|

Report

from

Europe

EU wooden furniture market

This analysis of EU wooden furniture supply draws on

production data from the Eurostat database of manufacturing

statistics and trade data from the Eurostat COMEXT database.

In line with Eurostat practice, all value data is reported in euros.

The data covers all types of wooden furniture with the exception

of kitchens. Kitchen furniture is excluded because it is supplied

almost exclusively by domestic manufacturers and is therefore

less relevant to overseas manufacturers.

In practice, the EU¡¯s kitchen furniture industry has more in

common with the joinery sector than with other parts of the

furniture industry. Note that while all data is ultimately derived

from Eurostat, it has been subject to significant adjustment

during preparation of this report in an effort to remove

numerous inconsistencies.

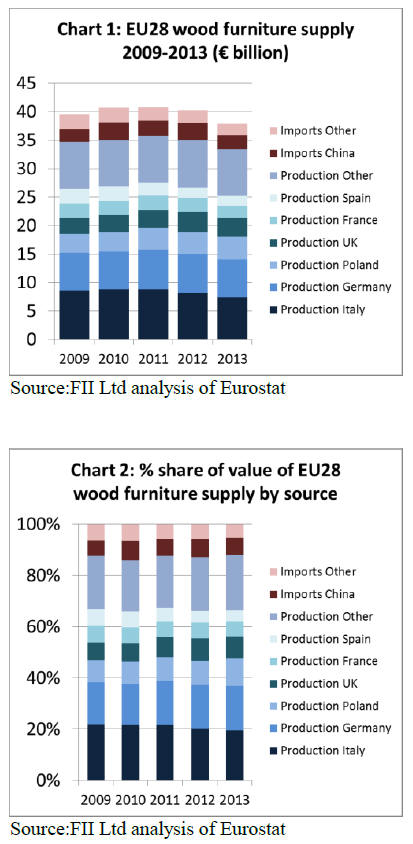

Total supply of wooden furniture into the EU28 market is

estimated to have been €37.9 billion in 2013, down 6%

from €40.3 billion in 2012 (Chart 1). EU28 wooden

furniture production decreased 4% from €46.45 billion to

€45.22 billion between 2012 and 2013.

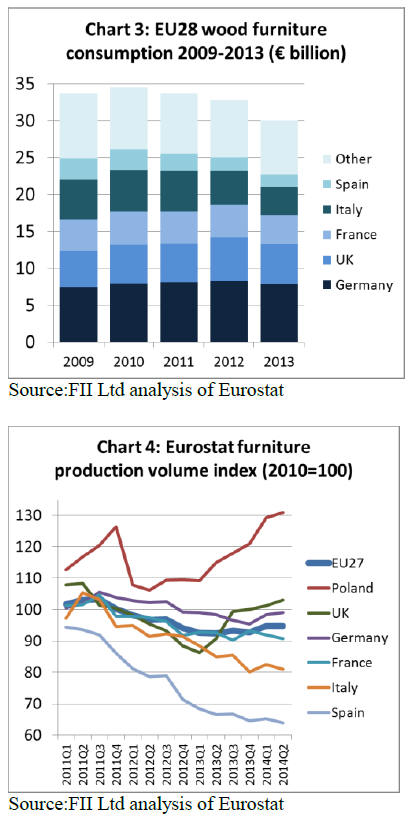

Imports decreased 13% from €5.2 billion to €4.5 billion

during the same period. In 2013, imports accounted for

12% of wooden furniture supply to the EU, down from

13% the previous year and the peak level of 14% recorded

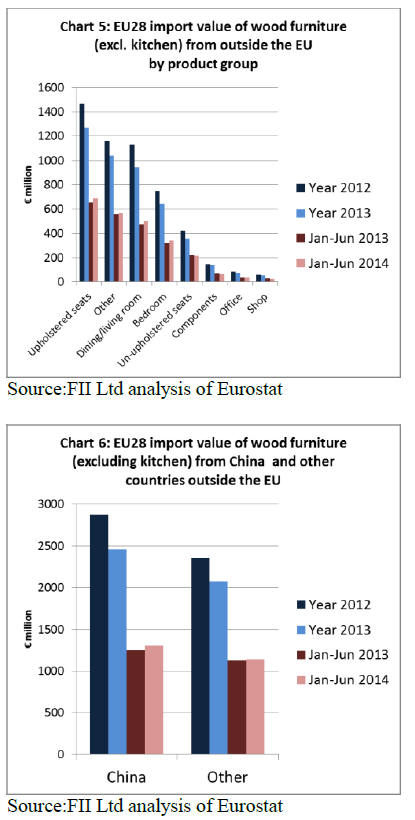

in 2010 (Chart 2). Overall consumption is estimated to

have fallen 8% in 2013 from €32.7 billion to €30.0 billion

(Chart 3).

The Eurostat wooden furniture production index suggests

that the downward trend in EU furniture manufacturing

has levelled off in 2014 (Chart 4). Production has risen

sharply in Poland and the UK since the middle of last year.

After sliding in 2013, production in Germany, Italy and

France stabilised in the first half of 2014. However

production has continued to slide in Spain this year.

Italian wooden furniture production down 8% in 2013

The value of wooden furniture production in Italy is

estimated to have fallen 8% to €7.45 billion in 2013,

continuing the decline of the previous two years. Italian

manufacturers recorded a 1% decrease in export market

sales during 2013, from €4.27 billion to €4.21 billion.

¡¡

Continuing weakness in the Italian domestic furniture

market led to a sharp 9% decline in imports from €702

million to €636 million. Overall wooden furniture

consumption in Italy is estimated to have fallen 15% from

€4.57 billion to €3.88 billion during 2013.

After a year of relative stability in 2012, the German

wooden furniture market declined in 2013. German

wooden furniture production is estimated to have fallen by

5% from €6.91 billion in 2012 to €6.57 billion in 2013,

mainly due to a 6% decrease in domestic market

consumption from €8.27 billion to €7.81 billion in 2013.

Between 2012 and 2013, German wooden furniture

exports decreased 14% from €2.65 billion to €2.28 billion,

while imports decreased 12% from €4.01 billion to €3.52

billion.

Meanwhile Poland, a country which has seen significant

inward investment in furniture production capacity in

recent years, recorded a 7% increase in production value

from €3.81 billion in 2012 to €4.01 billion in 2013. This

reverses a slight decline the previous year.

The rise in production was mainly due to growth in the

local market. Poland‟s domestic consumption of wooden

furniture increased 30% to reach €936 million in 2013, the

highest level for four years.

Poland‟s wooden furniture exports remained stable at

around $3.35 billion in both 2012 and 2013.

Euro value of UK wooden furniture consumption down

8% in 2013

In terms of € value, UK consumption of wooden furniture

recorded an 8% fall from €5.94 billion in 2012 to €5.49

billion in 2013. UK production declined 10% from €3.54

billion in 2012 to €3.18 billion in 2013.

UK exports of wooden furniture decreased 4% from €331

million in 2012 to €318 million in 2013. The value of UK

wooden furniture imports fell 4% from €2.74 billion in

2012 to €2.63 billion in 2013.

These negative numbers for the euro value of consumption

and production in the UK need to be considered in the

light of exchange rate fluctuations. The GBP was on

average around 10% weaker against the euro in 2013

compared to 2012. This depresses the € value of UK

production and trade in 2013 relative to 2012.

The UK government‟s own Index of Production for UK

furniture suggests production measured in GBP fell to a

low in February 2013 but then increased consistently for

the next 18 months.

After a slow year in 2012, French wooden furniture

consumption suffered a further 11% decline to €3.90

billion in 2013. French products also came under

increasing competitive pressure in export markets. Exports

of wooden furniture from France decreased 3% from €688

million in 2012 to €669 million in 2013.

Overall, French wooden furniture production fell 7% from

€2.44 billion in 2012 to 2.27 billion in 2013. Imports of

wooden furniture into France decreased 13% to €2.30

billion in 2013.

Catastrophic collapse of Spanish furniture sector

continues

The catastrophic collapse of Spain‟s wooden furniture

sector continued during 2013. Production fell a further 7%

from €1.83 billion to only €1.70 billion. Concerted efforts

to boost overseas sales led to a 5% increase in exports

from €515 million in 2012 to €541 million in 2013. This

follows a 3% rise in exports the previous year.

However this could not offset a 13% decrease in Spanish

wooden furniture consumption from €1.90 billion in 2012

to €1.64 billion in 2013. Spain‟s imports of wooden

furniture declined 16% from €579 million in 2012 to €485

million in 2013.

In contrast to Spain, wooden furniture production in

Portugal has rebounded quite strongly. Production in

Portugal increased 42% to €682 million between 2011 and

2012, and then gained a further 2% to reach €697 million

in 2013. Portugal‟s domestic market has remained very

weak. Imports into the country fell 16% to €123 million,

while total consumption was down 19% at €294 million in

2013. However, Portugal‟s wooden furniture exports

increased 13% to €527 million in 2013.

Dutch wooden furniture market falls sharply

In the Netherlands, wooden furniture consumption fell

16% to €1.024 billion in 2013. Production in the country

fell 12% to €649 million while imports were down 20% at

€782 million. Weaker demand in neighbouring EU

countries also led to a 19% decline in Dutch wooden

furniture exports to €408 million in 2013.

Wooden furniture consumption and trade were also much

weaker in Belgium last year. Consumption in the country

declined 10% to €811 million, production was down 5% at

€631 million and imports fell 13% to €841 million.

Exports from Belgium were €520 million in 2013, 16%

less than the previous year.

Rise in Romanian wooden furniture production

Wooden furniture production continued to rise in a

number of Eastern European countries during 2013.

Romania is the second largest manufacturer of wooden

furniture in Eastern Europe after Poland. Wooden

furniture production in the country increased 4% to €1.05

billion in 2014.

Romanian exports of wooden furniture were €783 million

in 2013, little changed from the previous year. After a

steep decline in 2012, domestic consumption of wooden

furniture in Romania increased 10% to €382 million in

2013.

However the Romanian furniture sector may face

challenging times ahead. Romania‟s economy is

weakening and there are reports of shortages of wood for

furniture manufacture in the country.

Wooden furniture production in Lithuania increased 3%

from €766 million in 2012 to €788 million, the vast

majority of this being exported. The value of wooden

furniture production in Lithuania has increased by around

65% in the last five years. Following recent investment,

Lithuania is now the fifth largest supplier of products to

the furniture giant IKEA.

Elsewhere in Eastern European during 2013, wooden

furniture production increased 7% to €442 million in

Slovakia and was stable in Czech Republic (€337 million),

Estonia (€224 million), Hungary (€287 million), and

Slovenia (€163 million). Wooden furniture production in

Croatia was €133 million in 2013, a 30% decline

compared to the previous year.

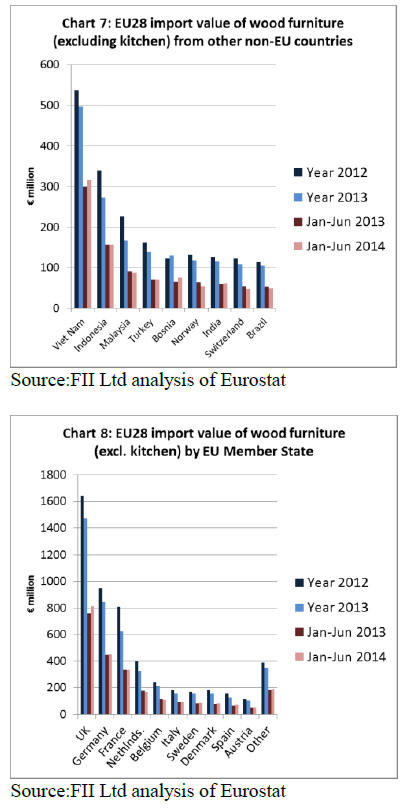

EU wooden furniture imports recover some ground in

2014

Imports of wooden furniture into the EU from outside the

region declined 13% from €5.27 billion in 2012 to €4.53

billion last year. However, the falling trend in imports in

2013 has reversed in 2014. In the first 6 months of 2014,

the EU imported €2.45 billion of wood furniture, 3% more

than the same period in 2013.

These trends are broadly in line with those across the EU

market for wooden furniture which declined in 2013 but is

showing signs of recovery this year.

EU import performance has varied widely by product

group this year (Chart 5). During the first 6 months of

2014, there was a rise in imports of upholstered seats

(+5%), dining/living room furniture (+6%) and of

bedroom furniture (+5%).

However there was a decline in imports of un-upholstered

seats (-2%). EU imports of wooden furniture components

and of shop and office furniture ¨C which already account

for only a tiny share of the market - were also declining.

After falling 14% to €2.46 billion in 2013, EU imports of

wooden furniture from China were €1.31 billion in the

first 6 months of 2014, 5% more than the same period in

2014 (Chart 6). EU imports of wooden furniture from

Vietnam were also up 6% at €316 million in the first half

of 2014 (Chart 7). But imports declined from Indonesia (-

1% to €157 million) and Malaysia (-4% to €87 million)

during the 6 month period.

In the first six months of 2014, imports of wooden

furniture from non-EU countries increased into the UK

(+7% to €813 million), Germany (+1% to €452 million),

Italy (+2% to €91 million), Sweden (+4% to €85 million),

Denmark (+4% to €83 million) and Spain (+14% to 70

million).

Imports from non-EU countries have fallen into France (-

1% to €334 million), Netherlands (-4% to €169 million)

and Belgium (-4% to €111 million).

|