2. GHANA

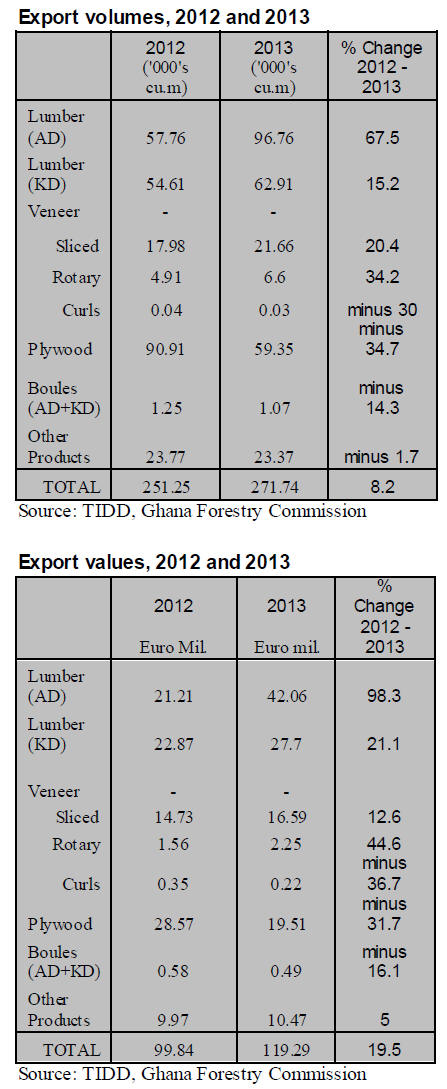

Year-on-year growth in exports

Ghana&s timber exports for the 2013 recorded a year-onyear

growth in terms of both volume and value according

to available data from the Timber Inspection Development

Division (TIDD) of the Forestry Commission.

Overall the volume of exports increased just over 8% in

2013 compared to 2012 while the value of 2013 exports

rose a healthy 19.5%.

Sawnwood and veneer exports grew in terms of both

volume and value in 2013 compared to 2012.Of the 21

products exported in 2013, air dried and kiln dried

sawnwood and plywood (including overland exports)

accounted for 35.6%, 23.2% and 21.8% respectively of

total export volumes which totalled 271,740 cu.m earning

euro 89.27 million.

Overland plywood exports to neighbouring countries

accounted for 96% of the total plywood exports

(59,350m3) in 2013. The main markets were Nigeria,

Burkina Faso and Niger.

Primary product exports (mainly sawnwood, boules,

veneers and plywood) accounted for over 90% of the

volume and value of exports. The major species exported

during 2013 were wawa, mahogany, ofram, sapele,

rosewood, dahoma and denya.

The United States, China, Germany, UK, Nigeria, Senegal

and India were some of the major markets for Ghana&s

wood products in 2013.

The ECOWAS countries , especially Nigeria, Burkina

Faso, Niger, Benin and Senegal, were significant buyers of

Ghana&s wood products in 2013.

Power rationing affects businesses

The Electricity Company of Ghana (ECG) has introduced

a nationwide power rationing scheme which became

necessary because the supply of natural gas from Nigeria

is inadequate to meet Ghana&s power requirements.

The load shedding and erratic power supply has meant that

businesses, including timber manufacturers, have had to

switch to on-site diesel generators which has pushed up

production costs.

Ghana relies on gas from Nigeria for power generation but

supplies are becoming unreliable due to frequent technical

problems with the West African Gas pipeline.

Domestic gas supplies to come on stream in

September

The head of the state-run Ghana National Petroleum

Corporation (GNPC), Alex Mould, has said Ghana will

start processing gas from its offshore Jubilee oil field by

September after long delays.

Construction work on the US$750 million plant, originally

scheduled for completion last year, has been delayed

because of both financial and technical problems.

Consumer price inflation at 3-Year high

Ghana's annual consumer price inflat ion rose to a fresh

three-year high of 14% in February, up from 13.8% in

January according to the Ghana Statistical Service . The

impact of the rise in fuel prices on transport and food

prices has driven inflat ion higher.

In related news a mission from the International Monetary

Fund (IMF) recently assessed the state of the Ghanaian

economy. At the end of the mission, the IMF issued a

press release which summarised the conclusions from the

visit wh ich says: 求 Ghana&s economy slowed down on the

back of sizable external and fiscal imbalances and energy

disruptions in the first half of the year.

Based on data for the first three quarters of 2013,

the

mission estimates growth of 5.5 percent〞well below the

levels of recent years. On the fiscal side, revenue

shortfalls, overruns in the wage bill, and rising interest

costs pushed the 2013 deficit to 10.9 percent of GDP,

versus a target of 9 percent.

The overrun would have been higher in the absence of

significant revenue measures, the elimination of fuel

subsidies, large increases in utility prices, and compression

of other expenditure.

The large fiscal deficit combined with a weaker external

environment, led to a widening of the current account

deficit to 13 percent of GDP and to further pressure on

international reserves.

The consequent weakening of the cedi together with large

administered price increases contributed to inflation rising

above the end-year target range to 13.5 percent′.

For the full release see:

http://www.imf.org/external/np/sec/pr/2014/pr1471.htm

Foundation for Ghana*s maritime transport hub

Ghana has established a mult i-million maritime safety and

security project that will ensure constant surveillance of

the country&s territorial waters. A vessel monitoring and

informat ion management system (VTMIS) has been put in

place providing for 24 hour monitoring of vessels moving

in and out of Ghana&s waters.

The Director-General of the Ghana Marit ime Authority

(GMA), Mr Peter Issaka Azumah, said in an interview

with the Graphic Press that 求completion of the VTMIS

project and its planned commissioning next month would

boost the country&s vision of becoming the central point in

West Africa where majority of marit ime businesses are

transacted.′ Mr Azu mah outlined the VTMIS at a

conference on Coastal and Maritime Surveillance in

Africa.

For the full story see:

http://graphic.com.gh/business/business-news/20099-

ghana-s-marit ime-hub-concept-gets-us-35m-boost.html

3. MALAYSIA

Low level of demand for certified wood

disappoints

industry

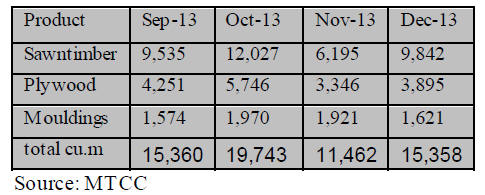

The MTCC has released data for the last four months of

2013 on exports of wood products certified through the

Malaysian Timber Certificat ion System (MTCS).

In the last four months of 2013, Malaysia exported

62,215

cu.m of certified timber products. The highest volume

went to Netherlands with 19,313 cu.m (31% of total),

United kingdom 9,977 cu.m (16%) and Germany 4,727

cu.m (7.6%).

The MTCS, operated by MTCC, is endorsed by the

Programme for the Endorsement of Forest Cert ification

(PEFC).

Industry analysts say that, despite the development and

progress of timber certificat ion in Malaysia, the purchase

of certified wood products has been disappointing. This

weak demand for certified t imber products is thought to be

discouraging companies from applying CoC certification.

The most commonly heard complaint from industry is that

demand for cert ified products is not expanding and even

when a price premium can be secured this is insufficient to

offset the additional expenses incurred.

Diversification into Glulam production

Glue laminated timber (Glulam) will be promoted by the

Malaysian Timber Council (MTC) to increase acceptance

by the domestic construction industry. MTC has identified

glulam as an innovative technically superior material that

will offer many advantages to construction companies.

Yeo Heng Hua of MTC said diversifying manufacturing is

one means for the country to achieve its export target of

RM53 billion by 2020 and ensure the growth of Malaysia's

timber industry.

Myanmar log export ban to benefit Malaysian

companies

Myanmar&s log export ban on 1 April is seen by many in

the industry as providing an opportunity for Malaysian

timber companies, especially as demand in India and

Japan is firm.

The investment research company, RHB Research

Institute, says 求Malaysia&s log prices will be undergoing a

re-rat ing as Myanmar&s log e xports catered to more or less

the same e xport ma rkets as Malaysia′.

RHB&s Hoe Lee Leng said, 求 Looking back at history,

when Indonesia banned log exports in 2001, Malaysia

went from having a 43% log export market share to a 58%

market share. In view of the change in Myanmar, we

expect tropical log prices to start to go up again from the

first half of 2014, after the existing inventory of logs held

in impo rting countries declines′.

Hoe is expecting the knock-on effect of the Myanmar ban

to be less felt in the plywood markets where he predicts

prices will go up 2 每 3% year-on-year.

He pointed out that while Japan housing projects grew

11% in the year 2013 and 12.3% in the first quarter of

2014, plywood imports did not rise by the same amount,

growing only 3.3% year-on-year.

The Myanmar log export ban is expected to benefit

Sarawa k t imber co mpanies most as they are the nation&s

main log exporters.

The Sarawak Timber industry Development Corporation

(STIDC), in its first quarterly magazine for 2014, states it

is hopeful that Sarawak will sustain timber and timber

product export values at RM7.2 billion (approximately

US$ 2.2 billion) this year.

Plantation C&I Standards under revision

The Malaysian Timber Cert ification Council (MTCC) is in

the process of reviewing its standards for the Criteria and

Indicators for forest plantations. The review committee of

sixteen stakeholders met for the second time in Kuching.

As a result of the second meeting, the committee prepared

an Enquiry Draft for a revised Standard which will be

further deliberated upon in the three regions of the country

namely, Peninsular Malaysia, Sabah and Sarawak. Details

of the regional consultations will be posted on the MTCC

website: www.mtcc.com.my.

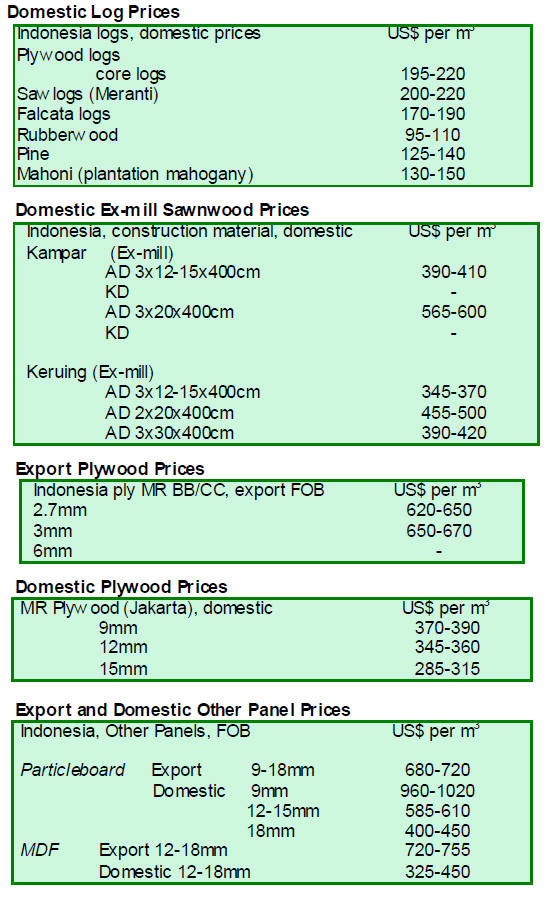

4. INDONESIA

Vietnam and Malaysia outperform

Indonesia's wood

product exports

The Indonesian Ministry of Trade has reported that the

2013 value of wooden furniture exports was US$1.2

billion and that rattan furniture exports were worth

US$219.8 million.

While this is a good performance, Indonesia's furniture

exporters are yet to match the achievements of both

Vietnam and Malaysia which exported more than twice

the amount in the case of Malaysia and 4 times as much in

the case of Vietnam.

However, none of the SE Asian exporters can match the

performance of China where wooden furniture exports in

2013 were US$12.38 billion. Indonesia&s Trade Minister,

Muhamad Lutfi has said that the country should do better

as it has 140 million hectares of forest so has ample timber

resources to support greater exports .

Furniture SMEs gain from CIFOR assistance

In order to take full advantage of the opportunity created

by the VPA for easy access to EU markets , furniture

manufacturers in Central Java have established a new

association that will help small and medium sized

companies secure legality cert ification under Indonesia&s

SVLK.

The establishment of the new body was assisted by CIFOR

through its Furniture Value Chain research project headed

by Herry Purnomo.

CIFOR had undertaken a study to find ways to boost the

incomes of small-scale furniture makers whose industry

has been in decline since the 2008 global financial crisis

and the impact of ASEAN free pact.

Result of biomass study released

The Indonesian Ministry of Forestry has released the

results of its massive biomass study conducted in Central

Kalimantan. The approach taken has the potential to be a

model for similar projects in other areas and the results

provide a key reference point in terms of national green

house gas reporting. For more details see:

http://www.forda-mof.org/index.php/berita/post/1662

﹛

5. MYANMAR

Commercial tax reduction

The Pyidaungsu Hluttaw (Union Parliament) while

debating taxation matters decided upon a reduction from

50% to 25% in the commercial tax on logs and rough sawn

timber.

After the log export ban, MTE will remain the sole

supplier of raw material to the domestic mills and it is

understood all sales by MTE are inclusive of the

commercial tax.

One analyst said that if the sales invoices from MTE

included the statement ‗pric ing is inclusive of commercial

tax& this would help e xporters speed up their preparation

of tax and export documentation.

Analysts close to the timber industry say that it appears the

commercial tax for processed timber products will be 5%,

another step towards the development of the export-driven

timber trade and industry.

Union Parliament approves electricity rate hike

The New Light of Myanmar of 20 March reported that the

Pyidaungsu Hluttaw has approved an increase in the

electricity rates from 1 April, the beginning of the new

fiscal year.

Some journalists are crit ical of this hike, arguing that rate

increases for the industrial sector would inevitably create a

chain reaction resulting in an increase in consumer prices .

Maung Maung Lay, vice chairman of the Union of

Myanmar Federation of Chambers and Commerce

Industry (UMFCCI), said production costs for Myanmar

industries were set to rise significantly as a result of the

change in power rates and that this will undermine the

competitiveness of Myanmar products.

Myat Thin Aung, chairman of the Hlaing Thayar industrial

zone in Yangon, voiced similar concerns as reported by

the Irrawaddy on 24 March saying 求All manufacturers will

be impacted # they can&t compete with imported goods

because production costs are increasing.′

EU and Myanmar to negotiate investment protection

agreement

The EU reinstated trade preferences to Myanmar in July

2013 and in late March this year the EU Trade

Commissioner Karel De Gucht opened negotiations for an

investment protection agreement between the European

Union and Myanmar with Dr. Kan Zaw, Union Minister of

National Planning and Economic Development of the

Republic of the Union of Myanmar.

The EU Member States gave endorsed the opening of

these negotiations which, if successful, will improve the

protection and fair treatment of investors from both sides

and will thus contribute to attracting investments to

Myanmar and the EU.

"This investment agreement could become an

important

accelerator for the reform process in Myanmar/Burma",

said EU Trade Commissioner De Gucht. "Experience has

shown that improving legal certainty and predictability for

investments is key in providing business opportunities and

much-needed development for this growing economy.

I hope we can conclude negotiations swiftly to open the

door to an increased flow of mutually beneficial

investments. The European Union fully supports

Myanmar's reform process and is ready to support further

efforts in this direction. Currently, there is no bilateral

investment treaty in place between Myanmar and any EU

Member States′.

For the full press release see: http://europa.eu/rapid/press -

release_IP-14-285_en.htm

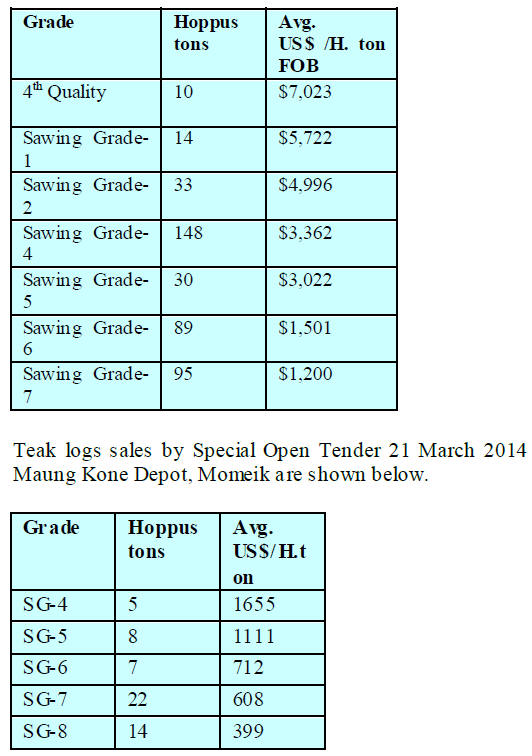

Teak sales

The following grades were sold by competitive bidding on

10 and 21 March 2014 at the Myanma Timber Enterprise

(MTE) tender hall.

Analysts say that, as these teak logs were sold

on-site at

the Maung Kone Depot in Momeik which is in the

northern part of the country, it is unlikely these logs can be

exported before the log export ban comes into effect.

Timber traders are desperately trying to ship whatever

they can before the 1 April deadline and are being helped

as both the weather and transport conditions are

favourable. Analysts expect to see a further surge in export

shipments of logs during the final days of March.

6.

INDIA

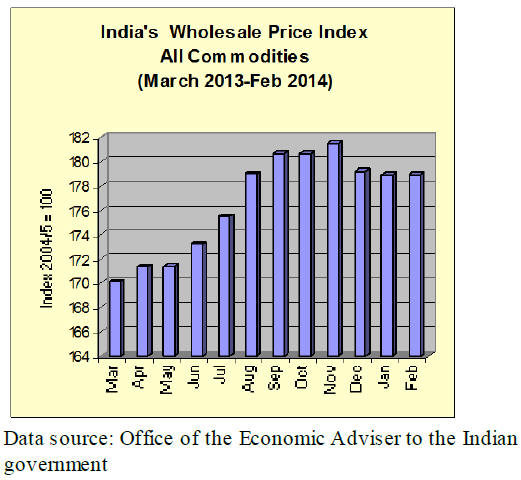

Wholesale price steady

The Office of the Economic Adviser to the Indian

government provides details of trend in the Wholesale

Price Index (WPI). The official Wholesale Price Index for

‗All Co mmodit ies& (Base: 2004-05 = 100) for the month of

February remained at 178.9. The indications are that the

wholesale price index will fall further in the second

quarter.

Indian economy on a stronger footing

Analysts are suggesting that the upcoming election could

lead to a further strengthening of the Indian economy and

an increase of inward investment, especially as the

economy looks better placed to withstand any further

external shocks.

Signs of a recovery in the global economy are boosting the

outlook for India's exporters and the recent decline in

commodity prices, especially of energy, industrial goods

and gold, combined with weaker domestic demand, is

helping reduce India's trade deficit.

The stable rupee:US dollar exchange rate has been

effectively maintained and from being one of the worst

performing emerging market currencies, the rupee has

become more resilient thanks largely to the actions of the

Reserve Bank of India.

In addition, the deficit has begun to fall as has the rate of

inflation. Overall, prospects for the economy have

improved and with polls showing a strong prospect of

continued political stability, the economy should further

improve after the elections.

In a recent press statement Morgan Stanley indicated it has

raised its forecast for India's 2014 GDP growth to 5.2%.

Inflation at nine month low

The inflation rate recently eased to a nine month low of

4.68%. Retail inflation, which eats into household budgets,

has also dropped to a two year low of 8.10% from 8.79 %

in January 2014.

Through recent action by, and new regulations from, the

Ministry of Environment and Forestry, the mining, power

and manufacturing sectors have improved opportunities

for added value production and export . These changes are

already filtering into the index for industrial production

which has improved over recent months.

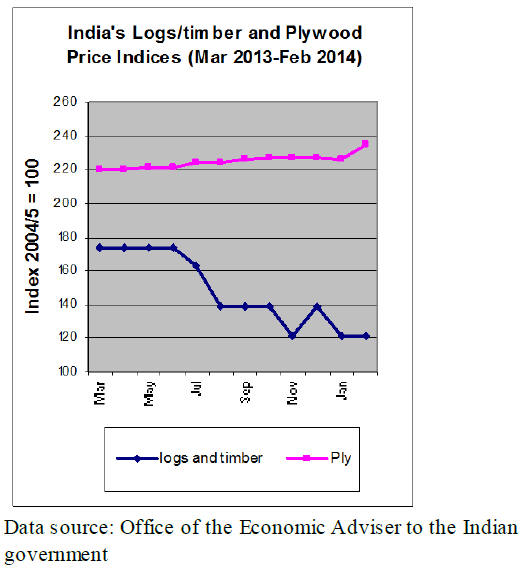

Timber and plywood wholesale price indices

In addition to data on the Wholesale Price Index for all

commodit ies, the Office of the Economic Adviser to the

Indian government also reports data on wholesale price

movements for a variety of wood products.

The Wholesale Price Indices for Logs/timber and Plywood

are shown below. The logs/timber index has remained at

the same level for two consecutive months.

Reliance on timber imports of concern

India has been meeting its growing demand for wood

products such as plywood, sawnwood and pulp and paper

through imports as domestic industries are inadequate to

meet the growth in demand but the dependence on imports

is of concern.

According to the National Research Centre for Agro

forestry (NCRA), the country imported six million cubic

metres of t imber last year. NCRA data suggests India has

23,220 saw mills, 2,562 large and small plywood mills,

660 pulp and paper mills but says most are operating at

only 40 per cent of their capacity.

The NCRA says the main reason for the inadequate supply

of raw materials is that a high proportion of logs come

from farmers and land owners which, under the present

regulations, have little incentive to produce wood raw

materials.

In an effort to boost agro-forestry output a National Agroforestry

Policy (2014) has been drafted which, say

analysts, has the potential to revive the agro-forestry

sector.

Currently small farmers avoid agro-forestry production

because of unfavourable regulations on felling and

transporting of farm grown trees in the Indian Forest Act .

The Act restricts felling and transportation of trees grown

even on private farmland, especially of those species

which are found in the nearby forests, a measure aimed at

reducing illegal felling.

In addition, unlike the agriculture sector, the agro-forestry

sector lacks an institutional insurance facility. The new

policy addresses this and for the first time promises risk

coverage to farmers practicing agro forestry against theft

and natural calamit ies such as cyclone, storm, floods and

drought.

The policy calls for farmers to be provided with soft loans.

Government estimates suggest that the policy will help

increase the area under agro forestry from 25.32 million

hectares to 53 million ha.

India&s imports of wood and wood products continue to

grow with firm demand from manufacturers.

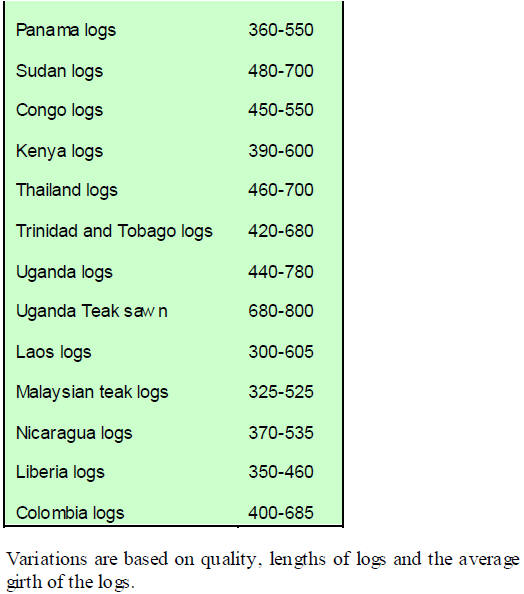

Current C & F prices for imported plantation teak, Indian

ports per cubic metre are shown below.

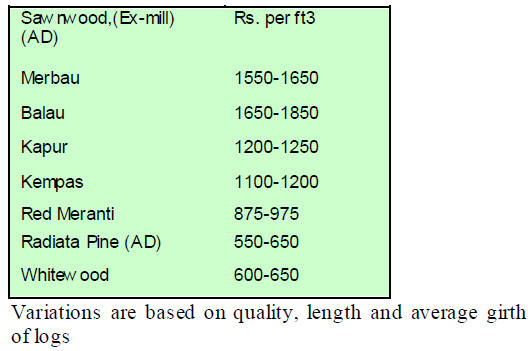

Prices for domestically sawn imported logs

Demand for Balau is very strong and because supplies

have not kept pace prices have risen. As a result of the rise

in prices for balau meranti is now more widely accepted.

Prices for air dry sawnwood per cubic Foot, ex-sawmill

are shown below.

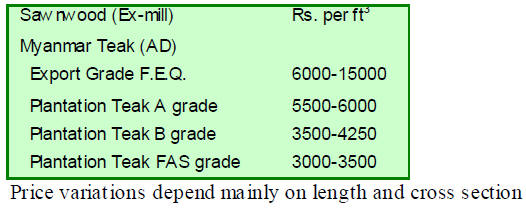

Myanmar teak processed in India

Export demand continues to be good but domestic demand

is still slow.

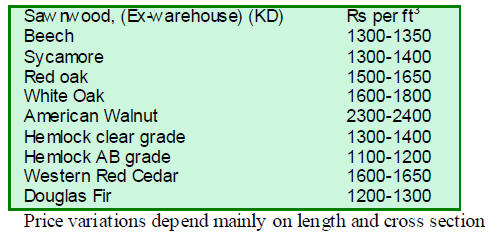

Imported sawnwood prices

Demand for hardwoods from the USA and timber from

Canada is improving as these timbers become more widely

accepted. Prices in the local market remain unchanged.

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

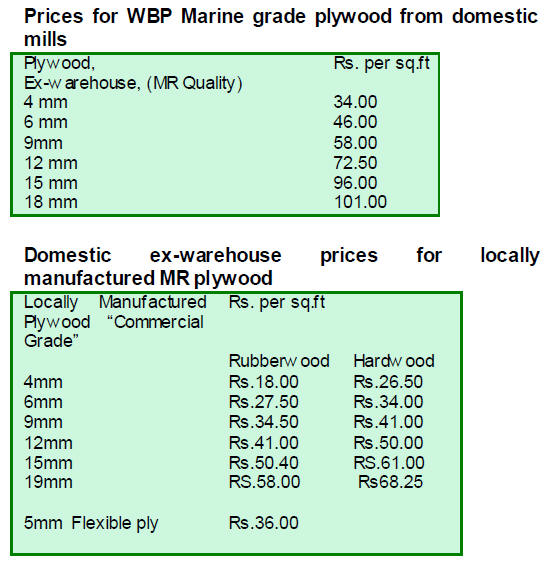

Plywood market slow to revive

With the Indian rupee slowly strengthening prices for

imported plywood as well as prices for plywood

manufactured from imported logs have fallen slightly.

Plywood manufacturers are expecting the domestic

housing market to get a boost after the general election

and anticipate this expand demand for plywood.

7.

BRAZIL

Real depreciation helping exports

The Consumer Price Index (IPCA) that measures inflation

in Brazil rose 0.69% in February 2014 after increasing

0.55% in January 2014. In February 2013 the IPCA rate

was 0.60%.

The average exchange rate in February 2014 was BRL

2.38 to the US dollar, significantly weaker than BRL 1.97

in February 2013 demonstrating by how much the

Brazilian currency has depreciated against the US dollar.

In February 2014, the Monetary Policy Committee of the

Central Bank (COPOM) decided to increase the Selic

(interest) rate from 10.5% to 10.75%.

Timber sector negotiates more favourable tax basis

The Department of Finance of the State of Mato Grosso

(SEFAZ) has published the wood price list that is used by

SEFAZ as the basis for calculating state taxes.

The state government initially planned to increase prices

in its minimum price list by 10%, but after strong lobbying

by the timber industry an increase of 4.1% was agreed.

According to Timber Industries Association of Northern

Mato Grosso (Sindusmad), this adjustment while consider

high, will not add significantly to costs or affect the

competitiveness of companies in relation to other

producing States.

The price list negotiations took into consideration the fact

that the state government needed to maintain the same

level of tax (Tax over Circulation of Goods and Services)

revenue from previous years.

Heavy rains and poor roads driving up timber

transport costs

Forest products transport from Mato Grosso state to the

main consumer centres is being hampered by the above

average rainfall for this period in the region.

Unpaved roads have been turned into muddy rivers and

river crossings have become difficult and dangerous. As a

result of the difficulty driving conditions companies in the

forestry sector have seen transport costs rise sharply

compared to what they were paying in December last year

when there was less rainfall.

According to the Union of Timber Industries for Mid-

North region in the State of Mato Grosso (SINDINORTE),

road transport costs increased 10% in less than two

months.

In order to transport wood products from Nova Maringa,

located 305 kilometers from Cuiab芍 (the state capital) to

the São Jos谷 do Rio Preto consumer cluster located in the

state of São Paulo the current freight costs are as high as

R$220 per ton. In December 2013 the transport cost for

the same route was about R$200 per ton.

Transport costs fro m Coln iza (one of the State&s largest

timber producers) to the State of Esp赤rito Santo have

jumped over 30% from R$360 to R$490 per ton in the past

two months.

Due to this unexpected rise in transport costs

SINDINORTE has requested a reduction in the prices for

wood products in the official list used to set taxes.

According to the Union of Wood and Furniture Industries

of Northwestern Mato Grosso (SIMNO), transport costs

could rise even more as companies are forced to use

alternative, longer routes.

February export performance

In February 2014, wood product exports (except pulp and

paper) increased 19% in terms of value compared to

February 2013, from US$186.2 million to US$221.6

million.

Pine sawnwood exports increased 37% in value in

February compared to February 2013, from US$12.7

million to US$17.4 million. In terms of volume, exports

rose 30.1%, from 57,900 cu.m to 75,300 cu.m in the same

period.

Tropical sawnwood exports rose just over 1% in volume,

from 27,700 cu.m in February 2013 to 28,000 cu.m in

February this year and the value of exports increased 7.2%

from US$15.2 million to US$ 16.3 million, in the same

period.

Pine plywood exports improved by around 13% in value

this February compared to February 2013, from US$30.2

million to US$34.1 million. There was also an increase in

the volume of exports by 13.8%, from 81,100 cu.m to

92,300 cu.m in the same period.

While of declining significance, tropical plywood exports

fell almost 18% from 4,500 cu.m last February to 3,700

cu.m in February this year.

Potential in furniture sector examined in new report

The value of wooden furniture exports increased from

US$34.3 million in February 2013 to US$37.2 million in

February 2014, an 8.5% increase and furniture production

for the domestic and international markets is expected to

expand throughout in 2014.

A study on the potential for the furniture market in 2014

has been launched by the Institute for Industrial Studies

and Marketing (IEMI). The early findings forecast a 3.5%

increase in furniture parts sales, a 14.5% rise in imports

and an 8% rise in exports in 2014.

The overall value of furniture output, says the study, could

rise to US$14.5 billion while imports could be around

US$337 million and exports US$503 million in 2014 on

the basis of an exchange rate of R$ 2.44 per US dollar.

Brazil has around 18,200 furniture manufacturers which

provide about 300,000 direct and indirect jobs.

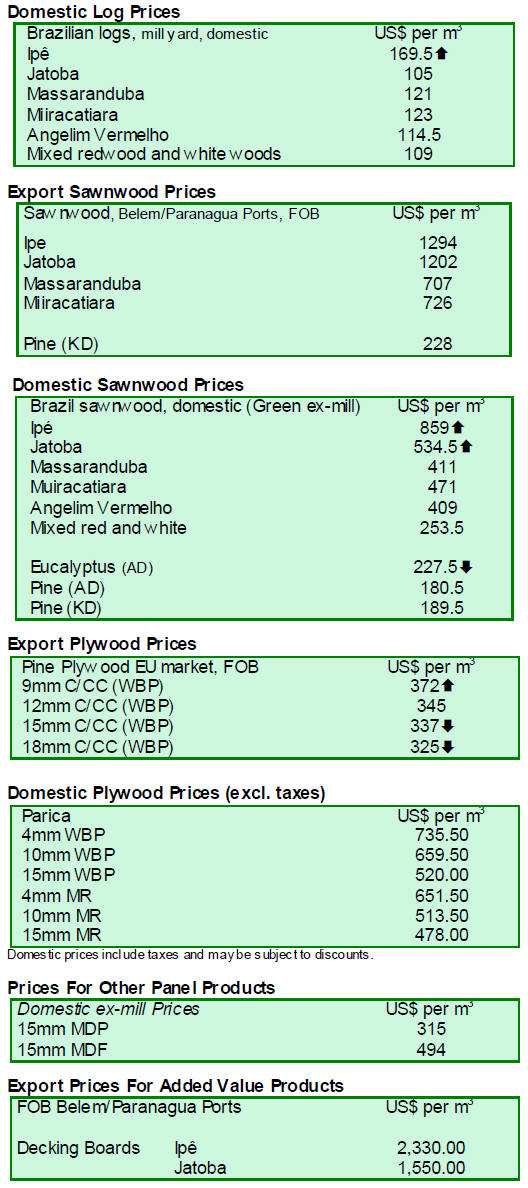

March prices round-up

Average natural forest roundwood prices range from

US$109 to US$169.5 per cu.m at mill yard, while average

prices for sawnwood from natural forest species varied

from US$253.5 to US$859 per cu.m ex-factory depending

on species. In both cases the highest prices were for ip那

(Tabebuia sp.).

The average price of parica WBP plywood ranged from

US$520 to US$ 735.5 per cu.m ex-factory depending on

thickness.

Prices for parica MR glue plywood were in the range of

US$478 to US$ 651.5per cu.m ex-factory, according to the

thickness. The average price for reconstituted panels were

US$314.5 per cu.m ex-factory for raw MDP (15 mm) and

US$494 per cu.m ex-factory for raw MDF (15 mm).

﹛

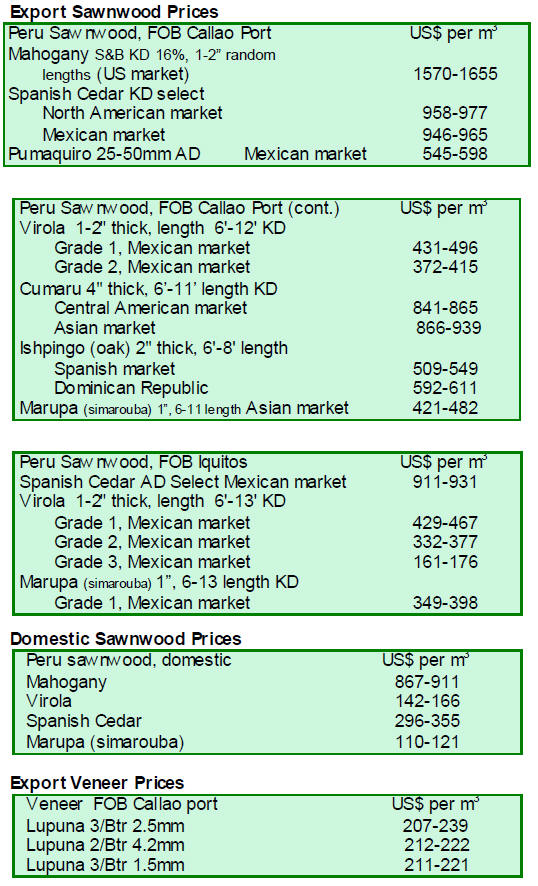

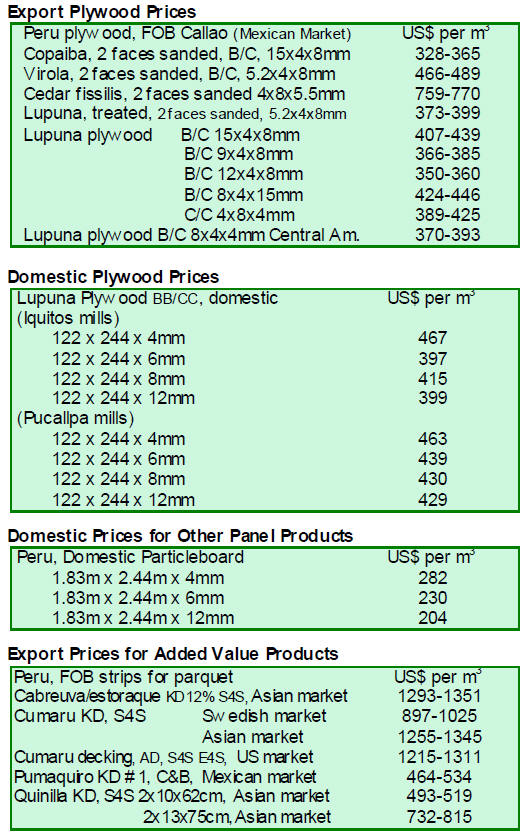

8. PERU

Strategy to promote forestry sector

investment

In order to achieve conditions that will lead to greater

investment and market access the Ministry of Agriculture

will be hosting workshops to promote the Forestry Sector

in the Amazon region namely, Mother God , Loreto and

Ucayali.

The workshop participants will be drawn from t imber and

non-timber resource mangers, native communities,

forestry consultants and major NGOs in the area.

INIA launches agro-forestry drive

The National Institute of Agricultural Innovation (INIA)

will promote agro-forestry to increase the productivity of

land in large regions of Peru. It is planned to introduce

pine in coffee producing areas of Villa Rica.

9.

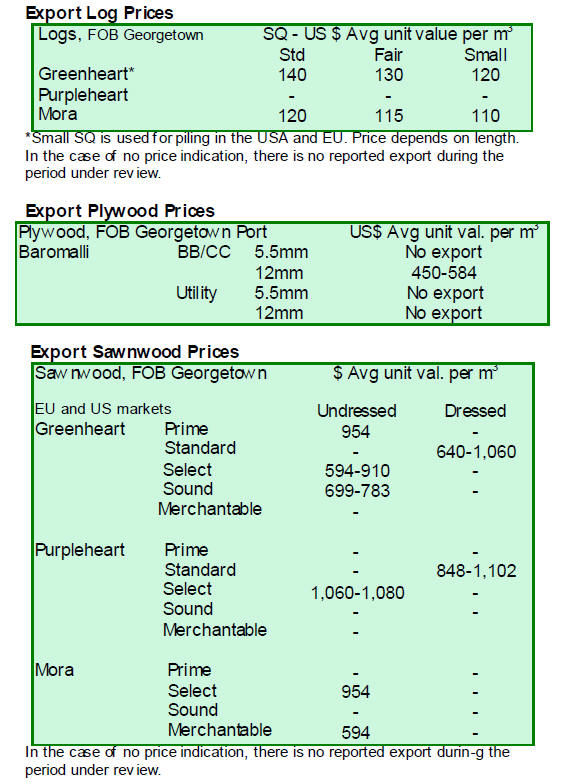

GUYANA

Mora log prices ease, India the top log

buyer

Only greenheart and mora logs were exported in the period

reviewed, there was no export of purpleheart logs.

Greenheart log FOB prices were fair on the market with

Standard Sawmill Quality priced at an average of US$ 140

per cu.m, Fair Sawmill Quality US$130per cu.m and

Small Sawmill Quality US$120 per cu.m.

In comparison mora log FOB prices were stable with

Standard Sawmill Quality traded at US$120 per cu.m and

Fair Sawmill Quality at US$115. The FOB price for Small

Sawmill quality mora logs was US$110 per cu.m FOB.

The majo r markets for Guyana&s logs were in Asian,

predominantly India.

Mora sawnwood outperforms other timbers

The sawnwood market was quiet over the past weeks.

Non-dressed greenheart (Prime Quality) low end FOB

prices remained stable at US$954 per cu.m but Select

Quality top end prices moved up from US$848 to US$910

per cu.m. Then again, Sound Quality Non-dressed

greenheart FOB prices were largely unchanged.

Non-dressed purpleheart Select Quality sawnwood prices

remained firm at US$1,080 per cu.m FOB but Nondressed

mora Select Quality prices saw a fall in FOB price

from US$976 to US$954 per cu.m.

On the other hand, Merchantable Quality mora FOB prices

climbed from US$500 to US$594 per cu.m. The main

destinations for sawn but Non-dressed species from

Guyana were the Caribbean, Europe, Oceania and North

America.

During the period under review Dressed greenheart

sawnwood FOB prices held firm price at US$1,060 per

cu.m. However Dressed purpleheart FOB prices saw a rise

in top end price from US$869 to US$1,102 per cu.m.

The Caribbean was the only market to absorbs dressed

sawnwood in the period reviewed.

Plywood export prices were unchanged at US$ 584 per

cu.m FOB in the markets of Central and South America.

Greenheart piles for heavy construction works secured a

fair price on the market earning as much US$425 per cu.m

FOB for Select Quality and US$432 per cu.m for Sound

Quality. Europe and North America remain the major

markets for this product.Guyana splitwood (shingles)

commanded a fair FOB price of US$1,023 per cu.m in the

Caribbean and N. Amercan markets.

Profit from using Lesser Used Species

Guyana&s forests contain a large diversity of timber

species but only a handful of these species (greenheart,

purpleheart, kabukalli and crabwood) are popular being

readily recognised for both their strength and aesthetic

properties.

It has been established that the technical properties of

many lesser used species (LUS) are comparable to those of

the more popular species for example Darina, a LUS has

similar properties to Hububalli, a popular t imber.

Hububalli is popular locally for furniture and building

components but now Darina is gaining in popularity.

Similarly, black kakaralli is suitable for piling as it has

properties close to those of greenheart but is available at a

more competitive price.

Update on Guyana*s VPA Process

Guyana is committed to fulfilling the aspects of the VPA

process as outlined in the Roadmap for Guyana EU

FLEGT VPA. The Communication and Consultation

Strategy is in its final stages of complet ion.

The document is currently being reviewed by stakeholders

directly and indirectly involved in the forest sector.

Importantly, the document will continue to be an active

document and will therefore be subjected to updates as

deemed appropriate in the interest of advancing the VPA

process.

The Nat ional Technical Working Group met with

representatives of FAO during March 2014 to discuss

strengthening and advancing the VPA process as well as

the progress made with the development of the

Communicat ion and Consultation Strategy and the

complet ion of the Scoping of Impact Study; both of which

are funded by the FAO.

Stakeholder engagement activities have continued within

the country. Staff have been recruited by the Guyana

Forestry Commission and were given an introduction to

FLEGT as well as an update of Guyana&s VPA process.

Additionally, members of the National Technical Working

Group met with a wide cross -section of stakeholders to

update them on the VPA process, fostering a better

understanding of the EU FLEGT process and examining

the Legality Definit ion.

Revision of the Draft Legality Definit ion is ongoing and

stakeholders are being urged to contribute. Emails can be

sent to: euflegt@forestry.gov.gy

﹛