through

adopting design strategies, market diversification and

technological innovations. SINDMÓVEIS is strengthening

its technical training activities for members and seeking

new opportunities in international markets.

Pine sawnwood exports up 30%

In 2014 Brazilian exports of pine sawnwood totaled

almost 1 million cubic metres year on year, representing a

30% growth compared to the previous year. Pine plywood

exports also increased by 10% to around 1.2 million cubic

metres in the same period.

This performance was underpinned by growth of the

construction market in the United States and the

appreciation of the US dollar against the Brazilian

currency. Weakness in the domestic market in Brazil

drove manufacturers to actively seek new international

markets.

The United States market accounted for around 45% of

Brazilian pine sawnwood exports in 2014 but Europe was

the main market for Brazilian pine plywood and this trade

was worth US$470 million in 2014.

Saudi Arabia, Vietnam, Mexico and China were also

important export destinations for Brazilian pine plywood.

Despite the good performance in 2014, exports of both

pine sawnwood and plywood are still well below 2008

levels, i.e. before the global financial crisis suggesting

there is considerable room for further growth if the US and

EU economies improve.

2015 fair to promote international business dialogue

MOVELPAR 2015, the Paran¨¢ State furniture fair will be

held in March. This will be the 10th fair which will see

promotion of the international ¡°Buyer Project¡±, which

supports business negotiations between foreign importers

and participants of the Brazilian Furniture Program

managed by APEX Brazil (Brazilian Trade and Investment

Promotion Agency) and ABIMÓVEL (Brazilian Furniture

Association).

The aim of the fair is to present innovations in the

Brazilian furniture industry focusing on quality,

differentiation and design to strengthen ties between

Brazilian manufacturers, retailers and designers and

potential buyers.

The MOVELPAR 2015 is organised by Arapongas

Furniture Industries Union (SIMA) and expects to host

more than 20 importers for the business negotiations. In

2013 business at the fair exceeded US$ 10 million, an

increase of 50% compared to the results of the previous

fair in 2011.

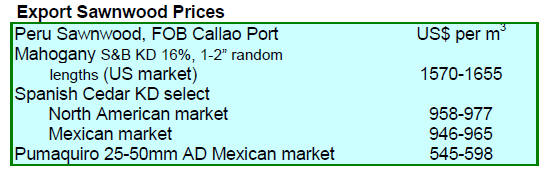

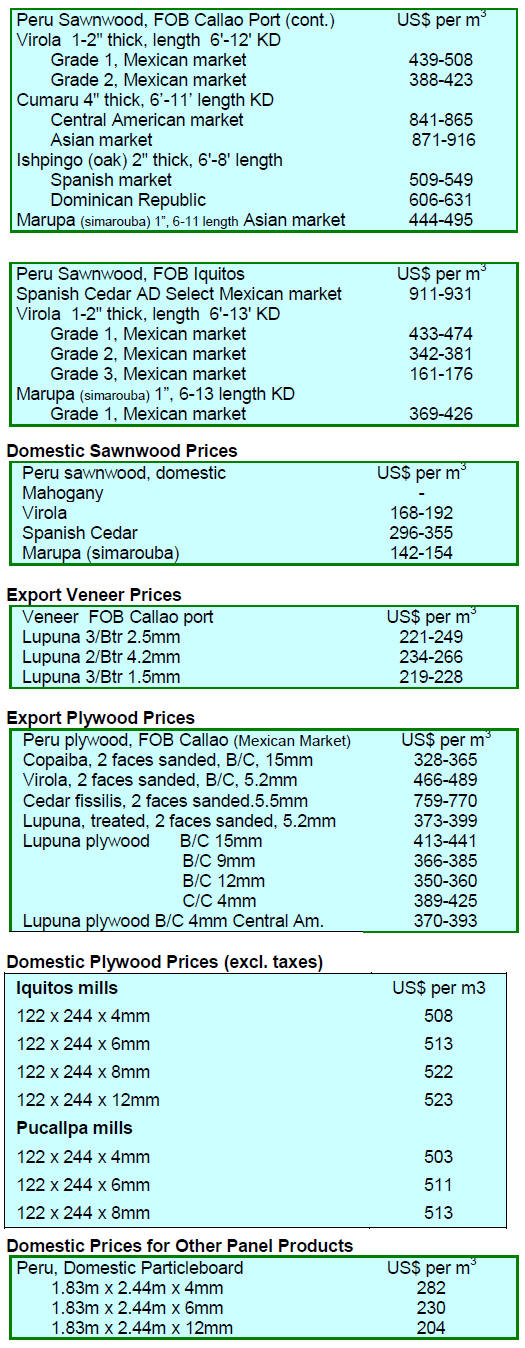

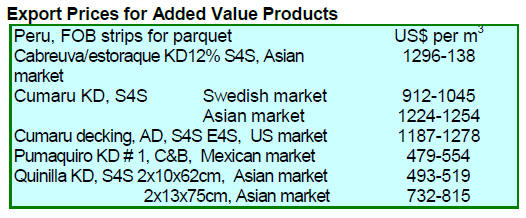

8. PERU

Higher agri-output without forest

clearing

The Ministry of Agriculture and Irrigation (Minagri) aims

to increase agricultural production through promoting

efficient methods not through making more forested land

available.

This is part of a plan by the Minagri in the development of

Nationally Appropriate Mitigation Actions (NAMAs) for

climate change revealed at the Twentieth Conference of

the Parties to the Framework Convention United Nations

Climate Change (COP20).

The ministry has prioritised three key issues on forests

including the promotion of integrated and sustainable

management of natural forests, creating forests through

incentives to forest plantations and combating

deforestation.

Forestry has more potential to contribute to growth

Jos¨¦ Luis Canchaya, Business Manager of Maderacre SA a

leading exporter of hardwood floorings, speaking at

COP20 said the export potential of the permanent

production forests is estimated at US1.5 billion and the

sector could support 100,000 jobs and as such has the

potential to boost economic growth. However, he pointed

out that in 2013 exports were on US$153 million and the

trade deficit in wood products was around US$ 800

million.

9.

GUYANA

Press release from GFC

The Minister of Natural Resources and the Environment,

Mr. Robert Persaud, in his end of year report on

developments in the various agencies under the ministries

control reported the following on the forestry sector:

The Land Reclamation Project saw the Government

allocating US$500 million for the execution of restoration,

rehabilitation and replanting of areas affected by mining

utilizing principally Acacia mangium.

The Geospatial Information Unit, one of whose main

functions is to provide information on monitoring and

compliance to the ministry and agencies under its purview

was engaged in analysis of deforestation caused by

mining, land reclamation project support, Amerindian land

titling project support and near real time analysis during

the year.

The ministry has made available to the public Guyana‟s

Monitoring and Verification System (MRVS), Year 4

Report (2013). The findings of this report provide a useful

basis for planning an ongoing monitoring programme

focusing on key hotspots.

First half 2013 export performance

The Guyana Forestry Sector Information Report covering

the first half of 2014 shows that, as of the end of June,

exports were worth US$21.8 million compared with the

US$16.8 million in the first half of 2013, a 29% increase.

Exports of sawnwood and plywood increased in volume

and value by 54% and 29% respectively. While log

exports fell year on year in the first half, they still

comprised almost 80% of all exports in terms of volume.

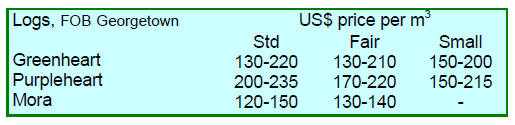

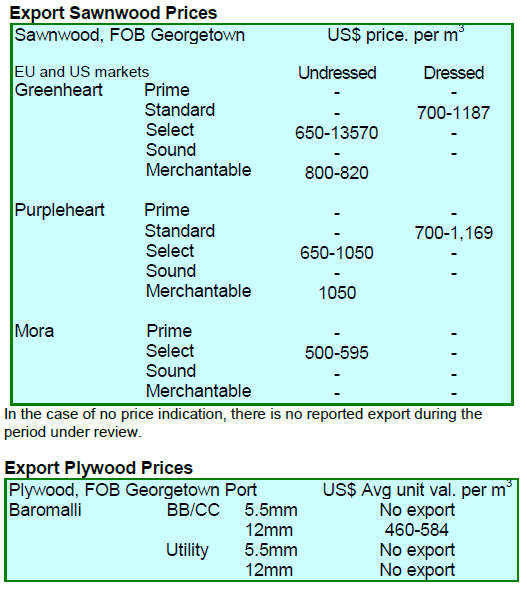

Export Prices

There were exports of greenheart, purpleheart and mora

logs in the period reviewed.