2. GHANA

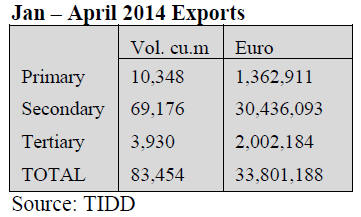

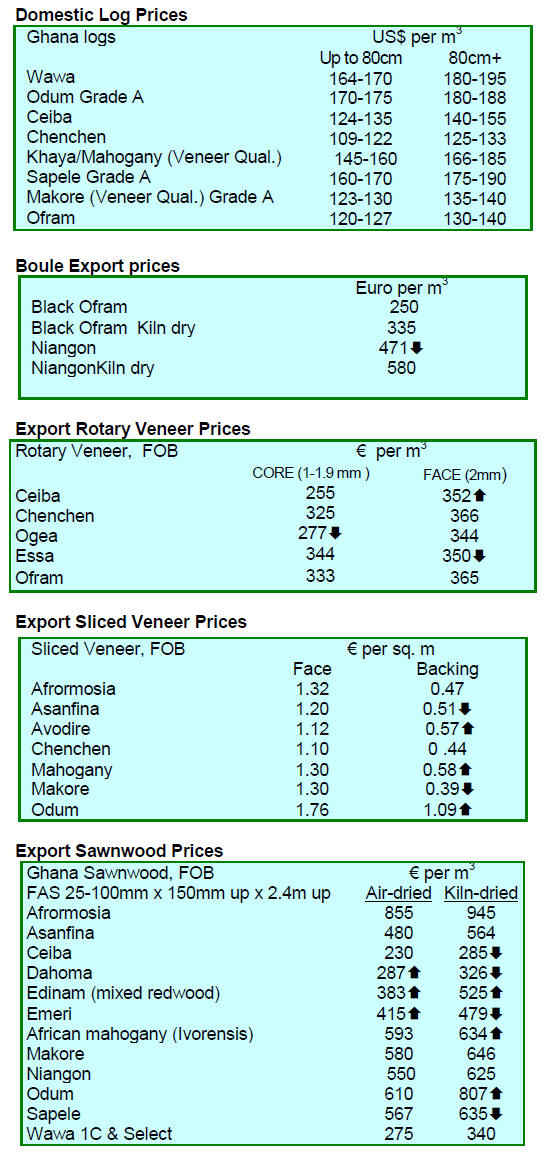

Export earnings fall

Ghana‟s exported less secondary and tertiary wood

products (TWPs) during the first four-months of 2014,

compared to the same period last year.

During that period export earnings totalled euro 33.80

million from the export of 83,454 cubic metres of wood

products, a 20% drop in volume and a nearly 8% decline

in value.

As a share of total exports, secondary wood products

(primarily sawnwood) accounted for 83% in the first four

months of this year as against 90% in the same period in

2013.

The decline in the export of SWPs can be attributed

to

lower sales of sawnwood, veneer and plywood. There

were also weaker sales of dowels, flooring, mouldings and

furniture parts.

The respective market shares of Europe, Africa and Asia

were 40%, 31% and 14% with the balance to the United

States, Middle East and Oceania.

Wood processing set to get more government support

The Ghana office of the World Bank, in collaboration with

the Ministry of Trade and Industry, recently organised a

workshop to engage stakeholders on how best to harness

the complexities of the technological era for the growth of

the manufacturing sector in order to boost

competitiveness.

Addressing the workshop, the Bank country director

Yusupha B. Crookes commended Ghana for achieving

rapid improvements in the business climate. He said

Ghana had a good ranking in the assessment of „ease of

doing business¡±. It is this that has helped attract foreign

investors into the country.

Mr Kofi Afresah Nuhu, Director in Charge of

Manufacturing at the Ministry of Trade and Industry,

disclosed the government is to further improve the

manufacturing and agricultural sectors and has identified

agro-processing, pharmaceutical, plastics and wood

processing for special attention.

In a related development, U.S-based Frontiers Strategy

Group has ranked Ghana as the 4th most preferred

investment destination on the continent after Angola,

Kenya and Nigeria.

Utility prices set to rise again

The Public Utility Regulatory Commission (PURC), the

utility regulator, has announced increases in water and

electricity tariffs.

In a statement the PURC said, effective 1 July 2014, water

and electricity tariffs will go up by 6.1% and 12.9%

respectively.

Long before the increase, manufacturers, including timber

companies, complained of high operating cost due to the

ever rising prices for energy.

The recent power load shedding has also affected the

operational cost of these companies and huge sums are

being spent on fuel to run power generators to keep mills

operational.

Government jobs to be cut

Ghana plans to reduce its public sector wage bill to 35% of

government revenue in three years as part of a plan to

restore macroeconomic stability according to Casie Ato

Forson a deputy finance minister. The public sector wage

bill accounts for around 70% of government expenditure.

3. MALAYSIA

South Korea re-introduces anti-dumping

duties

The South Korean Trade Commission has decided to

extend anti-dumping duties on Malaysian plywood.

The country will impose anti-dumping duties from 3.08-

38.1 % on Malaysian plywood for the next three years.

This decision comes after a three-month review of

business practices by importers and suppliers of plywood.

Beginning in February 2011 South Korea levied antidumping

duties from 5.12-38.1% on Malaysian plywood

but this measure expired at the end of January 2014.

The South Korean news agency, Yonhap, has reported that

Korean manufacturers had requested an extension of the

anti-dumping duties as early as July 2013.

Last year, South Korea‟s plywood market was worth

almost won 800 billion (approx. US$780 million). Local

manufacturers satisfy around 25% of the domestic

demand.

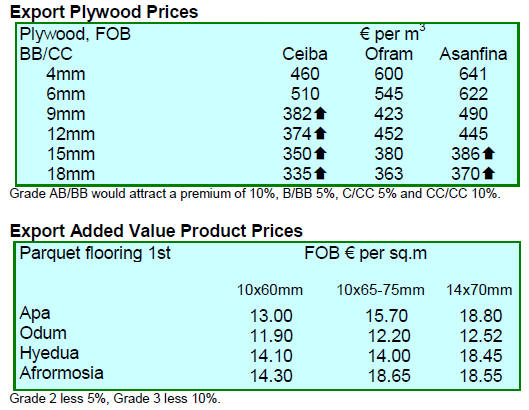

Latest exports of certified timber

Statistics on Malaysia‟s exports of MTCC certified wood

products in the final quarter of 2013 have recently been

published.

The top ten importers accounted for over 90% of imports

with the bulk going to EU markets. Markets in the Middle

East and N. Africa accounted for around 11% of all fourth

quarter 2013 exports of certified wood products.

The main products were sawnwood 28,064 cu.m, plywood

12,988 cu.m and mouldings 5512 cu.m .

Disbelief in ¡®temporary¡¯ acceptance of MTCC in

Netherlands

A press release from the Malaysian Timber Certification

Council (MTCC) captioned „Relief and Disbelief in

Malaysia on MTCS-Acceptance‟ addresses a decision by

the government in Netherlands on Malaysia‟s PEFCendorsed

Malaysian Timber Certification Scheme

(MTCS).

The press release reads: ¡°The Malaysian Timber

Certification Council (MTCC) welcomes the long overdue

acceptance of the already PEFC-endorsed Malaysian

Timber Certification Scheme (MTCS) under the Dutch

government‟s public procurement policy for timber.

This decision allows the timber and construction industry

in the Netherlands to use PEFC-certified timber under the

MTCS for Dutch public procurement projects.

There is however also disbelief that the acceptance by the

Dutch government is only temporary, in spite of the

intended full acceptance agreed upon three years ago¡±.

Yong Teng Koon, CEO of MTCC writes: ¡°We are

relieved that the Malaysian efforts in the field of

sustainable forest management opens the Dutch

government market for MTCS certified timber. However,

we are also concerned that our timber will be treated as

less sustainable.¡±

The Netherlands Ministry for Infrastructure and the

Environment classifies MTCS as „not fully meeting the

country‟s Timber Procurement Assessment System

(TPAS)‟, thereby continuing to show differential treatment

for the MTCS‟‟.

For more see:

http://www.mtcc.com.my/news-items/relief-and-disbeliefin-

malaysia-on-mtcs-acceptance

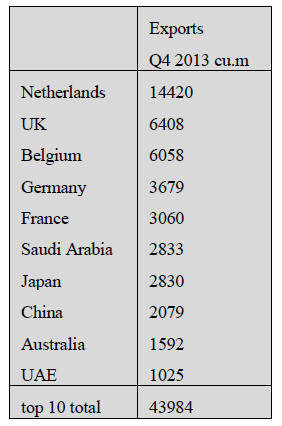

Long dry season could disrupt river transportation

The current dry season in Malaysia is rather extreme and

experts say it could last until August.

Loggers in Sarawak, who produce most of the logs in

Malaysia, are not unduly worried at present as the dry

weather is helpful for forest operations. However, if the

dry spell lasts too long and water levels in the rivers fall

too low rafting of logs will be disrupted.

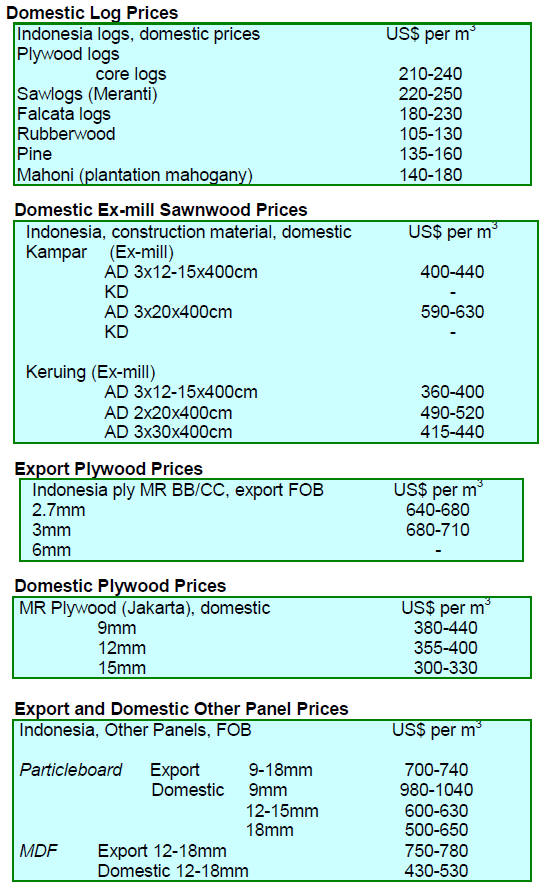

4. INDONESIA

Multi-Stakeholder Forestry Programme

extended

The third phase of the Multi-Stakeholder Forestry

Programme (MFP3) has been officially launched by the

Secretary General of the Ministry of Forestry, Dr. Ir. Hadi

Daryanto, D.E.A. This programme is to improve forest

governance and development through sustainable forest

management and the legal trade in wood products.

The outputs of MFP3 in the period 2014-2017 focus on

three issues:

Application of Indonesia‟s timber legality

verification system (TLAS/SVLK) in the

upstream and downstream wood processing

sectors to ensure the sustainable export of legal

timber products to the world markets.

Support to regional governments and

communities on business development in

community-based forest management.

Facilitating and enabling any mechanism to

ensure that communities have access to forests

and forest resources.

For more see:

http://www.dephut.go.id/uploads/files/6f6944f98495d5e69

2845c29fc9d4e22.pdf

Smoke haze spreading ¨C the perennial problem

The National Disaster Mitigation Agency (BNPB) has

issued a warning that thick haze could cover several

regions in Sumatra, especially Riau, due to several large

forest fires spotted on the island.

Sutopo Purwo Yuwono of the BNPB said that haze was

already building up in several regions in Riau such as

Rengat, Pelalawan, Dumai and Pekanbaru and that 250

hotspots had been spotted in Riau alone. At present

visibility ranges from three to eight kilometers in the

affected areas.

In related news, Singapore has offered to provide

assistance to Indonesia and Malaysia to fight possible land

and forest fires and to prevent the ensuing haze.

On offer is one C-130 aircraft for cloud-seeding

operations; two C-130 aircraft to ferry fire-fighting teams

from Singapore; a team to provide assessment and

planning of fire-fighting efforts and high-resolution

satellite pictures and hot spot coordinates.

Bio-mass alternative energy

The Bogor Institute of Agriculture (IPB) has concluded a

study to examine a bio-mass alternative to coal. Yanto

Santosa, a professor of ecology at IPB says the four plants

assessed were red calliandra, Gliricidia, white lead tree

(Leucaena leucocephala) and ear tree Enterolobium

cyclocarpum,.

The study found that pellets produced from these plants

could generate heat of around 4,600 to 4,700 calories per

kilogram. Calliandra (Calliandra callothyrsus) was the

most promising due to its fast growth rate and high

productivity.

Daru Asycarya, who supervises the project says it has

attracted the interest of several bio-mass users including

one from South Korea. Daru says the pilot pellet plant is

still in the testing stage and before entering commercial

production there is a need ensure that top quality products

can be produced.

5. MYANMAR

Life gone from log market

According to the Myanma Timber Enterprise (MTE) about

5,000 Hoppus tons (h.tons) of teak, tamalan and other

hardwoods was sold by open tender at the end of June.

About 1,700 h.tons comprising teak logs 321 h. tons; teak

sawnwood 289 tons; padauk and tamalan logs 439 h. tons;

kanyin logs 274 tons and other rough sawn or hewn timber

416 tons were sold by open tender at the MTE

headquarters.

Another 1300 h. tons of teak logs; 2550 h. tons hardwood

logs; 7 tons of tamalan hewn-timber and 83 tons of teak

sawn timber was sold by the office of the local marketing

and milling department of MTE.

Analysts say demand is very slow in the international

markets. The open tenders, which now only attract buyers

from domestic mills, are held only once, or at most twice,

a month. Before the log export ban the country was alive

with private traders but now it is very quiet.

Wood smuggling from Kachin

According to a study published by retired professor of

Botany, Nyo Maung, there is an active trade in illegal logs

from the Eimawboon Mountain in Kachin. The

Eimawboon forest reserve bordering China is located in

northeastern Kachin State and covers an area of 250,000

hectares.

Outlook for Myanmar¡¯s economy

Myanmar‟s economy is forecast to grow 8.5 percent

during the current fiscal year mainly due to rising gas

production and investment says the International Monetary

Fund (IMF). In January 2014, the IMF forecast 7.7 percent

growth during the fiscal year that ends March 2015.

The fund left unchanged its forecast that inflation during

the fiscal year will be 6.5 percent.

The IMF, which set up a monitoring programme in

Myanmar in 2013, said it intends to expand technical

assistance and training. The Fund expects expanded

foreign investment in manufacturing, telecommunications

and natural resources.

EIA says padauk and tamalan on the verge of

extinction

Myanmar‟s tamalan and padauk are disappearing at an

extremely rapid pace as traders have been targeting these

high valued timbers. The Environmental Investigation

Agency (EIA) is warning that, at current rates of cutting,

the species could be logged to extinction in Myanmar

within as little as three years.

EIA research of Chinese trade data found that imports of

tamalan (also known as Burmese tulipwood) and

Myanmar padauk has dramatically increased in recent

years.

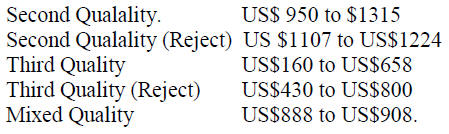

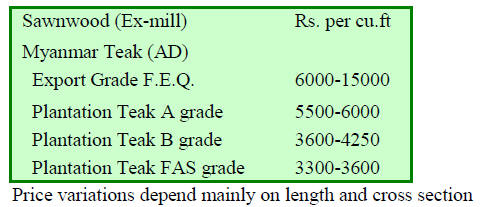

June tender prices

The results of the open tender sales made by Myanma

Timber Enterprise (MTE) held on 27 June 2014 are shown

below:

Sales of teak from MTE sawmills

MTE also sold 70 tons of various sizes of teak scantlings

by open tender.

The grades are mentioned as Second, Second Reject, Third

and Mixed. Sizes vary from 0.5 inches thickness to 5

inches; 1 to 7 inches in width and 1.5 to14 feet in length.

The total quantity sold was 70 tons and the value earned

was reported to be around US$ 35,000.

6.

INDIA

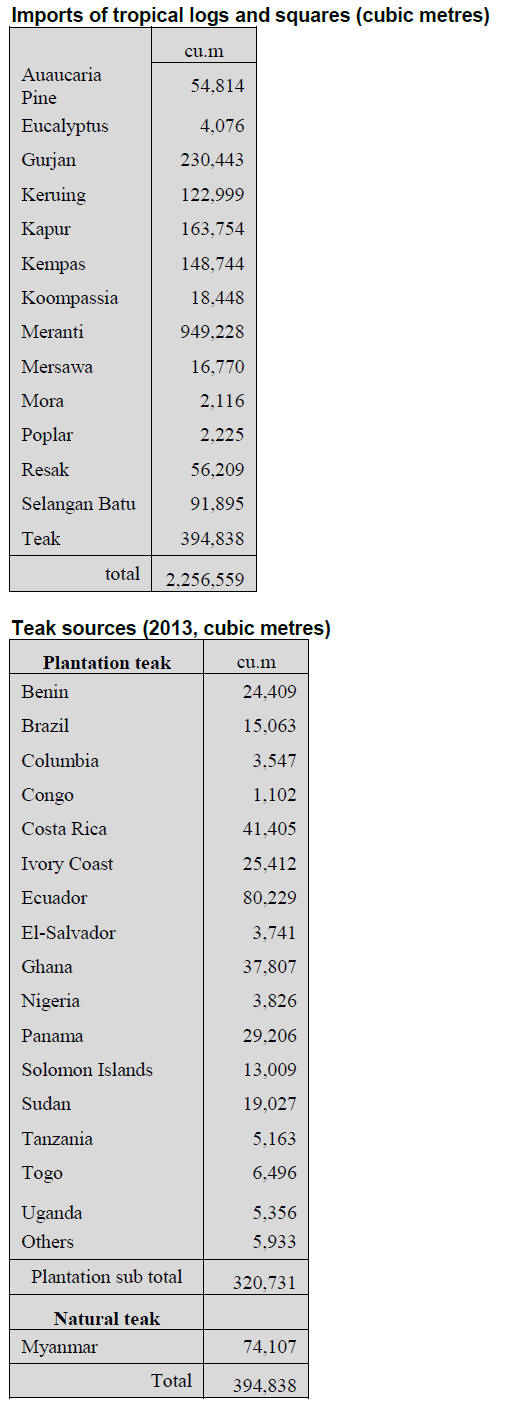

Import data reflect weak rupee

During the 2013-14 financial year wood product imports

(hardwoods and softwoods) through Kandla Port totalled

3,925,555 cubic metres against the 4,354,300 cubic metres

imported in the previous financial year.

Kandla Port handles around 50% of India‟s entire wood

product imports. The main reason for the decline in

imports was the weak rupee for most of the year.

Plantation teak imports 4 times that of natural

teak

2013 imports of natural forest teak from Myanmar totalled

74,107 cu.m and imports of plantation teak totalled

320,731 cu.m.

The log export ban in Myanmar has created a market

opportunity for suppliers of plantation teak to expand sales

to India and importers are urging plantation teak suppliers

to improve plantation tending and management techniques

to produce higher quality logs.

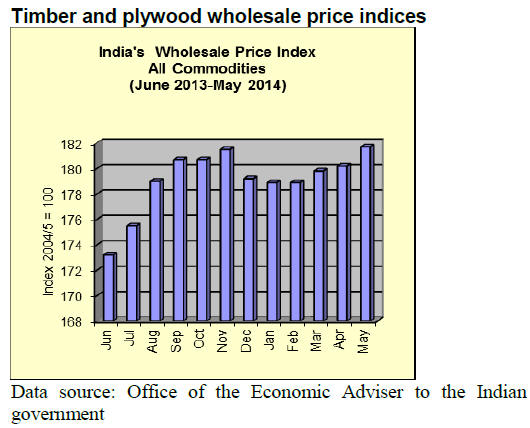

Inflation at 5 month high

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

Inflation in India jumped to a five-month high in May. The

cost of food was up 2.3 percent in May year on year while

energy costs rose around half a percent over the same

period. Forecasts are for a drier than usual monsoon which

could push food prices even higher.

See

http://eaindustry.nic.in/cmonthly.pdf

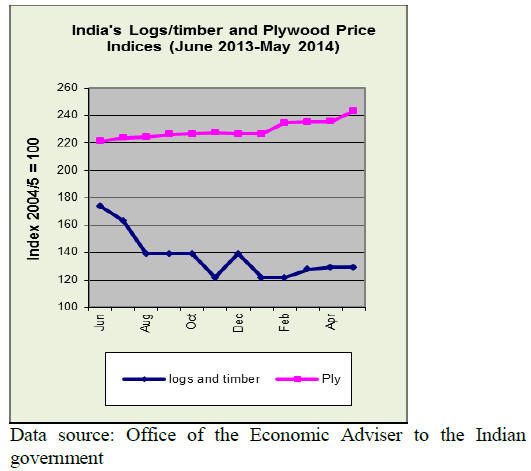

The OEA reports Wholesale Price Indices for a

variety of

wood products. The Wholesale Price Indices for

Logs/timber and Plywood are shown below. The May

2014 logs/timber index has remained fairly flat for the past

months in contrast to the index for plywood which has

steadily increased from the beginning of the year.

Prices for imported plantation teak

Over the past two weeks the rupee has weakened against

the US dollar mainly due to the conflict in Iraq and the

impact this is having on oil prices. Because of the rupee

weakness Indian importers are on the side-lines hoping the

rupee weakness is a short term problem.

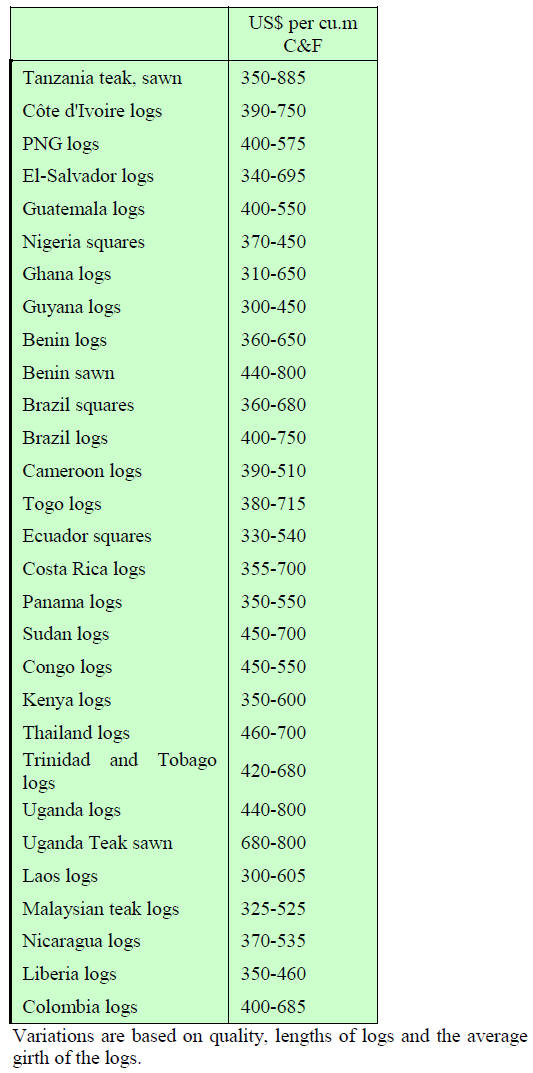

Current C & F prices for imported plantation teak, Indian

ports per cubic metre are shown below.

Domestic prices for sawnwood

Demand for imported non-teak tropical sawnwood is

steadily improving and hardwoods from Latin America are

appearing in the market.

The log market in India is slowly adjusting to the log

export ban in Myanmar, previously a major source of logs

for India.

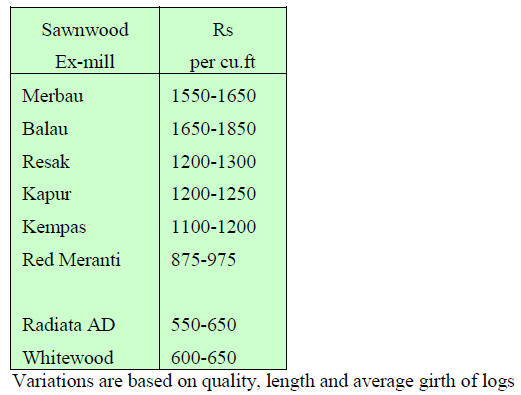

Prices for air dry sawnwood per cubic foot,

ex-sawmill are

shown below.

Myanmar teak processed in India

Importers have high stocks of Myanmar teak and analysts

suggest there is sufficient in India to satisfy demand for a

few months more.

The trade is carefully watching the situation in Myanmar

and hopes ways will be found to sustain the demand for

high quality teak from Indian and international buyers.

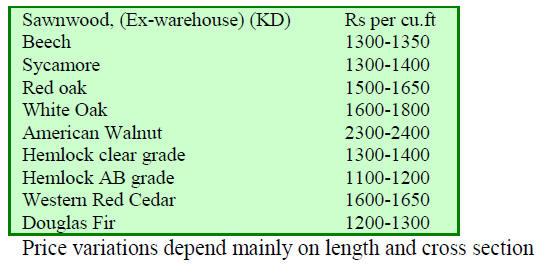

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

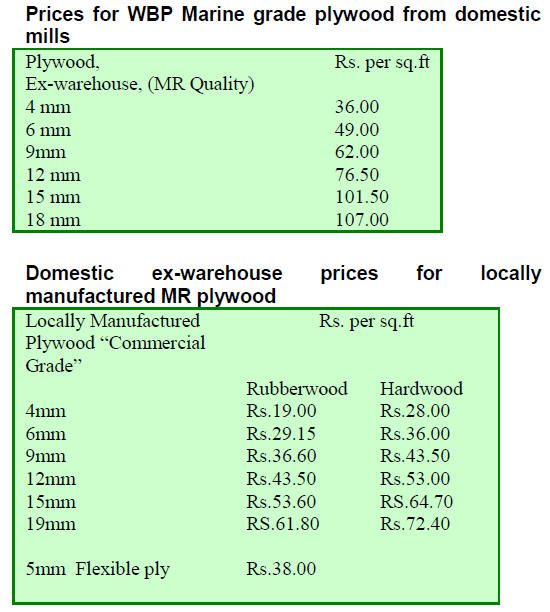

Plywood Market

Indian timber and plywood manufacturers are excited

about the new Governments‟ plan to develop 100 cities as

this will boost demand for building materials. Local

analysts estimate that the government‟s plan could involve

construction of around 5 million new homes.

¡¡

7.

BRAZIL

Respite from interest rate hikes

Brazil´s Consumer Price Index (IPCA) increased 0.46% in

May 2014 compared to the 0.67% increase in April 2014

and the May increase drove the accumulated inflation rate

to an annualised 3.3%.

After nine consecutive increases, the Monetary Policy

Committee of the Central Bank (COPOM) decided to keep

the Selic rate at 11%. COPOM reported that the decision

to keep the interest rate unchanged was based on

consideration the macroeconomic environment and the

risks to inflation.

New Timber Control System in Par¨¢ State

The Para State Secretariat of Environment (SEMA) is

developing a new Transport and Trade Control System for

Forest Products, called Sisflora 2. Once implemented the

improved system will allow better control over timber

movements and will strengthen efforts to combat

environmental degradation and illegal logging.

The main improvement in Sisflora 2 will be a georeferencing

feature where individual trees will be tracked

by REFID (Radio Frequency Identification) chips which

will be placed at the base of trees to be logged and on

subsequent billets transported.

Sisflora 2 is being developed in response to new demands

in the international market requiring proof of legality.

Despite the additional cost to timber producers the

investment will assure overseas buyers of the legal origin

of exports from the state.

Deforestation: Brazil fulfill goal of reducing emissions

from deforestation

The Ministry of Environment (MMA) announced, during

the celebration of Environment Week that Brazil was the

only country to meet the goal agreed at the Conference of

the Parties in Durban (COP17) of reducing greenhouse

gases emissions related to deforestation.

MMA reported that Brazil will officially submit the results

to the United Nations Framework Convention on Climate

Change (UNFCCC). Reports from Brazil say the country

has reduced GHG emissions over the past four years in an

amount equivalent to the annual emissions of the United

Kingdom (600 million tons of carbon dioxide equivalent).

MMA anticipates that this result will contribute to

discussion of a new global climate agreement, climate

negotiations in Lima (COP-20, in Peru, in December

2014) and Paris (COP-21, in France, in 2015).

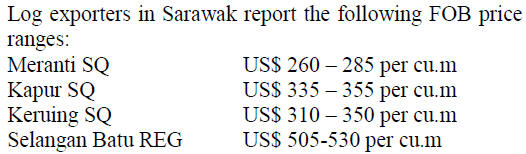

Exports rise but tropical sawnwood misses out

In June 2014, wood products exports (except pulp and

paper) increased 7.2% in terms of value compared to June

2013, from US$222 million to US$238 million.

Pine sawnwood exports increased 40.8% in value in June

2014 compared to June 2013, from US$12 million to

US$16.9 million. In terms of volume, exports rose 38%,

from 53,100 cu.m to 73,300 cu.m over the same period.

On the other hand, tropical sawnwood exports fell 17% in

volume, from 34,200 cu.m in June 2013 to 28,400 cu.m in

June 2014. In value terms export earnings dropped 13.6%

from US$16.9 million to US$14.6 million over the same

period.

Pine plywood exports fell slightly (-0.2%) in value in June

2014 compared to June 2013 but the volume increased

4.1%, from 104,700 cu.m to 109,000 cu.m, over the same

period.

Tropical plywood exports declined 37.5% in terms of

volume, from 4,800 cu.m in June 2013 to 3,000 cu.m in

June 2014.The value of exports fell 34.5%, from US$2.9

million in June 2013 to US$1.9 million in June 2014.

It came as a disappointment that exports of wooden

furniture declined in June from US$ 42.8 million in June

last year to US$ 41.4 million this June 2014, a 3.3% drop.

Furniture Industry seeks new markets in the Middle

East

Furniture manufacturers in Santa Catarina, one of the

largest furniture producing states in Brazil, want to

increase furniture exports to the Middle East.

One of the manufacturers in the state already sells to the

United Arab Emirates, Kuwait and Saudi Arabia and sees

a potential to expand into other Middle East countries.

According to company representatives there are

opportunities in Qatar, Oman, Jordan and Bahrain as

incomes are high and consumers appreciate the solid wood

style of furniture produced by the company.

At present the company exports around 5% of it output to

the Middle East but firmly believes this can be increased.

Ipe withdrawn from UK DIY stores

The British company Jewson announced that it will

temporarily stop selling Amazon timbers from its more

than 600 stores in England.

According to the company while exporters are only

required to have official Brazilian documents related to

timber transport (Document of Forest Origin - GF3) this

was considered insufficient to ensure and demonstrate the

legal origin of wood.

The British company has moved to strengthen its chain of

custody audit and has contracted specialists in Brazil to

assist with this.

For an overview of this story see:

http://www.ttjonline.com/news/brazil-laundering-illegaltimber-

says-greenpeace-4269397/

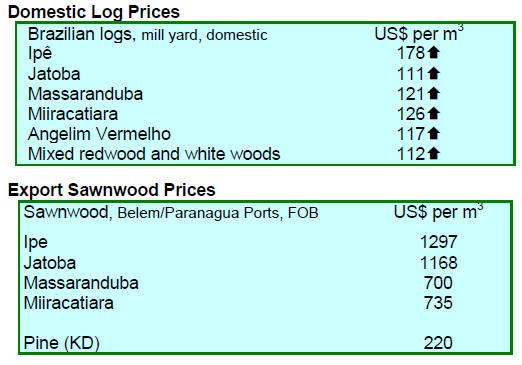

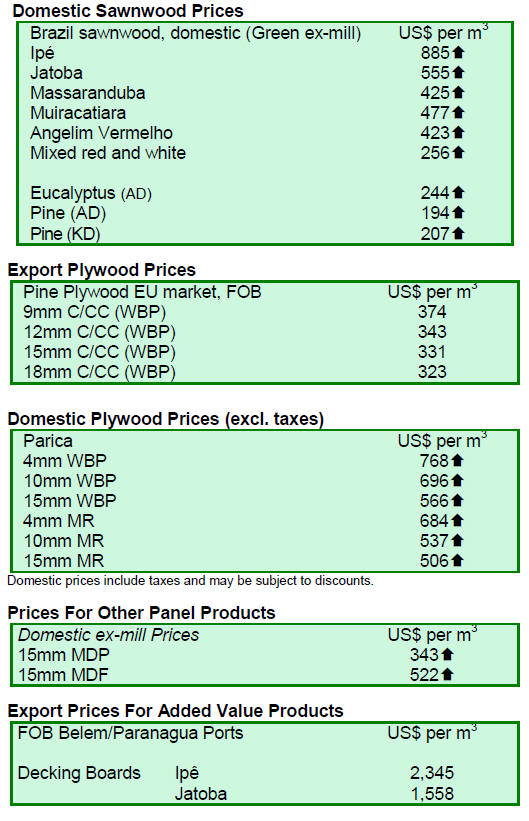

Price trend round-up

The price of Brazilian roundwood from natural forests

ranges from US$111 per cubic metre to US$178 per cubic

metre at mill yard while prices of Brazilian sawnwood

from natural forest logss varies from US$256 per cubic

metre to US$885 per cubic metre ex-mill depending on the

species.

The price of parica WBP glue plywood ranges from

US$566 per cubic metre to US$768 per cubic metre exmill

depending on thickness.

Prices for parica MR glue plywood range from US$506

per cubic metre to US$684 cubic metre ex-mill according

to the thickness.

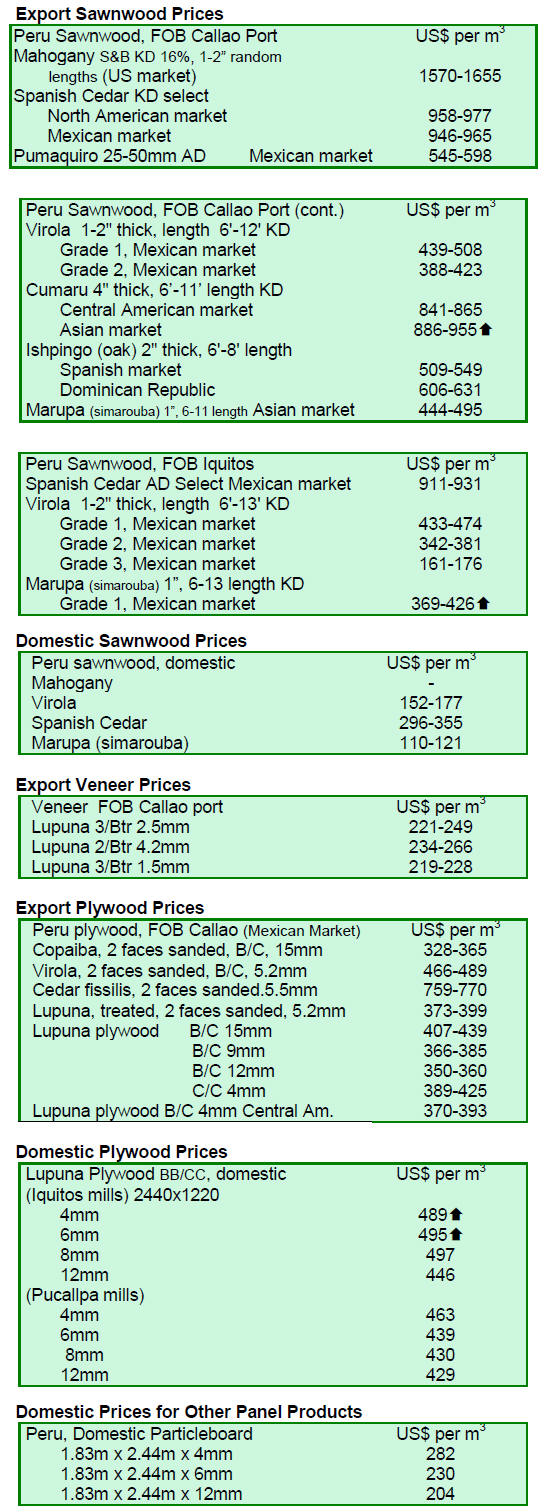

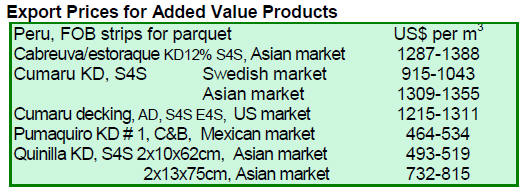

8. PERU

Government stimulus proposal attracts

criticism

Because of a sharp drop in output and exports from the

mining and construction sectors Peru‟s economy grew by

just 2% in April, the worst performance since October of

2009, during the global financial crisis.

In response the government introduced new economic

measures to reactivate the economy, attract investment and

boost confidence.

In an effort to boost growth the government has proposed

relaxing environmental rules by temporarily reducing fines

particularly in the mining and energy sectors.

This suggestion has attracted criticism from environmental

organisations who say they will undermine the

Environment Ministry's responsibilities in regulating

mining and energy activities.

In June the World Bank lowered its 2014 growth forecast

to 4% January‟s 5.5% estimate citing slower than expected

improvements in demand in the US and China, Peru‟s top

trading partners.

9.

GUYANA

Diversifying the product range

The Forest Products Development and Marketing Council

of Guyana Inc (FPDMC) is working with local

manufacturers to encourage product diversification

through the production of value added products and the

greater utilisation of residues from sawmilling operations.

The FPDMC is developing product/manufacturing

„profiles‟ to inform manufacturers of the opportunities that

exist in the industry and what investments and technology

would be required for a range of products.

The aim is to produce affordable products manufactured

from sustainably harvested lesser known species. Also,

sawmillers are being encouraged to produce dimensional

lumber to able to compete with imported products.

Financial challenges for Iwokrama

The 2012-2013 Annual Report for the Iwokrama

International Centre for Rainforest Conservation and

Development reveals that income for 2013 was down

almost 40% from levels in 2012 as grant income fell

sharply.

In the Annual Report the CEO, Dane Gobin, says ¡°2012-

2013 remained another challenging period for the Centre

as it struggled to find a viable financial model in light of

the still enduring international financial crisis.

Support from the Government of Guyana continued to be

our major source of funding and the Centre continued to

implement its austerity programme and pursue

consolidation activities,¡±

See: http://www.iwokrama.org/iwokrama-annual-report-

2012-2013/

The purpose of the Iwokrama International Centre (IIC) is

to manage the Iwokrama forest, a unique reserve of

371,000 hectares of rainforest, ¡°in a manner that will lead

to lasting ecological, economic and social benefits to the

people of Guyana and to the world in general¡±.