|

Report from

North America

US imports of most major wood products declined in June

following high May imports. The notable exception was

wooden furniture imports which grew by 3% from the

previous month.

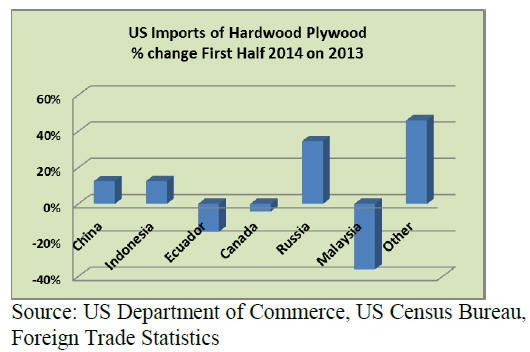

Hardwood plywood imports from China

The US imported 270,487 cu.m of hardwood plywood in

June, 18% less than in the previous month. However, yearto-

date imports were 10% higher than in June 2013.

Hardwood plywood imports from China increased despite

the overall decline in imports. China shipped 170,305

cu.m of plywood in June, up 15% from May. Year-to-date

imports from China were 13% higher than in June 2013

but plywood imports from Indonesia fell to just 23,271

cu.m in June, a decline of 77% from May. On the other

hand, imports from Ecuador fell to15,829 cu.m.

Moulding imports down

The value of hardwood moulding imports declined by

11% from the previous month to USUS$17.4 million in

June. But year-to-date imports are higher than in 2013.

Hardwood moulding imports from China and Brazil

declined in June, while Malaysian shipments increased.

Imports from Canada were stable compared to the

previous month.

June moulding imports from China were worth US$6.0

million, down 12% from May while imports of mouldings

from Brazil declined by 21% to US$4.3 million.

More hardwood flooring from Indonesia

US imports of hardwood flooring were maintained at May

levels (US$2.9 million in June) while assembled flooring

panel imports fell 4% worth US$11.3 million in June.

US imports of assembled flooring panels from China fell

by 14% in June to US$5.0 million while Assembled

flooring panel imports from Canada were unchanged at

US$2.8 million.

In contrast to the weak imports of Assembled Flooring,

hardwood flooring imports from Indonesia increased

significantly in June to US$0.73 million and hardwood

flooring imports from China were worth US$0.58 million,

up 44% from May.

Mexico¡¯s furniture shipments surpass Indonesia and

Malaysia

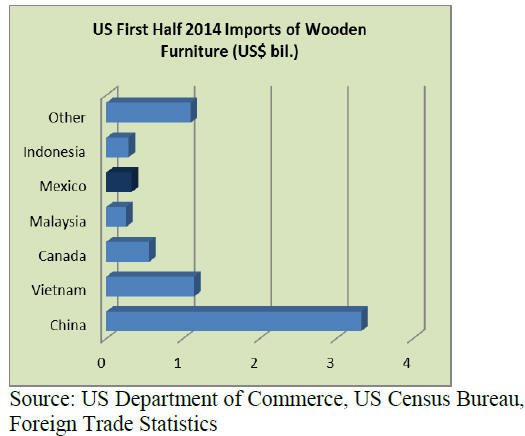

The growth in US wooden furniture imports continued in

June. Total imports were worth US$1.29 billion, up 3%

from May and 11% higher year-to-date than in 2013.

Imports from China increased by 6% in June to US$656.8

million and year-to-date furniture imports from China

were worth US$6.95 billion, up 11% from June 2013.

Furniture imports from Vietnam were worth US$183.6

million, down 11% from May. However, year-to-date

imports from Vietnam were 42% higher than in June 2013.

Canadian furniture shipments to the US increased by 14%

in June to US$103.8 million. Imports from Mexico

declined by 6% in June, but year-to-date imports are

significantly higher than in 2013.

Mexico has surpassed Indonesia and Malaysia to become

the fourth-largest supplier of wooden furniture to the US

after China, Vietnam and Canada.

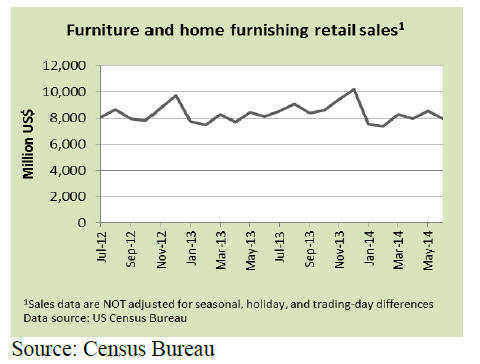

Furniture retail sales slow

While furniture imports increased in June, US retail sales

were down. Retail sales at furniture and home furnishing

stores in the US declined by 7% in June according to the

US Census Bureau. Sales were 2% lower than in June

2013.

Furniture sales (excluding home furnishing) declined by

9% in June compared to a month earlier and were 1%

lower than in June 2013.

Domestic furniture manufacturers increases output

The US manufacturing sector and the overall economy

expanded in July according to survey data from the

Institute for Supply Management. Once more the furniture

manufacturing sector posted the highest growth rate of all

industries. The only industry reporting lower output in

July was the primary wood product manufacturing sector.

Strong second quarter GDP growth

Economic growth accelerated from a dismal -2.1% in the

first quarter of 2014 to +4% in the second quarter

according to the US Department of Commerce. GDP

growth in April, May and June of this year was much

stronger than expected.

The increase in GDP was mainly due to higher personal

expenditure but exports as well as state and local

government spending also grew supporting GDP.

The contribution to GDP from residential and nonresidential

investment is a welcome development for the

timber sector.

Labour market indicators show economy is ¡®fragile¡¯

On the downside, the US unemployment rate was

unchanged in July at 6.2%, according to the Department of

Labor. Several labour market indicators show that the US

economy is still fragile. Average hourly earnings are only

2% higher than last year and below the rate of inflation.

The number of Americans working in part-time jobs who

would prefer a full-time job is almost twice as high as in

2007.

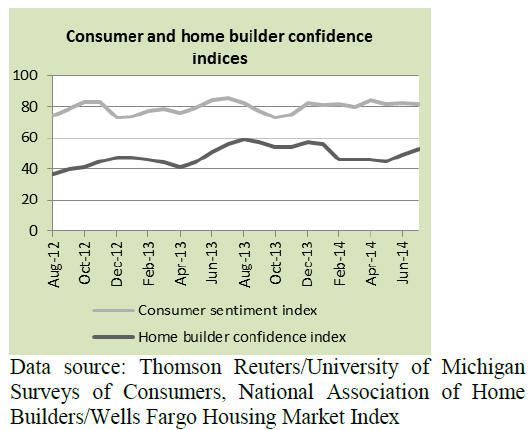

Consumer confidence falls but home builders more

confident

Consumers remain skeptical about economic growth this

year. Consumer confidence in the US economy fell in July

and it was 3.9% lower than in July 2013, according to the

Thomson Reuters/University of Michigan consumer

sentiment index.

A positive sign is that most consumers reported a recent

increase in income. Higher incomes support more

favourable buying plans for durable household items such

as furniture.

The housing market had a negative effect on consumer

confidence. Growth in home prices slowed, while inflation

increased slightly. Both factors contributed to a more

negative outlook by home owners.

The US Builders‟ Confidence Index increased to 54 points

in July, an index of over 50 means that more builders view

market conditions as good rather than poor. It is the first

time since January that the index is above 50.

Confidence in the market for newly built single-family

homes grew in all four regions of the country. The

strongest growth was in the West but housing construction

fell in the south of the US where construction of both

single and multi-family homes declined. Overall, housing

starts fell by 9.3% to 893,000 units at a seasonally

adjusted annual rate.

The decline was entirely due to a drop in construction in

the US South. All other regions of the country saw an

increase in the number of housing starts.

Soft landing for Canadian housing market, energy

exports driving economy

Canadian housing starts increased slightly in June to

199,000 at a seasonally adjusted annual rate. The

Canadian Housing and Mortgage Corporation anticipate a

soft landing of the Canadian housing market with slightly

lower starts in 2014 compared to the previous year.

The Canadian unemployment rate declined by 0.1 percent

in July to 7.0%. Canada‟s job growth has mainly been in

Alberta, where oil and gas production drive the economy.

Canada‟s exports of non-energy products remain weak and

the Central Bank kept interest rates near zero.

Higher prices forecast for softwood mouldings

In 2013, US consumption of pine and other softwood

mouldings increased by 12% according to a market study

released in August by International Wood Markets Group

(U.S. Clear Pine Lumber and Moulding Market Outlook:

2014- 2018). The US market for softwood mouldings is

largely driven by new home construction and home repair

and remodelling.

For 2014, the market study forecasts a 4% increase in

moulding demand. The relatively low growth is the result

of the slow recovery in new home construction. Mouldings

consumption is projected to grow faster from 2015 to 2018

because of an overall positive outlook for the US

economy.

The availability of clear pine grown in the US is much

lower than twenty years ago. As a result, the US millwork

industry (including moulding manufacturers) relies heavily

on imported sawnwood from pine plantations in Chile,

New Zealand and Brazil.

The market share of moulding imports is expected to

grow. In 2013, imported mouldings accounted for 40% of

total consumption. Softwood moulding imports almost

doubled between 2009 and 2013.

The value of moulding imports was US$693 million in

2013. Pine mouldings from Brazil and Chile dominate

imports but imports from China have grown significantly

and China is now the US‟ fourth-largest supplier of

softwood mouldings.

Solid pine mouldings are losing market share to hardwood

moulding, plastic and paint-grade mouldings made from

MDF or finger-jointed pine. Relatively few producers

supply the US softwood moulding market and the market

study predicts a rise in prices as US demand grows in the

next four years.

Residential window and door market outlook

The US market for residential windows is expected to

grow by 9.1% in 2014 and by 8.3% in 2015. Market

growth in 2013 was 10%. The Window and Door

Manufacturers Association released these forecasts in the

Window and Entry Door 2014 US Market Study.

An estimated 44.5 million residential windows were sold

in 2013. The leading window materials were vinyl (69%)

and wood-clad (20%).

The growth in demand for entry (front) doors is lower than

for windows. 14.1 million residential exterior doors were

shipped in 2013, 5.3% more than in 2012. For 2014 and

2015 the market for entry doors is forecast to grow by

5.1% and 4.8%, respectively.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

|