Japan Wood Products

Prices

Dollar Exchange Rates of

10th November 2014

Japan Yen 114.86

Reports From Japan

Consumption tax increase postponed

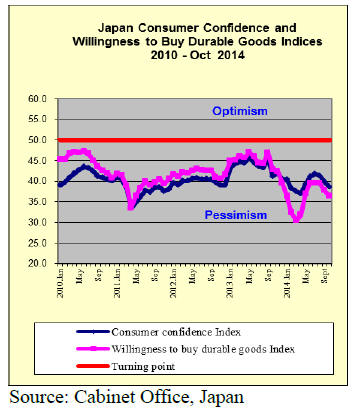

The latest consumer confidence survey released by Japan‟s

Cabinet Office shows the October index falling for a third

straight month.

The overall Sentiment Index for households, which

combines attitudes towards job and prospects for income

growth, also fell in October to the lowest reading since

April this year.

The weak data has resulted in the government deciding to

postpone, for 18 months, the planned additional tax

increase which would have brought the consumption tax to

10% in April 2015.

Trade deficit with China increases by 37 percent.

The trade between Japan and China in the first half of

2014 increased by 4.4% to US$168.4 billion, an increase

from the double-digit declines seen in the same period in

2013.

However, the total level of trade was not as high as in the

first half of 2012. Japan‟s exports to China in the first half

of this year increased by 2.5% to US$78 billion and

imports from China rose by 6.1% to US$90.4 billion.

While imports are recovering to almost the same level as

those of the first half of 2012, the recovery of exports is

sluggish which led to a record deficit of US$12.3 billion,

up over 37% from the first half of 2013.

China‟s share of Japan‟s total international trade in the

first half of 2014 remained much as in 2013 at around

20%. Amongst Japan‟s global trade partners, China

regained its number one trade partner ranking having

slipped into second place in 2013.

For more see:

https://www.jetro.go.jp/en/news/releases/20140822008-

news

Business sentiment indicator remains firm

Orders for new machinery by Japanese manufacturers, a

key indicator of private sector capital expenditure and a

reflection of business sentiment, rose by almost 3% in

September. This was the fourth consecutive monthly

increase but the pace of increase slowed in September.

According to a Cabinet Office survey, the value of

machinery orders received by 280 manufacturers operating

in Japan, including orders from domestic and international

companies, increased by 8.0% in September from the

previous month. For more see:

http://www.esri.cao.go.jp/en/stat/juchu/1409juchu-e.html

Private-sector machinery orders, excluding those for ships

and those from power companies, increased a seasonally

adjusted by 2.9% in September, and showed increase by

5.6% in July-September period. In the October-December

period machinery orders are forecast to increase by 9%.

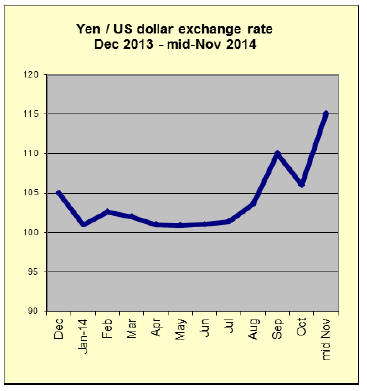

Yen slips to 115 to the dollar, exporters cheer

In response to the surprise announcement from the Bank

of Japan (BoJ) that it would expand its monetary easing

the yen fell sharply lower against the dollar and other

major currencies in mid-November.

Just after the BoJ statement the dollar was at 113.85 to the

yen close to the 114 seen as far back at 2007. Since the

announcement from the Bank the yen has continued to

weaken and on 10 November was at 115.40 to the US

dollar.

While Japanese exporters will benefit from the weaker yen

the impact on the trade deficit will be serious given the

high fuel import bill. Renewed yen weakness prompted

many Japanese exporters to reassess upwards their profit

outlook for the year to end March.

However, smaller companies that rely on imported raw

materials will now find business conditions even tougher.

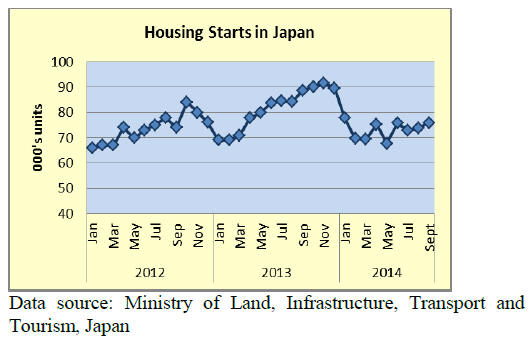

Government to consider quick action to revive home

sales

In the period April to September (i.e. first half of fiscal

2014) housing starts reported by the Ministry of Land,

Infrastructure, Transport and Tourism were down almost

12% from the same period a year earlier.

This has prompted the government to consider quick

action to revive home sales and, through this, the prospects

for the construction and building supply sectors which are

major employers.

To stimulate the housing market two actions are being

considered, bringing back the eco-point system and cutting

interest rates on fixed rate mortgages.

Under the Eco-points programme those building new

houses that meet energy-saving standards (or those

renovating homes for energy saving) earn points which

can be exchanged for consumer goods. It is likely that

these issues will be included in the ruling party‟s

manifesto as it prepares for a snap election.

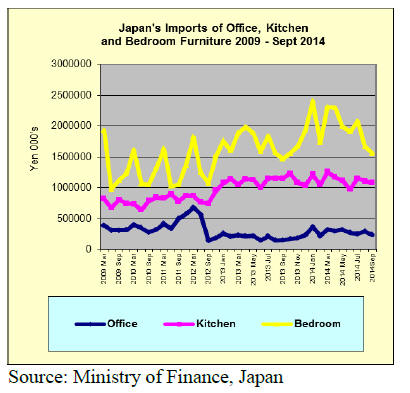

Trends in office, kitchen and bedroom furniture

imports

Japan‟s office, kitchen and bedroom furniture imports

from 2009 to the end of September 2014 are shown below.

The weakening of furniture imports reinforces the view

that consumer sentiment is negative and that the economy

is yet to recover from the consumption tax increase in

April.

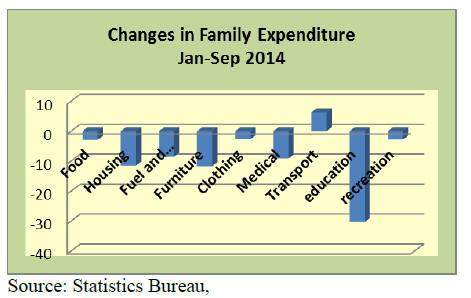

Households cut back on buying furniture

Between January and September Japanese households

have reigned in personal consumption. The latest Family

Income and Expenditure Survey reported by Japan‟s

Statistics Bureau shows average monthly income per

household stood at yen 421,809, down 6.0% in real terms

from the previous year.

Surprisingly, expenditure on education was sharply down

mainly as families cut back their children‟s extracurricular

activities. Expenditure on furniture was also

down over 10%.

See more at:

http://www.stat.go.jp/english/data/kakei/156.htm

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese

market.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.ph

p?id=7

JLR text -

SGEC prepares mutual recognition with PEFC

SGEC (Sustainable Green Ecosystem Council) is the

original forest certification system of Japan. It has been

preparing to have mutual recognition with PEFC (Program

for the Endorsement of Forest Certification Schemes), the

world largest forest certification system.

SGEC has been making revised plan of SGEC‟s

management and administration system and guideline for

certification, which are necessary for mutual recognition.

On October 16, it disclosed the content for public

comment for 60 days. After this period, SGEC will apply

for admission and hopes to start mutual recognition in

2016.

PEFC‟s chairmen will visit Tokyo in this month and will

hold the forum to commemorate SEGC‟s participation to

PEFC.

PEFC approved forest certification system of the U.S.A.,

Canada and Russia. In Asia, Malaysia has already done

mutual approval with PEFC then China started in January

this year.

Indonesia will be approved in November. SGEC joined

PEFC in last June as the first step for mutual recognition.

SGEC started in 2003 so it has built up enough base for

the system.

Ranking of wood based house builders

In 2013, housing companies enjoyed expanded demand

before the consumption tax increase. In 2014, new

housing starts are dropping and house builders are

aggressively developing renovation orders of used houses

and orders of non-residential buildings and rental multifamily

units.

Hajime Kensetsu is the top builder with 11,265 with

45.8% growth then Sekisui House built 5,066 units, 19.8%

increase. Its model of Shawood has high reputation. Touei

Housing had 4,329, 10.3% increase.

For wood based units built for sale and multi dwelling

complex like apartment, Hajime Kensetsu, Touei Housing

and Polus Group had large growth while Iida Home and

Tact Home declined in number.

August plywood supply

The demand has been dull and slow after May but the

manufacturers adamantly stuck to firm prices by

production curtailment so that the market had been

holding steady through September.

In demand slow market, small manufacturers started

selling with lower prices, which results in difference of

on-hand inventories. Large manufacturers‟ inventories are

getting close to one month so they are not able to hold up

any longer and started accepting lower offers.

Total plywood supply in August was 460,300 cbms,

10.7% less than August last year and 11.6% less than July,

which is the lowest monthly supply since October 2011.

In particular, imported plywood decreased by about 40 M

cbms compared to July and production curtailment by

domestic plywood plants also influenced total supply.

Total imports in August are 247,300 cbms, 13.4% less and

15% less. This is fourth straight months decline and the

lowest level in three years. Average monthly arrivals for

the first eight months are 302,200 cbms, 3.5% less than the

same period of last year.

Malaysian supply had declined for four straight months

and the August arrivals of 98,700 cbms are the lowest

monthly arrivals in this year. This is the lowest since

October 2011.Monthly average supply for the first eight

months is 126,500 cbms, 10.2% less than the same period

of last year.

Indonesian supply also dropped by about 20 M cbms from

July. 74,100 cbms are the lowest since September 2012

and this is 18.8% less than August last year and 20.7% less

than July. Eight month average is 88,800 cbms, 1.5% less

than the same period of last year.

China‟s supply of 54,700 cbms was 15.7% less and 14.8%

less. Monthly average for eight months is 66,300 cbms,

1.2% less than the same period of last year.

The supply by three major sources for the first eight

months is 5.5% less than last year. The importers estimate

arrivals in September and October would be about 260-

270,000 cbms.

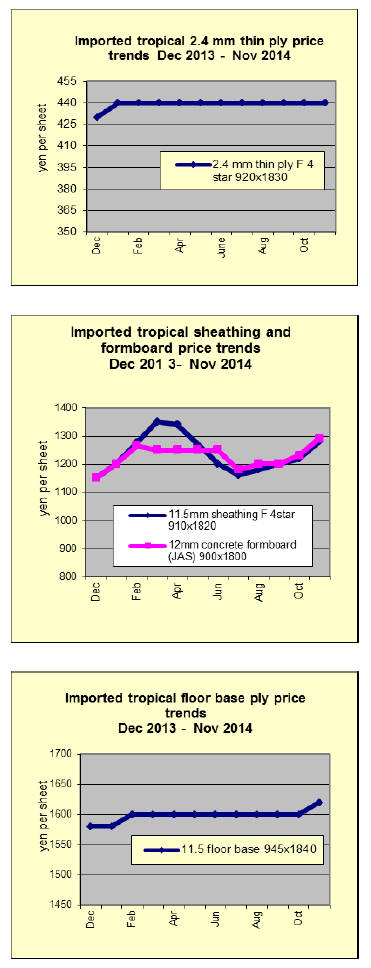

South Sea (tropical) hardwood plywood market

Import volume of South Sea hardwood plywood seems to

stay low though the year and the market finally shows sign

of recovery in small degree.

Because of continuous increase of export prices by the

suppliers, future purchases are limited. August arrivals

were less than 250,000 cbms, the lowest in three years out

of which Malaysian supply was less than 100,000 cbms.

Future contracts dropped considerably after June because

of the gap between suppliers‟ export prices and depressed

Japan market prices.

The market prices plunged since last May by dumping of

the some importers then finally bottomed out in late June.

The gap widened so that importers hardly commit future

purchase in June through August without hope of market

recovery.

ince late August the yen has started dropping against US

dollar so the situation got further difficult.

As a result of decline of future purchase, import volume

after September will be down to 260-270,000 cbms a

month. October offers by the suppliers are US$5-01 up

from September. Arrival cost of JAS 3x6 concrete forming

panel for coating would cost over 1,400 yen per sheet FOB

truck while the market prices now are 1,350 yen per sheet

delivered.

Although the prices are up by 20 yen per sheet compared

to September, they are far from suppliers‟ offer prices.

The supplies say to increase the offer prices further toward

December so future purchase is getting more difficult.

|