2. GHANA

Sawnwood exports drive up earnings

The Timber Inspection Development Division of the

Forestry Commission of Ghana has released export data

for the period Jan-Nov 2013.

The report shows that between January and November

2013 245,652 cubic metres of solid wood products were

exported earning euro 108.3 million. This performance

represents an increase of 8% in terms of volume and 21%

in terms of value.

The success of 2013 exports up to November is attributed

to improved exports of sawnwood (both air and kiln dried)

and the 34% jump in exports of sliced veneer.

However, overland export of plywood to neighbouring

countries plummeted almost 35% from 81,788 cubic

metres in the same period in 2012 to just 52,677 cubic

metres in the year to November 2013.

Export earning from this product dropped from euro 25.62

million in 2012 to euros 17.15 million in the year to

November 2013.

Ghana‟s export markets included Germany, Italy,

France,

UK and Belgium, China, India, Thailand, South Africa,

Morocco and Cape Verde.

Inflation at new high

Ghana's annual consumer price inflation rose to a threeyear

high of 13.8 percent in January, up from 13.5 percent

in December 2013 and was driven mainly by an increase

in utilities, housing, fuel and some foods.

Services to Attract VAT

Banks in Ghana will begin charging value-added tax

(VAT) on some services excluding loans by the end of

next month, Ghana Association of Bankers Chief

Executive Office Daniel Mensah said. He added that the

Ministry of Finance, Bank of Ghana (BOG), and the

Ghana Revenue Authority are in discussions to identify

the services that will attract VAT.

Government reassures investors

In his State of the Nation Address Ghana‟s President, HE

John Mahama, tried to reassured everyone that despite the

continuous fall of the domestic currency, Ghana remains

an attractive destination for investment.

Meanwhile, the government endorsed measures adopted

by the Central Bank to arrest the falling value of the local

currency.

New minimum wage rates to be announced

The Minister of Employment and Labour Relations, Nii

Armah Ashitey, has explained that a new minimum wage

will be introduced after the National Tripartite Committee

(NTC) recommendations have been fully considered.

The NTC comprises representatives of the government,

the Trades Union Congress , and the Ghana Employers

Association. Representatives of the Fair Wages and

Salaries Commission (FWSC), the National Labour

Commission (NLC) and other stakeholders also attended

the meeting.

The minister said it was important to let the public know

that, even though a final decision on the level of increase

in the minimum wage has not been decided, the

government was not idle on this matter.

The national daily minimum wage on the basis of twentyseven

working days per month was increased by 17% from

cedi 4.48 to 5.24 per day last year.

3. MALAYSIA

Industrialisation key to reduce

dependence on foreign

workers

The Malaysian Ministry of Plantation Industries and

Commodities (MPIC) has established the Institute of

Malaysian Plantation and Commodities (IMPAC) to

strengthen, transform and further industrialise the

country.s plantation and commodity industries.

IMPAC will oversee the human capital development needs

of the various industries. The Board of Directors for

IMPAC is drawn from palm oil, rubber, timber, cocoa,

pepper, kenaf and tobacco industries.

The government has set the institute two main objectives:

¡¡

. to become an international training centre

to meet

the needs of skilled manpower in plantations and

commodities

. to produce a knowledgeable workforce through

academic and skills-based training to meet the

needs of the commodities industry

IMPAC will run training courses tailored to the needs of

the various commodity sector. It is hoped that all future

training under the ministry and its agencies will be

rationalised under IMPAC to achieve coordination and

expanded coverage of skills.

In 2012, total commodity exports by Malaysia were

RM127.5 billion (approximately US$38.3 billion at

current exchange rates) accounting for almost 18% of all

Malaysia.s exports.

IMPAC was set up in recognition of the importance of

commodity exports to the economy and to address the

country.s over-dependence on foreign workers in the

plantations and associated processing plants.

Thailand top importer of Sabah sawnwood

The Department of Statistics in Sabah has released 2013

exports data for the state. The total volume of sawnwood

exported in 2013 was 241,889 cu.m valued at RM 359.2

mil. FOB (approx. US$107.9 mil.).

The single largest export species group was dark and light

red meranti and meranti bakau and exports totaled 68,860

cu.m valued at RM112.3 mil. FOB (approx. US$33.7

mil.).

The second largest species group exported was keruing,

ramin, kapur, teak, jelutong, kempas, mengkulang, balau

which totaled 67,176 cu.m valued at RM107.0 mil. FOB

(approx. US$32.1 mil.).

Exports of belian were 22,001 cu.m valued at RM33.1 mil.

FOB (approx. US$9.9 mil.). The main market for Sabah

sawnwood in 2013 was Thailand at 54,928 cu.m (22.7% of

total sawnwood exports) valued at RM69.9 mil. FOB

(approx. US$21.0 mil.).

The second largest importer of sawnwood from the state

was China at 39,296 cu.m (16.2%) valued at RM59.1 mil.

FOB (approx. US$17.8 mil.). Then followed Taiwan P.o.C

at 31,033 cu.m, (12.8%) Japan, 21,458cu.m, (8.9%), South

Africa, 20,106 cu.m, (8.3%) and Philippines 18,717 cu.m,

(7.7%).

Japan holds onto top spot for plywood imports from

sabah

Manufacturers in Sabah also exported 648,857 cu.m of

plywood in 2013 valued at RM1,039.6 mil. FOB

(approx.US$312.2 mil.). The main importer was Japan at

128,577 cu.m and the second ranked .importer. was

Peninsular Malaysia at 110,807 cu.m.

Other foreign export markets for Sabah plywood were

South Korea, 76,483 cu.m; USA 56,708 cu.m; Egypt

51,533 cu.m and Mexico at 49,227 cu.m.

60% of Sarawak.s 2013 log exports to India

The authorities in Sarawak have also provided 2013 export

data and this was published by the Sarawak Timber

Association.

In 2013, Sarawak exported 2,801,368 cu.m of logs worth

RM1,692.4 mil. FOB (approx. US$508.2 mil.). Exports of

meranti logs made up the bulk of exports at 1,296,014

cu.m followed by mixed light hardwood at 440,480 cu.m

and then kapur at 222,296 cu.m.

For 2013, India was the main importer of Sarawak logs

taking a volume of 1,724,838 cu.m. Taiwan P.o.C was the

second largest importer of logs from the state at 363,085

cu.m.

In 2013 Chinese imports of logs from Sarawak amounted

to just 267,094 cu.m followed by Vietnam, 177,306 cu.m.

Japan was the fifth ranked importer of Sarawak logs at

only 142,269 cu.m. Buyers in Indonesia imported 69,821

cu.m of Sarawak logs worth approximately US$4.1

million.

4. INDONESIA

Partnership for sustainable furniture

production

WWF-Indonesia and ASMINDO (Furniture Industry and

Handicraft Association of Indonesia) recently formed a

partnership aimed at ¡°sustainable production and

consumption as best practice in forest product markets,

safeguarding forest value and supporting poverty

reduction¡±.

Details of this initiative can be seen at:

http://iffinaindonesia.com/partnership-between-wwfindonesia-

wwf-uk-and-asmindo/

The objective is to expand capacity building in the small

and medium sized wood processing enterprises to enable

their ability to conform to Indonesia‟s timber legality

assurance system and, through this, to emphasise the

commercial link between sustainable wood product

manufacture and market demand.

Through this partnership, says the press release,

¡°stakeholders are expected to increase their technical

capacity in respect of legality and strengthen the Timber

Legality Verification System (SVLK) implementation in

Indonesia¡±.

Let the shows begin

It is show time in SE Asia with IFEX from 11 - 14 March,

IFFINA from 14 - 17 March (both in Jakarta) and

the International Furniture Fair, Singapore, (IFFS) from

13-16 March in Singapore.

Jakarta will play host to a new furniture expo, IFEX, that

the organisers say ¡°promises to deliver on Indonesia‟s

legendary creativity and artistic diversity¡±. See:

http://www.ifexindonesia.com/Press_Release.php

The seventh annual IFFINA, has the theme, ¡°Eco Green¡±.

In a press release, Ambar Tjahyono the chairman of

ASMINDO, explained that this theme is to introduce the

concept of eco-friendly furniture which incorporates

environmentally friendly material selection and production

processes meeting top environmental standards. See

http://iffinaindonesia.com/eco-green-theme-of-iffina-2014/

Since its first show in 1981, IFFS has grown to become a

major regional and international event for companies

aiming to penetrate the global market. The International

Furniture Fair Singapore will be held in conjunction with

the ASEAN Furniture Show, The D¨¦cor Show and The

Hospitality 360¡ã. For more see:

http://www.iffs.com.sg/

Indonesia:US commitment on combating wildlife

trafficking

Minister of Forestry, Zulkifli Hasan, and US Secretary of

State, John Kerry, signed a Memorandum of

Understanding committing both signatories to conserving

wildlife and combating wildlife trafficking.

This MoU comes on the heels of the Indonesia-USA

Comprehensive Partnership amongst others. The Indonesia

Ministry of Forestry has reaffirmed it commitment to

cooperate with international organisations to combat

trafficking and trading of regulated flora and fauna.

Consultations continue on SFM and legality issues

The Ministry of Forestry will hold multi-stakeholder

consultations at the regional and national levels to

strengthen standards and guidelines for implementing

SFM and timber legality verification. This activity is a

follow up to the agreement between Indonesia and the EU

on the Action Plan for the FLEGT ¨C VPA.

Finding sustainable solutions for the palm oil sector

An international conference on oil palm and the

environment under the theme ¡°Oil palm cultivation:

Becoming a model for tomorrow‟s sustainable agriculture¡±

was recently concluded.

Participants sought to respond to challenges in minimising

deforestation, mitigating greenhouse gas effects and the

conservation of biodiversity.

The oil palm industry is seen in a negative light in many

quarters however, WWF Indonesia CEO, Efransjah, said

improvement of cultivation practices are the key to

transforming the negative image of the palm oil industry.

In a press release WWF Indonesia says ¡°the palm oil

industry is one of the most lucrative industries in

Indonesia where 4.5% of 2012 GDP came from this

commodity. But environmental concerns always loom

high in the industry as expansion of palm oil plantations

become the main driver of deforestation and the loss of

biodiversity in Indonesia¡±.

The urgency to find sustainable practices for this sector

encouraged WWF-Indonesia along with CIRAD and PT

SMART Tbk to convene the fourth International

Conference on Oil Palm and Environment (ICOPE) on 12-

14 February 2014.

Indonesian economy already adjusted to negative

effects of US monetary „tapering‟

Analysts have been quick to point out that the decision of

the US Federal reserve to slow its asset accumulation has

had a far reaching and negative impact on emerging

economies.

While this is largely correct Indonesia has, it seems,

adjusted already as investor and consumer confidence has

improved in recent weeks. The Indonesian stock market

has jumped significantly as foreign investors increase

holdings of Indonesian shares.

Because of the inflow of cash the Indonesian rupiah has

also strengthened and the upward momentum of the rupiah

was boosted by news of the US$1.5 billion trade surplus

for December.

Adding to the good news, the ANZ-Roy Morgan

Indonesian Consumer Confidence survey reports an

improvement in January consumer sentiment as more

Indonesians are confident about the domestic economic

outlook.

For more see: http://www.anz.co.nz/commercialinstitutional/

economic-markets-research/consumerconfidence/

Interest rates on hold

The Bank Indonesia has decided to maintain interest rates

at 7.50%, a decision consistent with the tight monetary

policy stance currently adopted in order to steer inflation

back towards the Bank‟s target of 4.5 (plus minus1%) in

2014.

For more see: http://www.bi.go.id/en/ruang-media/siaranpers/

Pages/SP_160814.aspx

5. MYANMAR

Date for final payment for export logs

revised

Export shipments from 1 April 2013 to end January 2014

are estimated to have been 397,807 cu.m of teak logs and

1,307,095 cu.m of other hardwood logs.

Total export shipments for the 2012-13 fiscal year were

494,650 cu.m of teak logs and 1,561,540 cu.m of other

hardwood logs.

Though shipments this year are likely to exceed those of

the previous year, analysts do not expect to see any

significant change in export volumes. However, recently

shipments from Yangon Port have increased.

It has been reported that the date for final payment for logs

that are ready to be exported has been extended to 31

March 2014 rather than the previously announced date of

28 February 2014. However, overseas buyers are advised

to ship all logs by midnight 31 March 2014.

Logs that are not shipped before the 1 April deadline will

have to be processed in some way in Myanmar.

The date for final payment of these logs has been extended

to 30 September 2014 instead of the previously announced

30 June 2014. For further details please contact Myanma

Timber Enterprise.

Where to now Myanmar timber industry?

For decades Myanmar has been a major exporter of logs

but now a ban on log exports will be introduced and at the

same time the log harvest volumes will be drastically

reduced.

Analysts point out that if raw material availability is

reduced too far then neither existing domestic mills nor

any new mills established by local or overseas investors

will have sufficient logs and ask, will the Myanmar timber

industry need to import logs like in India, Thailand, and

Vietnam?

Following on from this, what would be the import duty

and tax implications for local processors? A clear „road

map‟ for the future of the timber industry in Myanmar is

needed says one analyst.

Limit on size of private plantations suggested

The MOECAF Deputy Minister Aye Myint Maung, during

a visit to Bago Division, said that the establishment of

private teak and hardwoods plantations began 2006 and

that to date 43,444 ha. of teak and 20,968 ha. of other

hardwoods have been established.

On this topic Forest Research and Environment

Development and Conservation Association (FREDA)

Chairman Ohn, has suggested that private company

plantations should be limited in size and that communities

should be encouraged to establish plantations.

Muse (China border) trade figures

The value of trade from 1 April 2013 to end January 2014

through the Muse border crossing with China exceeded

US$3 billion according to the Directorate of Commerce, as

reported by the Myanmar press (Daily Eleven Feb 20).

Of this amount the value of commodity exports, including

agriculture products is reported at US$ 1.9 billion, some

US$606 million more than during the same period in the

last financial year. The value of seized goods along Muse-

Mandalay route is said to have exceeded US$3.5 million

last year.

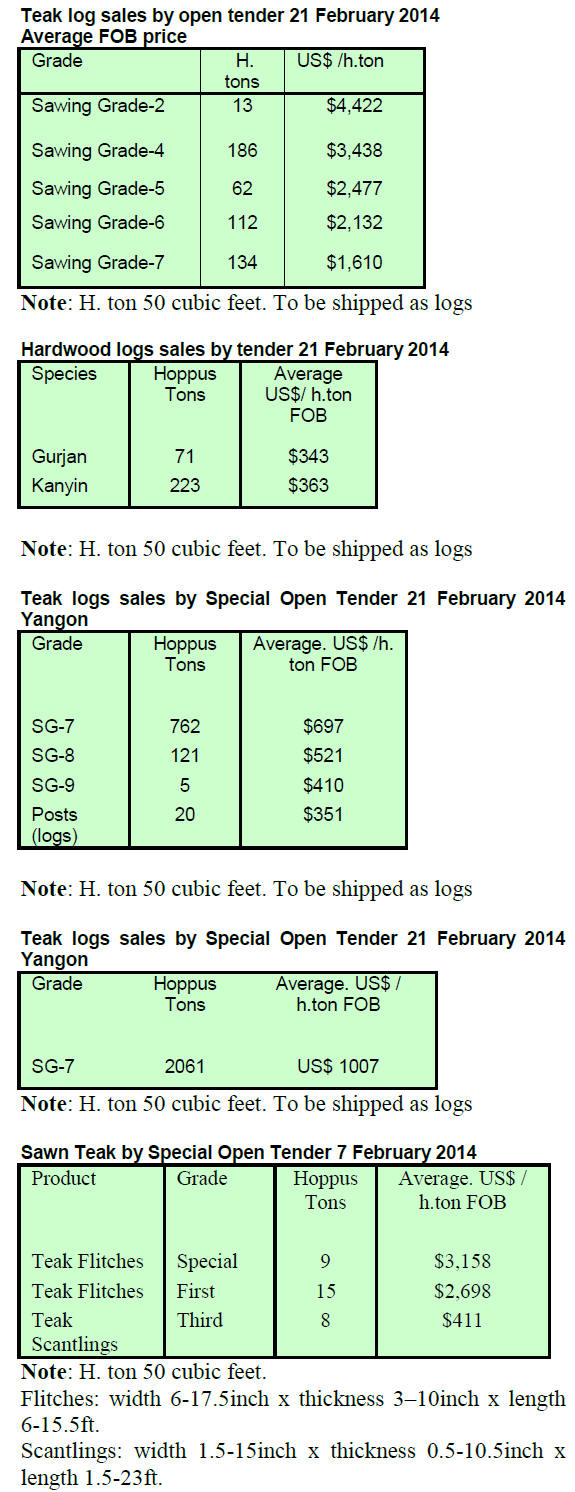

Teak and hardwood prices

The following items were sold by competitive bidding on

21and 24 February 2014 at the Myanma Timber

Enterprise (MTE) tender hall.

6.

INDIA

Good news on wholesale prices

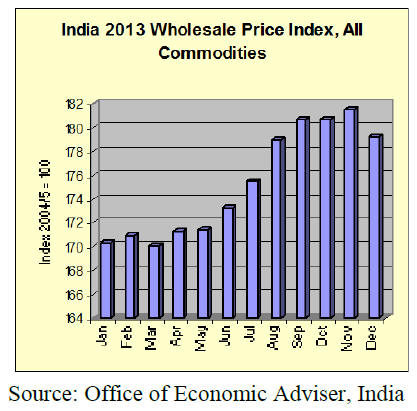

A press release from the Office of the Economic Adviser

to the Indian government provides details of the trend in

the Wholesale Price Index (WPI).

The official Wholesale Price Index for „All Commodities‟

(Base: 2004-05 = 100) for the month of January 2014

declined by 0.2 percent to 178.9 (provisional) from 179.2

(provisional) for the previous month.

In other encouraging news it has been revealed that

the

annualised rate of inflation, based on the monthly WPI,

stood at 5.05% for January 2014 compared to 6.16% in

December 2013 and 7.31% in January 2013.

See: http://www.eaindustry.nic.in/

However, the Reserve Bank of India has cautioned that

core WPI inflation worsened to 3 percent last month, its

highest since early 2013.

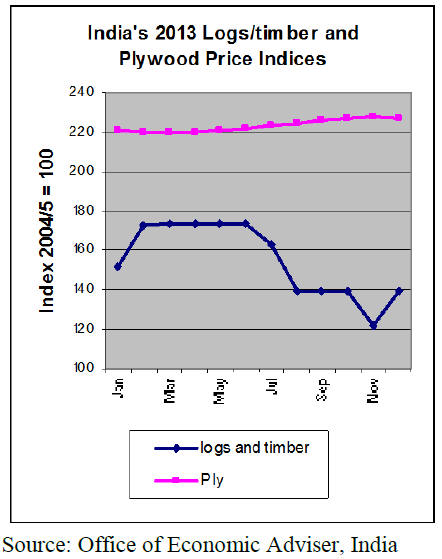

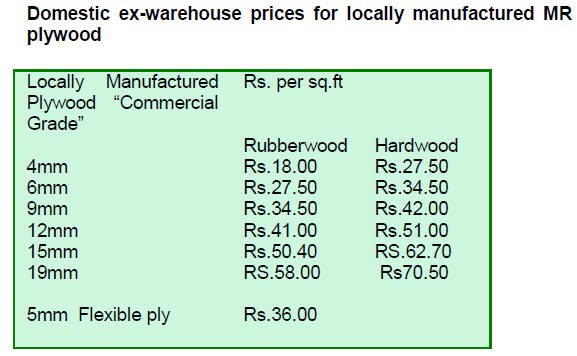

Timber and Plywood Wholesale Price Indices

In addition to data on the Wholesale Price Index for all

commodities, the Office of the Economic Adviser to the

Indian government also reports data on wholesale price

movements for a variety of wood products.

The Wholesale Price Indices for Logs/timber and Plywood

are shown below. Despite the depressed housing market

plywood prices changed little during 2013 whereas the

Logs/timber index has shown considerable volatility.

Global real estate consultancy launches India.s

first

real estate sentiment index

Knight Frank India Pvt. Ltd., in association with the

Federation of Indian Chambers of Commerce and Industry

has released the first of its real estate sentiment index

reports on the Indian real estate market conditions from

the house builder and sellers point of view.

Knight Frank, with a HQ in London, is a global real estate

consultancy with an integrated prime commercial and

residential offering, operating in key hubs across the

globe. a global real estate consultancy. The latest news

released on Indian real estate market sentiment can be

found at :

http://www.knightfrank.co.in/news/knight-frank-indialaunches-

india%E2%80%99s-first-real-estate-sentimentindex-

today-02574.aspx

Quoting from the news release the latest report says:

. Stakeholders feel the real estate market has

deteriorated compared to the last six months

. Current sentiments are pessimistic across all

zones

. East and South remain marginally more

optimistic compared to the rest of the country

. Credit lending/ funding situation may also remain

muted in the near future

. While there remains an evident optimism for the

residential sector, the office market on the other

hand is expected to be pessimistic in the coming

two quarters

. Larger project completions at a time when

business growth and employee addition remain

weak, will lead to higher vacancy levels in the

Indian office market

. Majority of the respondents are positive about the

economic scenario and expect an improvement in

the next six months

Auction of Sandalwood (Santalum album) in Kerala

On 5 February one of the largest sandalwood auctions was

held at Marayoor, Kerala.

Despite rampant poaching of sandalwood in the four

southern states of India, the Forest Department of Kerala

was able to protect some 8,500 acres of natural forest rich

in sandalwood in the Marayoor Kanthalloor forest reserve

in Western Ghats.

The sandalwood here is carefully tended and a seed farm

has been established as most of the sandalwood trees are

over 60 years old.

For the recent auction the Forest Department does not

harvest living trees but collects dead and storm blown

trees as well as fallen branches. Every year, several tons of

sandalwood is collected, stored and then auctioned at the

Government Sandalwood Depot.

A large number of buyers from temples, oil factories,

traditional medicine manufacturers and handicraft

factories bid for this precious fragrant wood.

At the auction last year 40 tons of sandalwood were sold

for Rs. 330 million. The average price was around

Rs.6000 per kg. This year a total of 38 tons of sandalwood

was sold for the following prices:

Class II Rs.7810 per Kg.

Class V Rs.7640 per Kg.

Class VI Rs.6925 per Kg.

Class VII Rs.6711 per Kg.

Roots 2nd class Rs.6507 per Kg.

Maharashtra natural forest loss

A recently released report tracking climate change in India

has suggested Maharashtra state lost 2,116 sq.km of

natural forest area over the past twenty years.

On the other hand the report notes that the state has also

gained 5,030 sq km of forest cover in the period 1987-

2011. However, the forest cover gain includes rubber and

teak plantations.

The authors of the report say the government needs to

rethink its forest compensatory policy to emphasise the

need to regenerate natural forests and not merely

compensate the loss of natural reserves with plantations.

Imports of plantation teak

India.s total imports of wood and wood products under HS

chapter 44 for the month of January 2014 were valued at

US$269.52 million while exports under the same chapter

were US$28.88 million. Wood product imports continue to

grow as domestic demand continues to be firm.

Current C & F prices for imported plantation teak,

Indian

ports per cubic metre are shown below.

Prices for domestically sawn imported logs

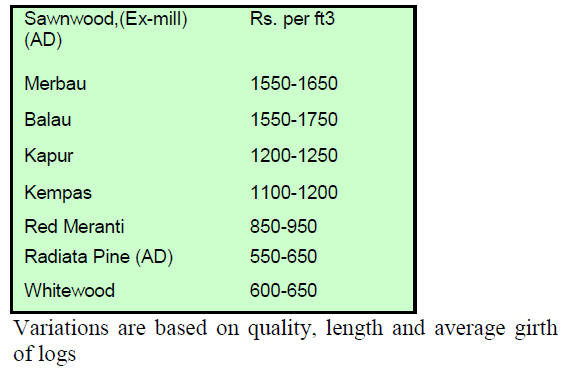

Prices for air dry sawnwood per cubic Foot, ex-sawmill

are shown below.

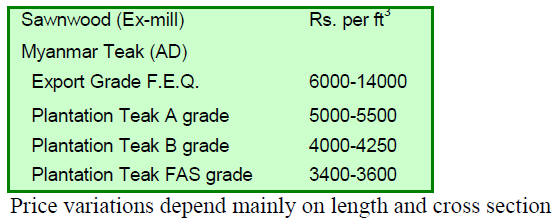

Myanmar teak processed in India

Export demand continues to be good but domestic demand

reportedly sluggish.

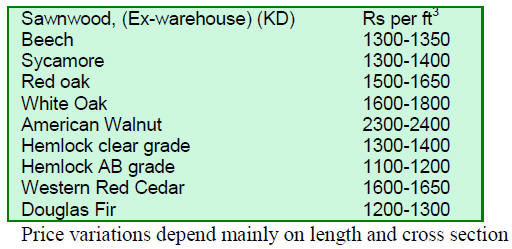

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

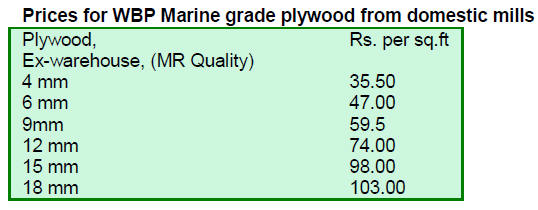

Plywood market gets slight boost

Plywood manufacturers report continuing weak market

conditions, the only bright spot being in the industrial

sector where some growth in investment is giving a mild

boost to demand for plywood. Prices remain unchanged.

7.

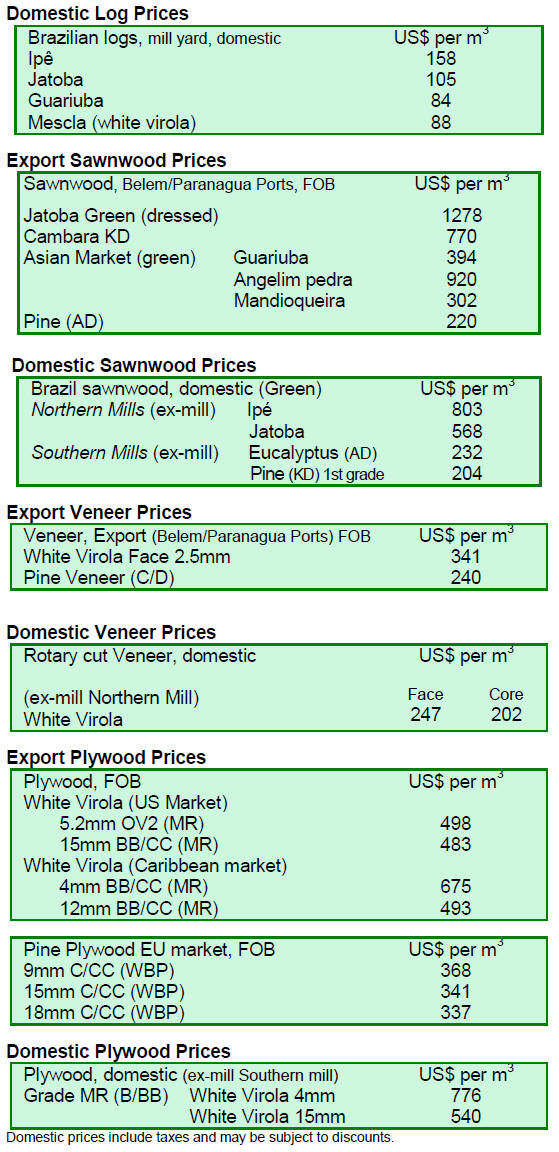

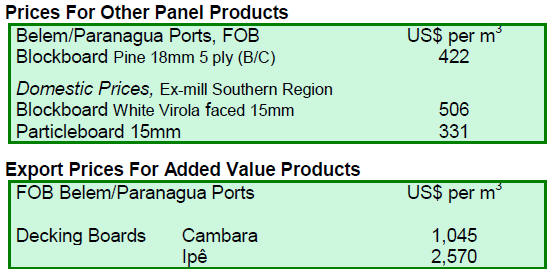

BRAZIL

Central Bank claims success in fight

against inflation

The Governor of the Brazilian Central Bank has defended

the actions of the Bank in addressing inflation. Rather than

blaming the winding down of the easy money policy in the

US, the Bank chief said this was good news for the global

economy as it was a sign that the US economy was

strengthening.

Never-the-less, the change in the US is putting

pressure on

emerging economies such as Brazil.s and the Central Bank

has responded to the inflationary pressures by increasing

interest rates.

The Bank has also utilised foreign exchange reserves to

ease the impact on domestic businesses from the sharp fall

in the value of the Brazilian currency over the past year.

In other news in support of the success of the Central

Bank, the National Consumer Price Index (IPCA) slowed

down to 0.55% in January 2014, the lowest rate since

2009. In January 2013, IPCA was 0.86% while in

December 2013 inflation was 0.92%.

New challenge, recession in 2013 to impact 2014

prospects

Central Bank preliminary data on GDP suggests that,

technically, the Brazilian economy dipped into recession

in the second half of 2013.

According to the latest releases from the Central Bank,

GDP shrank 0.2 per cent in the final quarter of 2013

following on from a similar dip in the third quarter. Final

2013 GDP figures will be available on February 27.

For more see

http://www.bcb.gov.br/?red-indicators

Arbitrary tax structure weakening forest sector

Forest sector businesses in the State of Mato Grosso

recently met with the Department of Finance for the state

(SEFAZ) to discuss the system for collecting price

information to define wood prices used by state authorities

to determine taxes .

Until now the base price for tax determination was decided

unilaterally by SEFAZ but now the system has been

changed and prices are closer to actual trade values

however, enterprises in the state want this refined further.

The purpose of the price collection system is to try and

discourage mis-reporting by companies and to serve as a

reference to determine the ICMS tax (Tax on Circulation

of Goods and Services).

According to the Mato Grosso Center for Wood Industries

Producers and Exporters (CIPEM), only 30% of the forest

sector¢¥s potential is being utlised because of a lack of

incentives. This says CIPEM is resulting in low

productivity, low profitability, poor job creation and low

state revenues.

High taxes in the forest sector have been a problem in the

State of Mato Grosso for a long time and have resulted in

the closure of many businesses says the Industries

Federation of Mato Grosso (FIEMT). FIEMT says over

the past five years a thousand businesses have closed. Ten

years ago there were 393 plywood, veneer and panel

manufacturers but today only four industries remain.

Local entrepreneurs say the main problem in the sector is

the excessive tax burden which means businesses in the

state are unable to compete with timber enterprises in

other states where taxes are lower.

Forest concession plan for 2014

According to the Brazilian Forest Service (SFB), the 2014

Annual Plan for Forest Concession (PAOF) is the result of

consultation between governmental agencies, such as the

Chico Mendes Institute for Biodiversity Conservation

(ICMBio), the Secretariat of the Union Assets

(SPU/MPOG), the National Defense Council (CDN) and

the Public Forest Management Committee (CGFLOP).

Public hearings are also conducted to secure the option of

as many stakeholders as possible.

According to the Brazilian Institute of Geography and

Statistics (IBGE), when the 2.8 million ha scheduled for

allocation are under effective forest management they

have the potential to produce about 1.3 million cubic

metres of roundwood per year, approximately 10% of the

log production in the Amazon(13.5 million cubic metres in

2012).

Of the total area to be allocated in 2014, 11 concessions

will be in National Forests (FLONA) and others will be in

the States of Acre, Amazonas, Para and Rondonia.

Most of national forests in the state of Para included in the

Plan are located in the region along the BR-163 Highway

(Cuiaba . Santarem).

January export review

In January 2014, the value of wood products exports

(except pulp and paper) increased 3.3% compared to

January 2013, from US$168.7 million to US$ 174.2

million.

The value of pine sawnwood exports increased 35% in

January 2014 year on year from US$10.3 million to

US$13.9 million. In terms of volume, pine sawnwood

exports rose 28%, from 47,600 cu.m to 61,000 cu.m over

the same period.

In contrast, tropical sawnwood exports fell 8.8% in

volume, from 25,000 cu.m in January 2013 to 22,800 cu.m

in January 2014 but the decline in the value of exports was

not as steep declining by only 4.2%.

Pine plywood exports declined over 12% in value in

January 2014 compared to January 2013, from US$31

million to US$27.2 million. Export volumes in January

2014 fell 11%, to 74,900 cu.m. from the 84,200 cu.m in

January 2013.

There was a startling decline of 59% in the volume of

tropical plywood exports in January this year. Exports fell

from 5,400 cu.m in January 2013 to just 2,200 cu.m in

January this year.

On a brighter note, the value of wooden furniture exports

increased from US$28 million in January 2013 to almost

US$30 million in January 2014 (plus 6.4% year on year).

Joint venture investment in sawmilling

A German business group from Darmstadt City and the

Envira Municipality State of Amazonas have established a

joint venture to invest some R$300 million in the wood

processing sector in the municipality. The first sawmill

production line will begin operations in April this year and

this will create around 120 new jobs.

The proposal submitted by the German business group

was assessed by state environmental technicians who

looked at the proposed management and quality

performance system to be applied in forest operations, the

level of local processing, the use of technological

innovations and the impact on the local community.

This investment will represent an important addition to the

economy of the municipality and will generate higher tax

revenues for Envira.

After recording a 140% growth between 2009 and 2011,

the timber industry in the municipality grew only 6% in

2012 but this dropped sharply in 2013 because of reduced

logging and consequent rising prices for raw materials.

This new investment aims to reverse the decline in output

from the timber sector in the municipality.

Wooden door manufacturers‟ mission to Spain

Representatives of wooden door manufacturers

participating in the ABIMCI Sectoral Program of Internal

Wood Door Quality programme recently visited the

¡°Fimma Maderalia¡± Fair, which brought together

international suppliers of wood / frame and furniture

sector.

Besides visiting the fair, the entrepreneurs participated in

meetings with machinery and equipment manufacturers, as

well as suppliers of raw materials and accessories and door

manufacturers in Spain.

According to ABIMCI, technical cooperation with other

countries and exposure to new products and equipment

will bring significant benefits to industries participating in

the certification programme.

Price trends

As is the case with other tropical timber suppliers,

Brazilian prices remain unchanged.

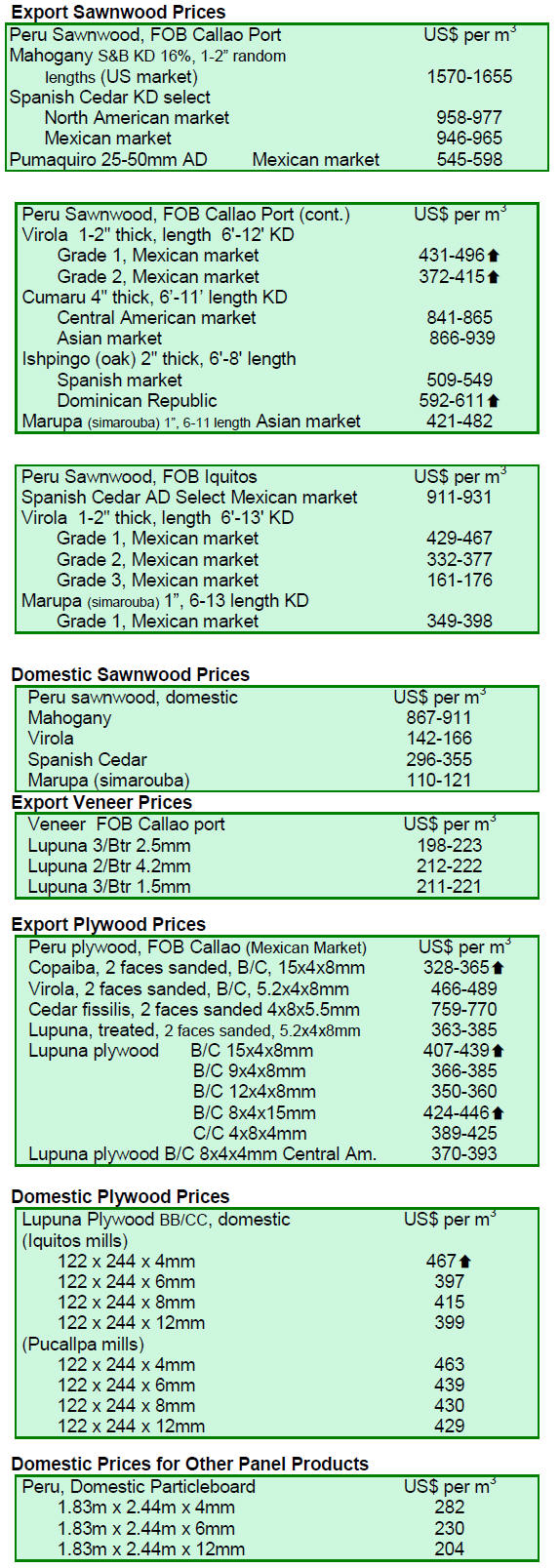

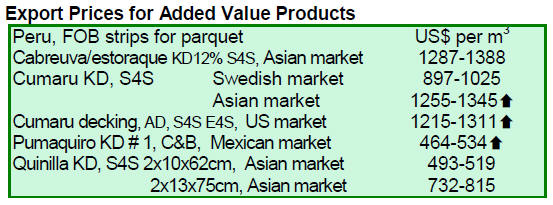

8. PERU

GDP growth figures looking good

The National Institute for Statistics and Information has

released growth figures for late 2013 which show the

economy grew 5% in December compared with the same

month a year earlier. 2013 GDP is expected to come in at

5.5% and the forecast is for 2014 GDP to expand by over

6%.

During the year construction activity expanded almost 9%

which drove demand for sawnwood. In addition growth in

the retail sector was almost 6%.

Business conditions improving

A recent survey by La C¨¢mara de Comercio de Lima

(Lima Chamber of Commerce) has concluded that small,

medium and large entrepreneurs are optimistic about

prospects for 2014 and want to continue investing.

The survey asked about the financial situation of

entrepreneurs and two thirds of respondents said they

expected business to improve over the next six months

with only a small group saying conditions are likely to

worsen. In the October 2013 survey less than half thought

their businesses improved in the short-term. Companies

have also indicated that they expect to increase the work

force.

For more see:

http://www.camaralima.org.pe/principal/noticias/noticia/tr

anquilidad-para-los-emprendedores/124

Bridging financial gap for forestry enterprises

In early March a event will be held bringing together

forestry and wood processing industries and financial

institutions with the aim of bridging the financing gap

between these institutions and forestry sector enterprises in

Peru.

The event will bring together small and medium forest and

timber enterprises as well as producer organisations to

provide one-on-one meetings with financial institutions.

The goal of this event is to help producers in Peru obtain

adequate finance. This event is an initiative of the Alliance

for Sustainable Trade.

9.

GUYANA

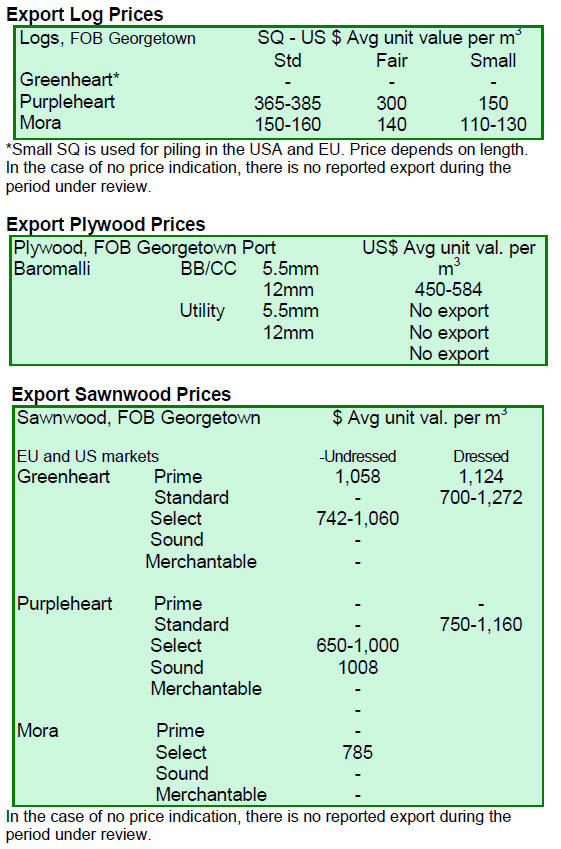

Mora log prices encouraging

Exports of purpleheart and mora logs continued in the

period reviewed but there were no exports of greenheart

logs.

Purpleheart log FOB prices saw some changes but the

Standard Sawmill quality log top end price of US$385 per

cubic metre remained unchanged.

However, Fair Sawmill quality purpleheart logs attracted a

favourable price of US$300 per cubic metre FOB, while

Small Sawmill quality logs were traded at a fair FOB price

of US$150 per cubic metre.

FOB prices for all categories of mora logs improved. Mora

Standard Sawmill quality top end prices increased to

US$160 per cubic metre followed by Fair Sawmill quality

at US$140 per cubic metre and finally Small Sawmill

quality mora log top end prices were US$130 per cubic

metre. The Asian markets, mainly China and India, were

the major buyer of Guyana.s logs during the period

reviewed.

Sawnwood export markets were diverse and delivered

favourable prices for Guyana.s sawnwood which resulted

in a favourable contribution towards the total export

earnings from wood product exports.

Undressed greenheart (Prime quality) recorded an increase

in price from US$955 to US$1,058 per cubic metre FOB

in the Middle East market of Kuwait where the timber is

used for both indoor and outdoor structural applications.

Undressed greenheart (Select quality) FOB prices slipped

from US$1,209 to US$1,060 in the period reviewed.

However this category of sawnwood was widely traded in

Caribbean, European, Middle Eastern and North American

markets.

Additionally, Undressed purpleheart (Select quality) FOB

top end prices fell from US$1,378 to US$1,000 per cubic

metre, while in the Sound quality sawnwood FOB prices

were an encouraging US$1,008 per cubic metre. Buyers in

the Caribbean and New Zealand continue request this

product.

Prices for Undressed Mora Select quality increased from

US$594 to US$785 per cubic metre FOB in the North

American market.

During this period Dressed sawnwood secured favourable

FOB prices with the Caribbean being the primary export

market.

Dressed greenheart FOB top end prices rose from

US$1,060 to US$1,272 per cubic metre FOB while

Dressed greenheart of Prime quality FOB prices moved to

as high as US$1,124 per cubic metre. Similarly, Dressed

purpleheart prices improved from US$1,102 to US$1,160

per cubic metre FOB.

Opportunities for investors

The Guyana Forestry Commission is promoting the

potential of the timber sector as a very profitable option

for foreign investors. Whether for constructing a home or

producing beautiful value added products Guyana.s

timbers can be utilised for a wide variety of products.

According to the World Bank survey .Doing Business

2013., Guyana has improved its ranking through providing

foreign investors equal access to opportunities and this has

led to a growth in investment.

The Forestry Sector is expected to attract more private

investors as the Forest Products Development and

Marketing Council (FPDMC) continues to promote the use

of lesser known species for high value products.

Because Guyana will conclude a Voluntary Partnership

Agreement (VPA), with the European Union wood

product exporters will secure good access to European

markets.

Increased loans to forestry sector

According to the latest Bank of Guyana, Statistical

Abstract, monthly private commercial bank loans and

advances to forestry and wood product manufacturing

enterprises between January and September 2013 averaged

G$552 million.

This represents a 3.6% increase when compared to the

G$533 million in the same period in 2012. In January

2013 alone loans valued at G$630 million were made

while in August 2013 loans fell to a modest G$486.6

million. Analysts point out that the increased level of loans

is indicative of the opportunities in the sector.

Update on Guyana.s EU FLEGT VPA Process

The authorities in Guyana are currently focussed on

stakeholder engagement activities within the forest sector.

These have generated useful inputs for the VPA process,

specifically the Legality Definition. An updated version of

the document defining legality is expected to be available

within a few weeks.

The first draft of the Communication and Consultation

Strategy should be complete by the end of February.

Work on the Scoping of Impacts Assessment continues.