Japan Wood Products

Prices

Dollar Exchange Rates of

10th December 2014

Japan Yen 117.89

Reports From Japan

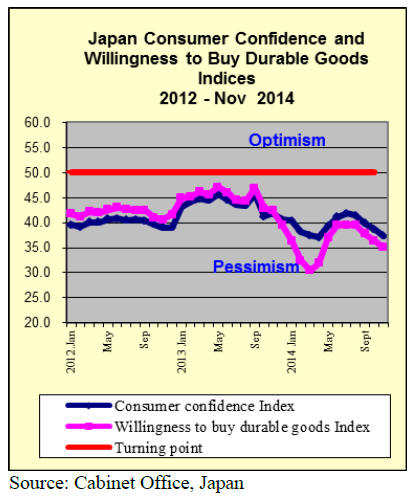

Consumer confidence continues to falter

Cabinet Office data on consumer confidence for

November showed an unexpectedly steep decline. As a

result of this the government had to come to terms with the

reality that consumer confidence remains weak.

The overall consumer confidence index for general

households, which includes consumer perceptions on

income and job prospects, was at 37.7 in November down

1.2 points from the previous month and the lowest since

April this year.

The index is split between several categories of consumer

perceptions. The November data reports that the livelihood

index stood at 34.9 (down 1.5 from the previous month);

the income growth index, at 37.6, was down 0.4 from the

previous month; the employment index was 42.8 (down

1.9 from the previous month) and the willingness to buy

durable goods index stood at 35.4, down 1.1 from the

previous month.

For more see:

http://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html#cci

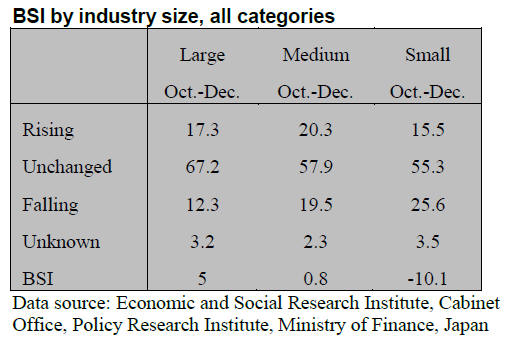

After 4 positive months BSI reverses course

The latest report from Japan‟s Economic and Social

Research Institute shows a decline in the business

sentiment index (BSI), even among large Japanese

companies.

The index is compiled to reflect the difference between

enterprises assessing business conditions as improving

from the previous quarter and that of companies

experiencing a decline in business conditions.

See:

http://www.esri.cao.go.jp/en/stat/hojin/h26hojin/141012yo

soku-e.html

It came as no surprise that the sentiment index for small

enterprises in Japan was in negative territory as it has been

for the past three quarters of the year. Japan's economy fell

into recession in the third quarter and consumer

confidence has been trending down for months.

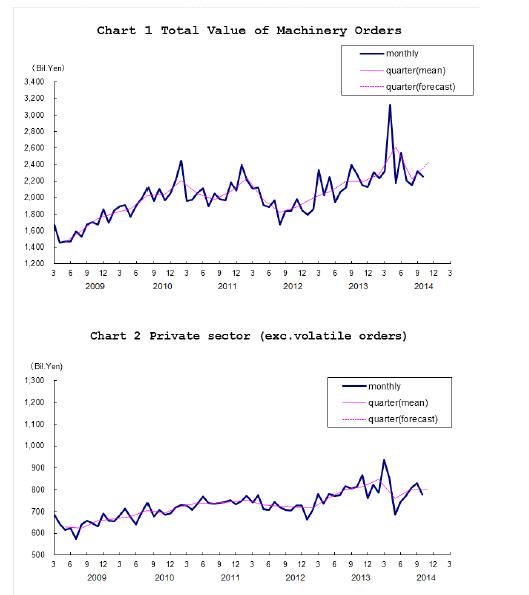

Machinery orders down after 4 straight monthly

increases

One of the leading indicators of private sector investment,

core machinery orders, fell 6.4% month on month and

4.9% year on year, bringing to an end the rises reported

over the past 4 months.

The Cabinet Office report says: “The total value of

machinery orders received by 280 manufacturers operating

in Japan declined by 2.9% in October from the previous

month on a seasonally adjusted basis.

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

declined a seasonally adjusted by 6.4% in October.

These disappointing numbers must be viewed against the

recent four consecutive monthly increases and the Cabinet

Office is maintaining its stance that the economy is on a

recovery track.

For more see:

http://www.esri.cao.go.jp/en/stat/juchu/juchu-e.html

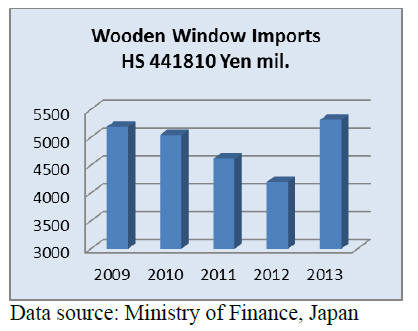

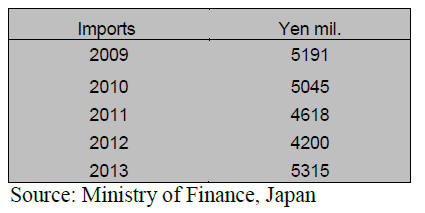

Trends in wooden window frame imports

Japan‟s imports of wooden window frames from 2009 to

2013 are shown below. Between 2009 and 2012 there was

a steady decline in imports of wooden window frames but

imports picked up again in 2013.

From 2009 to 2012 imports of wooden window frames fell

around 19% from yen 5,191 mil. to yen 4,200 mil. but in

2013 imports rose 27% to yen 5,315 mil. reflecting the

improved housing market trend.

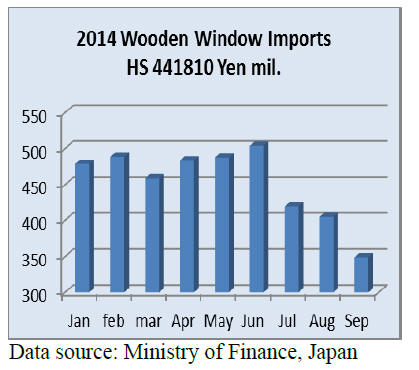

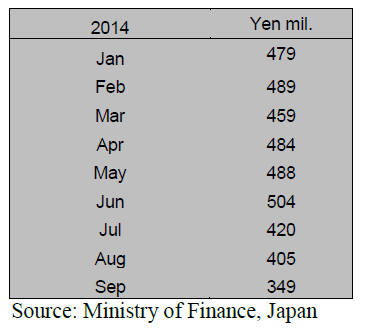

First half 2014 imports of wooden window frames

averaged around yen 4,600 mil. but figures from Japan‟s

Ministry of Finance show third quarter imports collapsed

by almost 45%, the worst quarter imports for a decade.

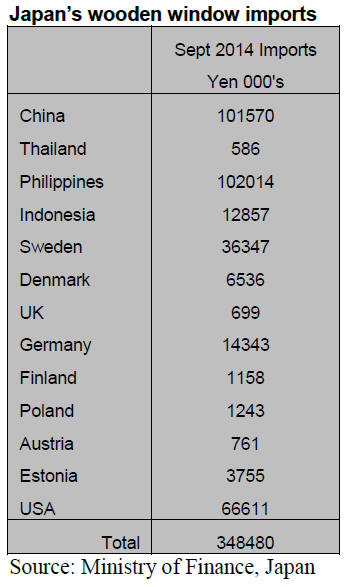

September imports of wooden window frames

China and Philippines are major suppliers of wooden

window frames to Japan and in September 2014 each

country supplied approx. 30% of all imports of wooden

window frames.

Other suppliers include the US which delivered around

20% of Japan‟s window imports for the month of

September. Of the balance the manufacturers in Europe

supplier a significant value of wooden window frames to

Japan with Sweden being the largest European supplier.

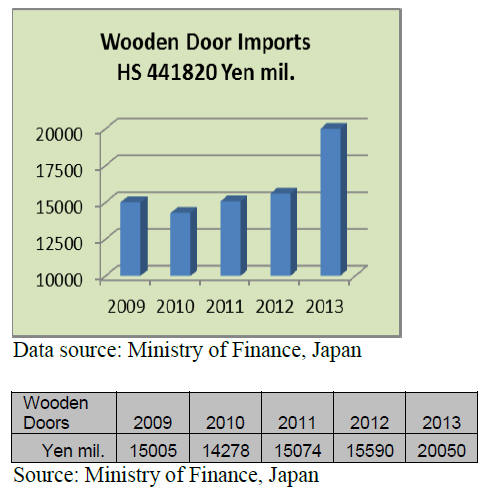

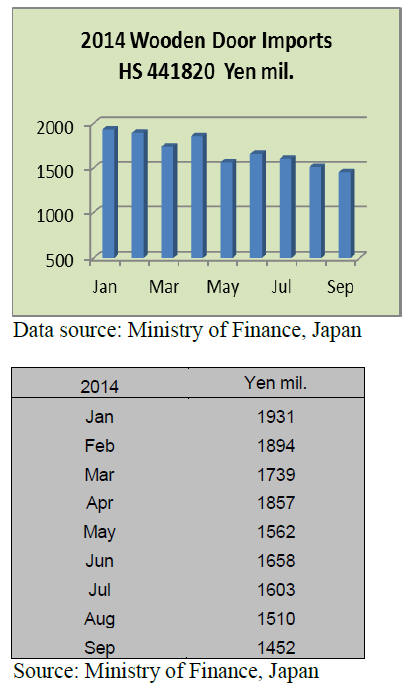

Trends in wooden window door imports

The demand for wooden doors and frames in Japan‟s

residential and commercial building sectors is substantial.

In contrast to the trend in wooden window frame imports,

imports of wooden doors between 2009 and 2012

remained fairly steady at about yen 15,000 mil. annually

but increased by 30% to yen 20,000 mil. in 2013.

The increased level of wooden door imports continued

into the first quarter of 2014 but thereafter began a steady

decline to a point when, in the thrid quarter, imports were

back to 2012 levels. However for the year to September

2014 the value of imports of wooden doors had already

surpassed the cummulative total for 2013.

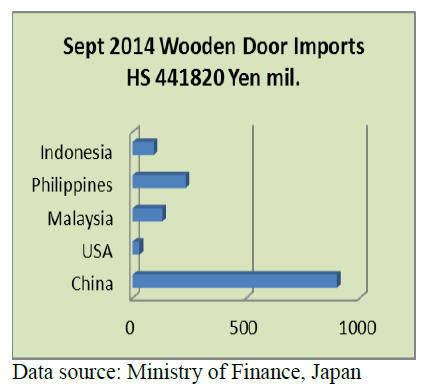

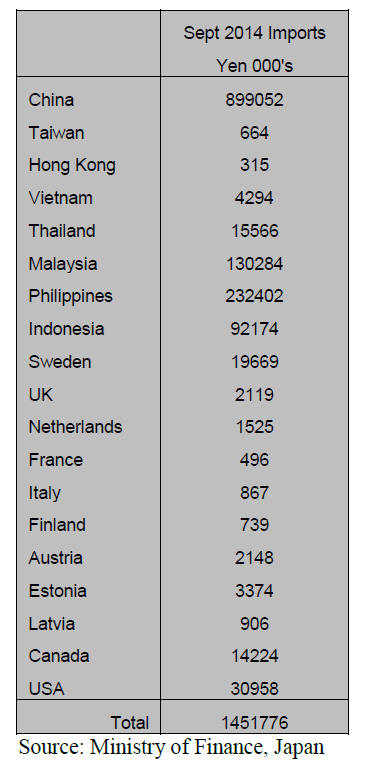

Suppliers in just five countries provided over 90% of the

value of Japan‟s imports of wooden doors. The fllowing

graphic illustrates the dominance of China as a supplier of

wooden doors to the Japanese market followed by

Philippines and Malaysia.

September wooden door imports

Some 62% of all Japan‟s wooden door imports in

September were supplied by manufacturers in China

follwed by Philppines (16%), Malaysia (9%) and

Indonesia another 6%. Of the remaining suppliers the US

provided 2% of Japan‟s Seotember imports of wooden

doors.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Yen depreciation pushes up import costs

The recent rapid and significant depreciation of the yen

since late October pushes cost of all the imported

commodity sharply.

North American Douglas fir log prices for November

shipment are US$20 per M Scribner up FAS., making IS

sort prices of US$870. An increase in FAS dollar prices

plus weak yen will make arrived yen cost much higher,

which will impact Douglas fir lumber prices in Japan.

Export prices of South Sea hardwood plywood remain

unchanged but recent higher FOB prices with exchange

rate of about 115 yen per dollar, arrived cost of JAS 3x6

concrete forming panel would be about 1,370 yen per

sheet FOB truck port yard and coated concrete forming

panel about 1,500 yen about 150 yen per sheet higher than

current Japan market prices.

Negotiations on European lumber are in confusion as the

European suppliers intend to increase the export Euro

prices but the Japanese buyers are unable to increase the

sales prices because of market slump.

The Yen‟s depreciation comes when the demand for wood

products is sluggish with low housing starts so the yen

prices of wood products would remain weak and price

hike is impossible for a time being.

Expansion of domestic log export

The Japan Wood Products Export Promotion Council held

the first meeting for establishing of a network for cooperation

with overseas relevant organizations to promote

more wood products export from Japan.

The Ministry of Agriculture, Forestry and Fisheries sets a

target of export amount of agricultural and marine

products of one trillion yen by 2020 out of which forest

products is 25 billion yen and it is discussing to have a

measure to increase export of forest products by

constructing groups of Japanese groups and Chinese

groups.

This is a part of Forestry Agency‟s strategic project of

doubling local wood supply. Total export value through

September this year reached 12.7 billion yen, which

exceeded last year‟s total export value of 12.3 billion yen.

The total of this year would be about 15 billion yen.

The Council has been working together with Chinese

organizations to test and evaluate basic performance of

Japanese wood and to hold seminars and supply guide

book. Demand in China for Japanese wood is mainly for

concrete forming and supporting bar and structural

materials. For this purpose the main demand is for logs.

September plywood supply

Total plywood supply in September was 495,800 cbms,

2.6% less than the same month a year ago and 7.7% more

than August. Imported plywood volume has declined less

than 300,000 cbms for four consecutive months and the

monthly volume seems to stay low like 270-280,000 cbms

for coming months.

Total imported plywood volume in September was

269,800 cbms, 0.4% less than September last year and

9.1% more than August. Monthly average volume for the

first nine months was 298,600 cbms, 3.2% less than the

same period of last year.

Malaysian volume in September was 115,200 cbms, 12%

less and 16.7% more. The first increase after five months.

First nine months average is 125,300 cbms, 10.4% less

than the same period of last year.

Indonesian supply was 78,800 cbms, 20.9% more and

6.3% more but the monthly average is 87,300 cbms, only

0.4% more.

Chinese volume was 59,800 cbms, 9.1% more and 9.4%

more. Monthly average is 65,600 cbms, 0.2% less. The

supply for the first nine months from three major sources

was 5% less than the same period of last year. September

production of domestic plywood is 226,000 cbms, 5.2%

less than September last year and 6.1% more than August.

Plywood market weak

The domestic softwood plywood market is weakening.

Plywood manufacturers held strong stance since July

through September with stiff prices but as the inventories

climb and demand continues inactive, manufacturers are

not able to hold up any longer and the prices started

edging down.

September production was 210,000 cbms, 5.9% less than

September last year but 5.7% more than August. The

manufacturers announced 15% production curtailment

since July but actual reduction was only 8-9% down

except for August (vacation season).

The shipment was 219,000 cbms, 0.1% less and 13.3%

more. This is a sort of manipulated figure as September is

book closing month so that the trading firms pushed sales

regardless of the demand.

The shipment volume exceeded the production so that the

inventories were 215,400 cbms, 9,000 cbms less than

August. The market has not recovered in November and

the prices continue inching down. Current market prices of

12 mm 3x6 panel in Tokyo market are about 900 yen per

sheet delivered, 20 yen down from August.

Cost of imported plywood soared by weakening yen

despite the same export C&F dollar prices. The importers

are firmly asking higher prices since second week of

November.

The cost of future cargoes, arriving late January and early

February would be about 1,370 yen per sheet FOB truck

port yard for 3x6 JAS concrete forming panel and 1,500

yen for coated concrete forming panel while current

market prices are 1,280 yen and 1,380 yen respectively.

Looking at these high future prices, concrete forming users

immediately started buying low priced items.

|