Japan Wood Products

Prices

Dollar Exchange Rates of

11th August 2014

Japan Yen 102.2

Reports From Japan

Japan’s GDP drops as expected

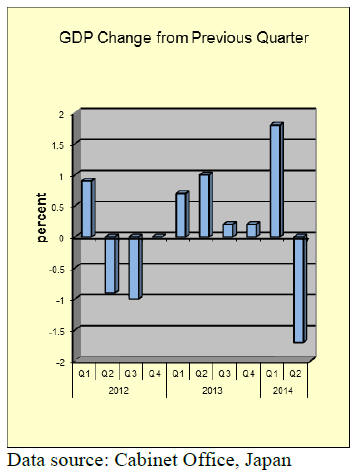

Gross Domestic Product (GDP) in Japan contracted 1.70

percent in the second quarter of 2014 over the previous

quarter, the steepest drop since the 2011 earthquake.

The decline in GDP was much as anticipated since

economic activity suffered a set-back after the

consumption tax rise in April this year.

Analysts now expect swift action by the Bank of Japan to

provide an additional boost to the economy.

Consumer confidence index holds onto recent gains

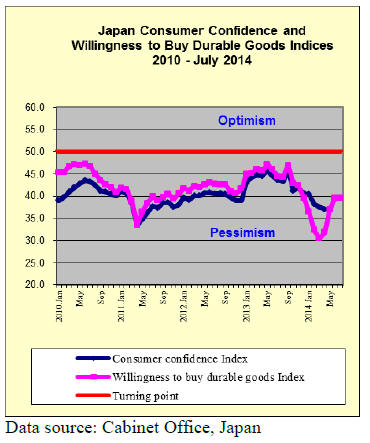

The latest consumer confidence survey was conducted on

15 July and Japan‟s Cabinet Office has just released the

results which show the index rose 0.4 point to 41.5, the

third monthly increase.

However the pace of increase slowed compared to the

previous month and was below levels for the same month

a year earlier.

Those surveyed were slightly more optimistic on the

prospects for the economy on three of the four categories

in the survey - overall economic well-being, income

growth and job prospects, but the sub-index on time to buy

durable goods remained unchanged.

Machinery orders signal slow economic recovery

Details of machinery orders, a key indicator of capital

spending by Japanese companies, has been released by the

Cabinet Office.

See:

http://www.esri.cao.go.jp/en/stat/juchu/juchu-e.html

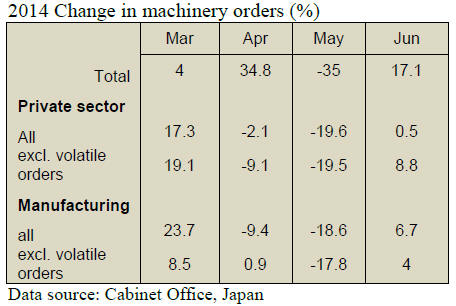

For the first time in three months machinery orders rose in

June after a steep fall in May. But with export growth

remaining weak and with subdued industrial output and

consumer spending the short-term outlook for the Japanese

economy is of concern especially coming on the heels of

the fall in GDP growth for the second quarter.

June 2014 machinery orders rose only 8.8% following a

record 20% fall in May however the consensus is that the

economy will resume a moderate recovery in the third

quarter.

June housing starts – better than forecast

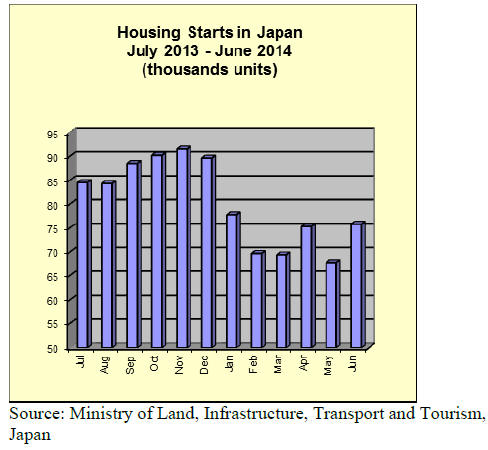

June housing starts data from Japan‟s Ministry of Land,

Infrastructure and Transport show that, while there was an

improvement over levels in the previous month, year-onyear

starts are around 9% down.

However, many analysts had expected figures somewhere

in the region of minus 12%.

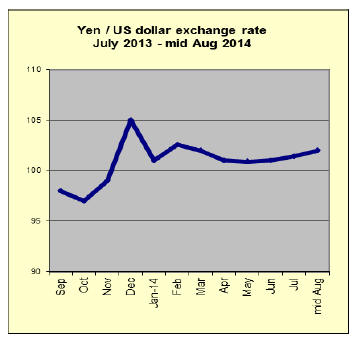

Yen strengthens but then falls back

At its latest meeting the Bank of Japan (BoJ) maintained

its stance and kept monetary policy unchanged saying it

will continue its yen 60-70 trillion annual asset buying but

it did warn of the risks from declining exports and slowing

industrial output.

The impact of the BoJ assessment of the economy and its

response was largely expected so there was not much

impact on the yen which has been trading in a narrow band

all year. The greatest impact has come from investors

seeking a safe haven in response to fighting in Ukraine

and Gaza which lifted the yen at the beginning of the

month.

One worrying piece of information from the BoJ was that,

on an annual basis, housing loans in Japan rose 2.7% in

the second quarter compared to a rise of 2.9% recorded in

the preceding quarter.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

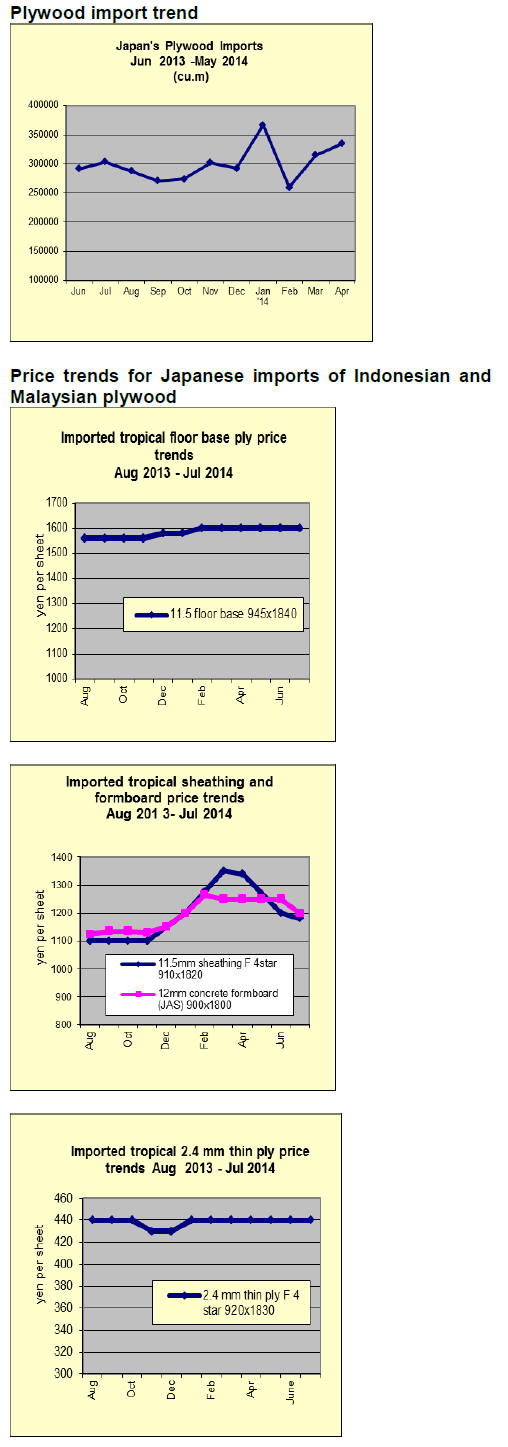

Imported South Sea (tropical) hardwood plywood

The largest supplier in Malaysia announced price hike

since July on 12 mm concrete forming panel. Malaysian

suppliers are all bullish since log prices stay up high even

in full logging season.

In Japan, the market has been slackening with slower

demand but facing strong supply side proposals, the

importers and wholesalers have started stopping

underselling.

In Sarawak, Malaysia, dry weather continues and water

level in rivers dropped, which hampers log transportation.

By limited log supply and India‟s aggressive purchase

after Myanmar banned log export, log prices stay up high

so local plywood mills have to pay high log prices. Then

Islamic fast for a month in late June and Islamic New Year

in late July slowed log production.

The largest supplier proposed $15 per cbm price increase

for July shipment. In late June, the export prices of

concrete forming panel was unchanged at about $560-565

per cbm C&F.

Other plywood suppliers in Malaysia have the same high

log price problem so their proposal is high with less offer

volume. Indonesian concrete forming panel suppliers

enjoy robust orders from the Middle East so they would

not listen to weak Japan prices.

In Japan, with slow shipments, port inventories are still

high but future arrivals will decline so the marketers see

that the supply and demand are estimated to balance out

probably in September. Since the importers have curtailed

future purchases, they need to start purchasing cargoes of

September and on.

South Sea (tropical) logs

After Myanmar stopped log export, India had to increase

log purchase from Malaysia, particularly hardwood

species like keruing and kapur, for plywood mills. India‟s

domestic demand is getting strong and at the same time,

their currency is getting strong so their purchase is more

powerful and vigorous now.

Export prices of keruing and kapur for plywood climbed

by $20-30 in recent weeks. Prices of other species are also

pushed up by $5-10. Meranti regular prices for Japan

market is edging up to US$290-295 per cbm C&F.

Log importers in Japan are tired of rising prices since the

demand in Japan is stagnant and it is difficult to cover the

higher cost. MLH log prices for crating are US$195-200,

US$5-10 higher than last month.

In PNG and Solomon Islands, weather continues foul with

continuous rain so the log production is slow and there are

many ships waiting for logs. Chinese buyers are asking to

reduce log prices since log prices are dropping in China.

Acceptance of foreign workers

The Ministry of Land, Infrastructure and Transport made a

public notification for acceptance of foreign labor.

Specifically, as an emergency measures to have foreign

workers in construction field, it shows specific

requirement for accepting construction companies and

administration groups.

The Ministry will invite public comments until July 25

then it will be officially announced in early August and it

will go into effect in April 2015. This is measures with

limited period to deal with increasing construction works

for next Olympic Games in 2020. This makes it possible to

accept experienced foreign workers smoothly.

Accepting number is up to total regular workers of

accepting companies have and wage must be more than

the Japanese workers with the same skill.

Trends in wood drying

There is growing demand for dried wood for construction

since dried wood has clear strength performance with less

cracking and curving after applied in building. According

to the Ministry of Agriculture, Forestry and Fisheries,

lumber shipment in 2013 was 10,100,000 cbms, 8.6%

more than 2012.

Building materials and engineering works construction

materials, which takes 80% of lumber shipment, increased

by more than 10%. Meantime, that for furniture, fittings,

crating and boxing dropped little from previous year.

In this, shipment of kiln dried lumber was 2,984,000 cbms,

8.7% more and the share of KD lumber was 29.54% from

29.49% in 2012.

Back in 2002, share of kiln dried lumber was only 12.4%

so in last ten years, it grew by 17.1 points to almost

30%.The largest reason is high housing starts in 2013,

10.6% more than 2012 so total wood demand increased.

Also the government set a target of achieving 50% of

wood self-sufficiency rate by 2020 and large house

builders promoted using domestic species and preferred

using kiln dried lumber.

Another topic of wood drying is drying large size lumber,

laminated lumber and CLT since there are increasing

number of large wooden buildings. Also with increasing

number of biomass power generation facilities in relation

to FIT system, drying wood chip quickly and

economically becomes important issue from now on.

By type of energy source for drying, steam is the most

popular then gas burning. Hot water and electric follow.

Size of chamber is becoming larger as more drying

demand for lamina and stud is increasing.

|